Volatility Shares is launching two Solana (SOL) futures exchange-traded funds (ETFs), the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT), on March 20.

In response to the Securities and Change Fee filing, SOLZ will function a administration payment of 0.95% till June 30, 2026, when the administration payment will enhance to 1.15%.

Volatility Shares’ 2X Solana ETF offers traders twice the leverage and can function a 1.85% administration payment.

Volatility Shares Solana ETF SEC submitting. Supply: SEC

The filings characterize the primary Solana-based ETFs within the US and comply with the Chicago Mercantile Change (CME) Group’s debut of SOL futures contracts.

Following a leadership change at the SEC and the reelection of Donald Trump as president of america, asset managers and ETF corporations have submitted a torrent of ETF purposes to the SEC for approval.

Associated: Solana’s 5th birthday: From pandemic origins to US crypto stockpile

CME Group debuts SOL futures

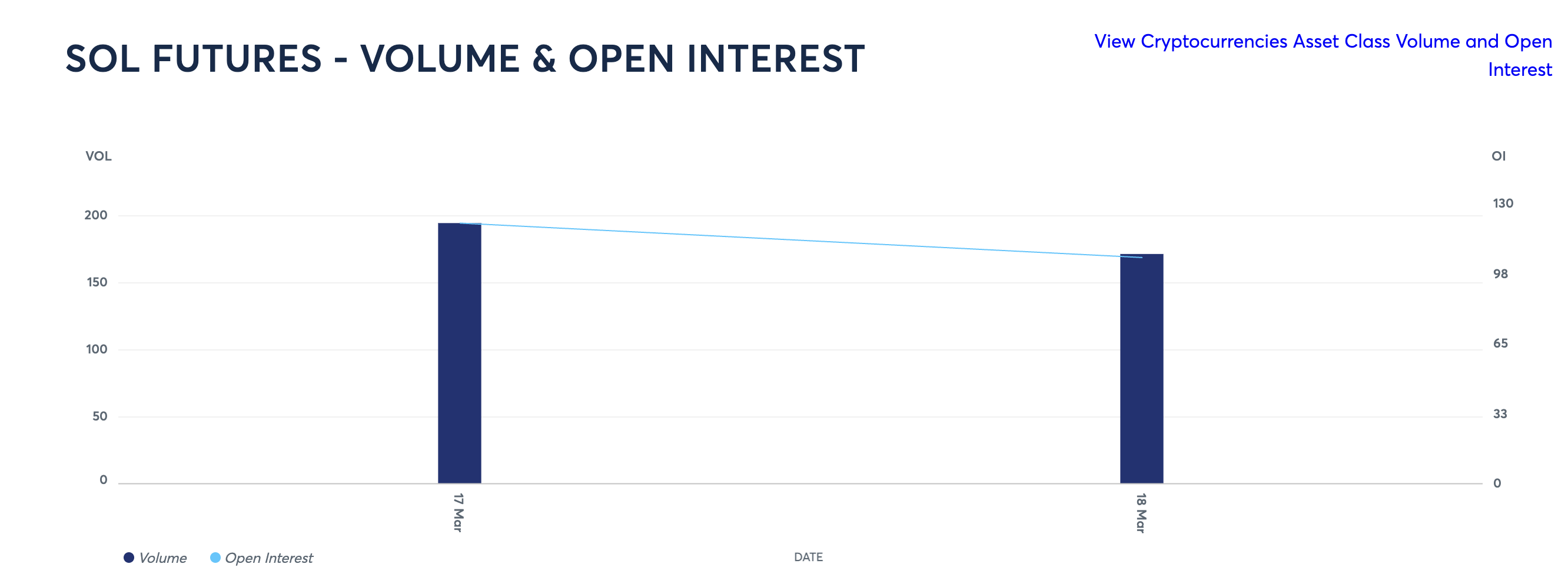

SOL futures went dwell on March 17 with a trading volume of approximately $12.1 million on the primary day.

For context, Bitcoin (BTC) futures debuted at over $102 million in quantity on the primary day of buying and selling, and Ether (ETH) futures garnered over $30 million the day they launched.

Regardless of the comparatively low quantity, SOL futures contracts may assist increase demand for the cryptocurrency from institutional traders and encourage worth discovery.

SOL futures quantity and open curiosity. Supply: Chicago Mercantile Exchange

The launch of SOL futures signaled the approval of SOL ETFs in america as monetary regulators embrace digital property amid a coverage pivot.

In response to Chris Chung, founding father of Titan — a Solana-based swap platform — the CME’s futures point out that SOL is now a mature asset able to attracting institutional curiosity.

Chung added that the launch of SOL futures and ETFs place Solana as a blockchain community poised for real-world use circumstances comparable to funds, not only a memecoin on line casino.

ETFs may additionally enable investor capital to circulation into SOL, making a sustained rally within the altcoin that opponents missing an ETF may miss out on.

The launch of Bitcoin ETFs in 2024 is broadly believed to have siloed institutional capital away from the remainder of the crypto market, preventing capital rotation from BTC into altcoins and upending altseason.

Journal: Memecoins are ded — But Solana ‘100x better’ despite revenue plunge