Ethereum co-founder Joe Lubin mentioned the way forward for the good contract community on the Digital Asset Summit and stated layer-2 (L2) scaling networks would proceed to be central to the Ethereum ecosystem.

In an unique interview with Cointelegraph’s Turner Wright, Lubin stated purposes would require next-generation databases powered by high-throughput blockchain applied sciences. The Ethereum co-founder added:

“The Ethereum ecosystem is so massive and so mature that it will likely be finest for brand new sorts of databases — new sorts of layer 2 networks — to arrange store, as layer 2s of Ethereum. We've our personal that has some nice traits referred to as Linea.”

“One other nice utility, or nice layer 2, that’s rising quickly is named MegaETH,” Lubin continued.

The Ethereum co-founder in the end concluded that newer layer-1 chains can have a tricky time competing with the Ethereum community, which already options sturdy structure and safety ensures.

Joe Lubin talking on the Digital Asset Summit. Supply: Digital Asset Summit

Associated: Ethereum pushes back Pectra upgrade to conduct third testnet ‘Hoodi’

Traders have doubts about layer-2 method

In keeping with L2Beat, there are at the moment over 140 distinctive scaling options for Ethereum, together with 60 rollup networks.

Traders have criticized Ethereum’s layer-2 networks as parasitic parts that drain the layer-1 community of revenues whereas solely contributing minimal financial worth to the bottom layer.

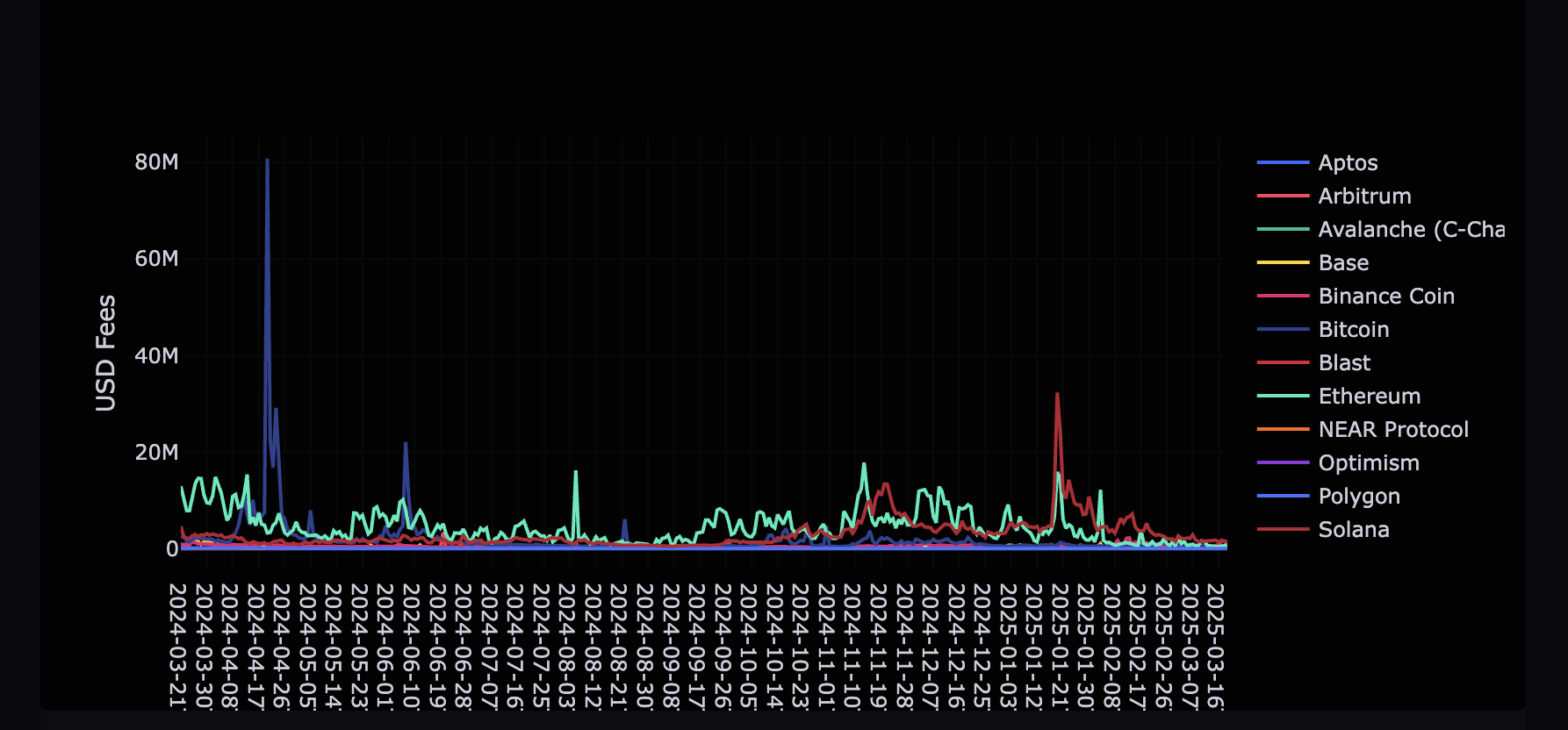

Ethereum's common fuel price dropped by 95% following the Dencun improve in March 2024, which dramatically lowered transaction charges for layer-2 networks.

This discount in transaction charges brought about a 99% collapse in revenue on the Ethereum base layer by September 2024.

Community charges on the Ethereum layer-1 flatline following the Dencun improve. Supply: The TIE Terminal

Since that point, the worth of Ether (ETH) has usually been in decline, plummeting to a latest low of roughly $1,759 on March 11 and main many analysts to foretell a further price decline in 2025.

Information from Farside Traders exhibits outflows from Ether exchange-traded funds (ETFs) have continued for 11 consecutive days amid a broader downturn within the crypto markets.

Probably the most important day of outflows occurred on March 13, when buyers pulled a collective $73.6 million from ETH ETFs as they dumped risk-on belongings for much less unstable alternate options comparable to money, authorities securities and dollar-pegged stablecoins.

Journal: MegaETH launch could save Ethereum… but at what cost?