Key Takeaways:

- New methods uncover behavioral signatures in digital cash flows, suggesting criminals are quickly adapting past easy transfers.

- The swift, borderless nature of crypto exposes a widening hole between legacy rules and fashionable monetary crime.

- These insights push for a proactive overhaul of worldwide oversight, urging tech-driven and collaborative methods to safe international finance.

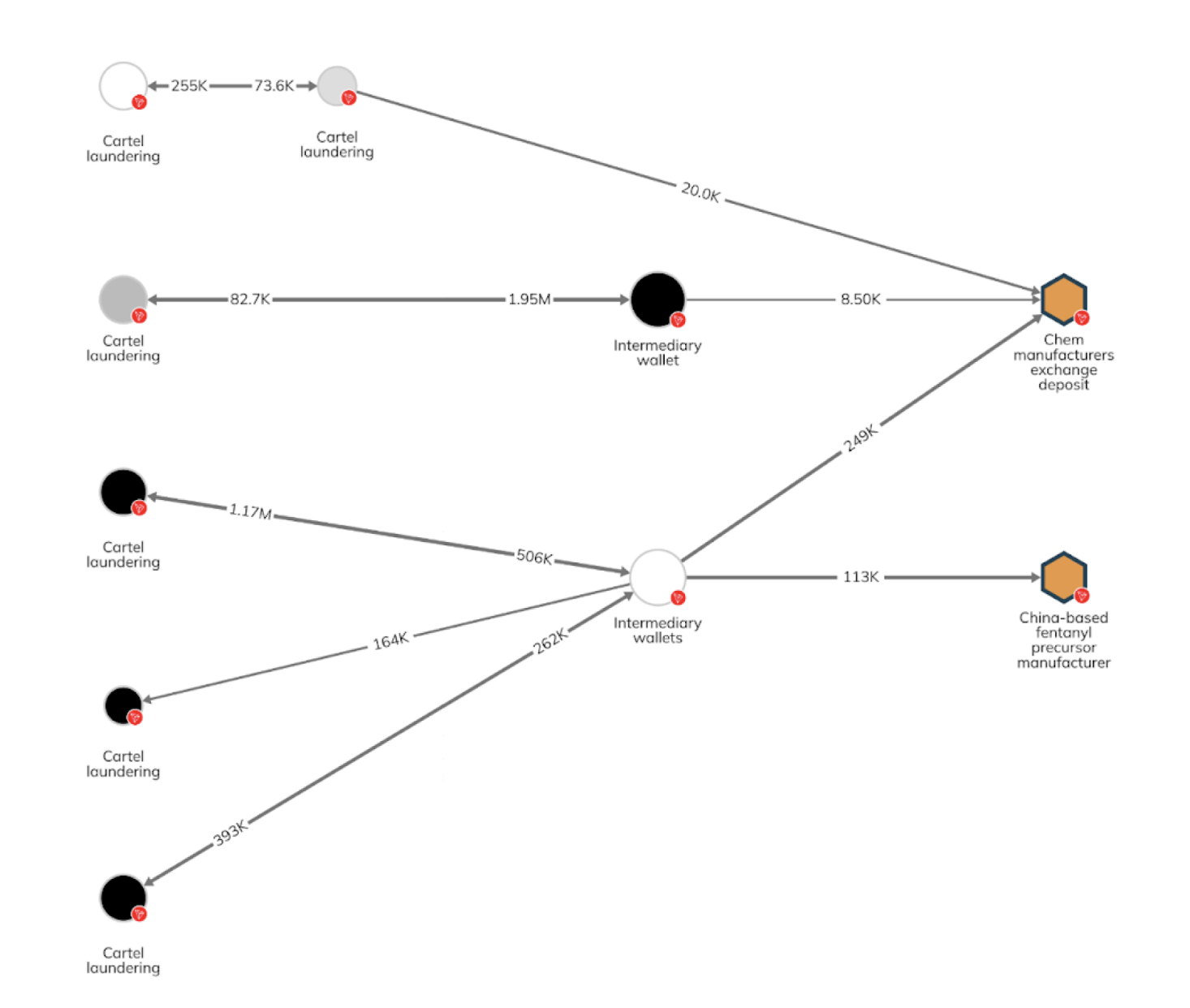

On March 19, blockchain analytics agency Chainalysis uncovered direct monetary hyperlinks between Mexican drug cartels and Chinese language suppliers of fentanyl precursors via crypto transactions.

