Key Takeaways:

- Traders discover a new option to have interaction with crypto by means of structured devices.

- The strategy displays evolving preferences for managed, oblique publicity.

- Such merchandise could immediate a rethink of conventional crypto buying and selling strategies.

- Market methods would possibly adapt as threat administration takes middle stage.

Volatility Shares LLC is making ready to introduce the first-ever futures-based Solana ETFs in america, with the launch scheduled for Thursday, according to a Bloomberg report.

The Florida-based agency will roll out two ETFs: the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT).

SOLZ will monitor Solana futures and supply normal publicity to the cryptocurrency, whereas SOLT will present leveraged publicity, aiming to double each potential good points and losses.

The ETFs obtained approval from the U.S. Securities and Alternate Fee (SEC) earlier this month.

This marks the primary time Solana ETFs will probably be out there to U.S. traders, broadening entry to one of many largest cryptocurrencies by market capitalization.

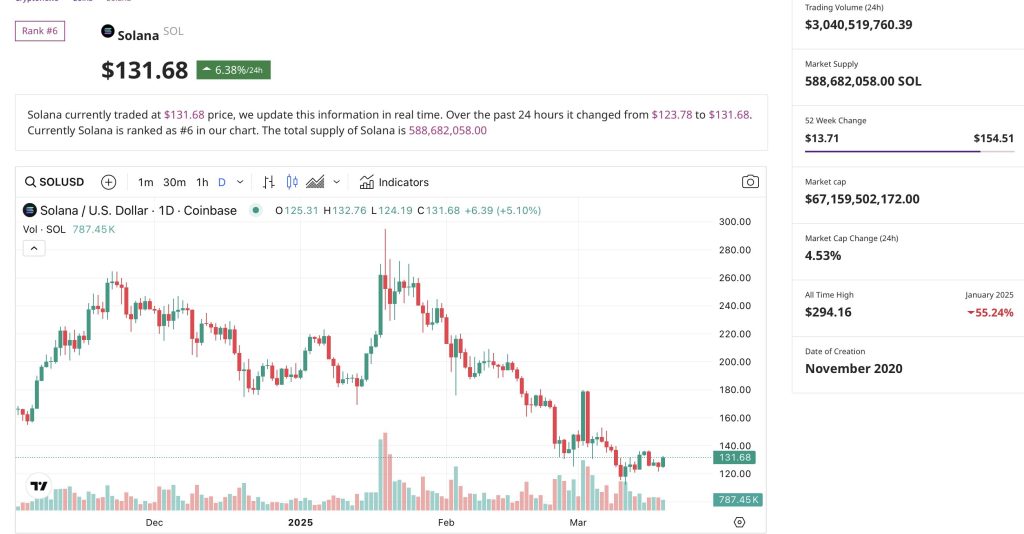

SOL Fails to React to ETF Information, Market Worth at $67B

Solana, valued at roughly $67 billion, has gained recognition for its quick transactions and low charges.

The upcoming launch of the Solana ETFs displays rising investor curiosity in diversified crypto merchandise past Bitcoin and Ethereum, which have traditionally dominated the market.

Following the announcement of the Solana ETF launch, SOL’s value remained comparatively secure.

It traded at round $131.68, up 6.3% over the previous 24 hours, exhibiting little quick response to the information.

The brand new Solana futures ETFs comply with the success of Bitcoin futures ETFs, which attracted substantial investor demand.

Not like spot ETFs, which maintain the underlying cryptocurrency, futures-based ETFs commerce contracts that monitor value actions.

This construction permits traders to realize publicity with out immediately buying Solana, providing a regulated and doubtlessly lower-risk avenue.

Volatility Shares first submitted filings for the Solana ETFs in December 2024.

The expense ratios are set at 0.95% for SOLZ and 1.85% for SOLT, overlaying the prices related to managing futures contracts.

“Our launch comes at a time of renewed optimism for cryptocurrency innovation within the U.S.,” stated Justin Younger, CEO of Volatility Shares, in an interview with Bloomberg.

As soon as dwell, the Solana ETFs will supply traders new methods to entry the cryptocurrency market with out the necessity to maintain digital assets immediately.

The put up Volatility Shares to Launch First Solana ETFs in the US appeared first on Cryptonews.