The investigation expands upon earlier findings, the place authorities had recognized over $37.8 million in suspicious crypto funds from 2018 to 2023 involving China-based chemical merchants.

China Stays the Main Supply of Fentanyl Precursors Regardless of Foreign money Ban

In accordance with Chainalysis’ investigative report, crypto transactions have turn out to be a key software for buying chemical precursors with out direct bodily interactions.

Moreover, these transactions kind half of a bigger underground monetary community spanning Mexico, the U.S., and China.

Chinese language cash laundering operations, together with people based mostly within the U.S., are more and more collaborating with drug trafficking organizations (DTOs), particularly Mexican cartels. These partnerships facilitate the laundering of drug proceeds, usually via crypto transactions.

Since China’s strict capital controls restrict people to buying solely $50,000 in overseas foreign money yearly, underground banking networks tied to the fentanyl commerce have emerged instead technique.

Though China has banned cryptocurrency, it continues to be the main provider of fentanyl precursors and associated tools, together with TDP die kits.

These kits are important for pill urgent in pill-making machines. They encompass molds and punches that form powder into strong tablets.

Whereas these kits have reliable makes use of in pharmaceutical manufacturing, they're additionally generally utilized by drug traffickers to supply counterfeit drugs, together with fentanyl-laced tablets.

Beforehand, Chainalysis had flagged over $37.8 million in suspicious crypto transactions from suspected China-based chemical merchants.

Consequently, Mexican cartels, such because the Sinaloa Cartel, depend on these suppliers to supply artificial opioids like fentanyl, that are trafficked into the U.S.

Over $5.5 Million Seized in Current China-Mexico Fentanyl Crypto Crackdown

A recent civil forfeiture case within the Japanese District of Wisconsin resulted within the seizure of greater than $5.5 million in cryptocurrency. The investigation originated as a cash laundering probe right into a U.S.-based community linked to a Mexican cartel.

Authorities recognized crypto transactions involving centralized trade accounts and digital wallets used to course of illicit drug proceeds, primarily from the sale of fentanyl and methamphetamine.

Chainalysis traced these funds again to crypto wallets beforehand related to Chinese language firms supplying fentanyl precursors.

The report famous a stark distinction between cartel-affiliated cash launderers and cybercriminal syndicates, similar to North Korean state-backed hackers, who make use of superior obfuscation methods.

Cartel-linked actors have operated extra overtly, transferring funds swiftly via centralized exchanges and unhosted wallets, making it simpler to trace their monetary actions.

USDT’s Rising Function in Cartel Cash Laundering

Mexican and Colombian drug cartels have leaned extra closely on cryptocurrencies in recent times.

Amongst them is the Sinaloa Cartel, which options in each native media experiences and Chainalysis’ newest findings.

USDT has turn out to be their most popular selection. It holds regular in opposition to the U.S. greenback, making it simpler for traffickers to maneuver cash with out worrying about worth swings.

In Mexico, USDT often trades below market value as a result of a lot of it's tied to drug proceeds.

Cartels purchase up the discounted tokens, then promote them at the next worth in locations like Colombia to show a revenue.

To maneuver funds, these teams use a mixture of strategies: crypto exchanges, peer-to-peer transfers, and over-the-counter trades. Every step makes it tougher for investigators to observe the path.

Final October, U.S. federal investigators opened a case against Tether, the corporate behind USDT.

They checked out whether or not USDT had been used to interrupt sanctions or skirt anti-money laundering guidelines, and whether or not penalties had been warranted.

USDT trades billions of {dollars} every day. Its hyperlink to the U.S. greenback offers prison teams a easy workaround in nations the place {dollars} are laborious to come back by.

In a separate case, a U.S. grand jury indicted nine people last November.

They allegedly laundered drug cash for Mexican and Colombian cartels between 2020 and mid-2023, utilizing crypto transactions disguised as enterprise offers to keep away from detection.

Continuously Requested Questions (FAQs)

They decode complicated behavioral patterns and hidden transaction clusters, permitting companies to see past remoted transfers to complete adaptive networks.

The hole permits agile prison ways that might undermine market integrity, exposing vulnerabilities in techniques that haven’t developed with digital cash flows.

Cross-border digital transactions demand unified enforcement and shared intelligence, guaranteeing that speedy, decentralized funds may be successfully tracked and intercepted.

The publish Chainalysis Uncovers Crypto Transactions Linked to Mexican Drug Cartels and Chinese Labs appeared first on Cryptonews.