Bitcoin (BTC) sought to strengthen larger help on the March 20 Wall Road open as bulls broke out of a key downtrend.

BTC/USD 1-hour chart. Supply: Cointelegraph/TradingView

Trump pledges to make US “Bitcoin superpower”

Information from Cointelegraph Markets Pro and TradingView confirmed BTC/USD returning above $86,000.

Now circling the day by day open, Bitcoin continued to construct on power which got here the day prior because of encouraging macroeconomic signals from the US Federal Reserve.

Rumors of an extra announcement on crypto by the US authorities administration helped BTC value motion to succeed in two-week highs.

President Donald Trump was because of ship digital remarks on the third day of the Blockworks Digital Asset Summit 2025 occasion in New York.

Trump doubled down on his pledge to not promote confiscated US Bitcoin, in addition to finish regulatory mechanisms comparable to Operation Chokepoint 2.0. No new info on BTC purchases, nonetheless, was delivered.

He mentioned:

“Collectively we'll make America the undisputed Bitcoin superpower and the crypto capital of the world.”

In so doing, BTC/USD reclaimed two key transferring common pattern traces, together with the 200-day easy transferring common (SMA), a key help element throughout bull markets.

Analyzing the present panorama, widespread dealer and analyst Rekt Capital targeted on an analogous reclaim of the 200-day exponential transferring common (EMA).

“Bitcoin has most just lately Day by day Closed above the 200 EMA and actually is now within the means of retesting it into new help,” he wrote in a part of his newest content material on X, calling the pattern line a “long-term gauge of investor sentiment in the direction of BTC.”

BTC/USD 1-day chart with 200 SMA, EMA. Supply: Cointelegraph/TradingView

A further X post revealed a extra spectacular feat from bulls, with the day by day chart displaying a breakout from a downtrend on Bitcoin’s relative power index (RSI) — one thing in place since November 2024.

“Bitcoin has damaged the Day by day RSI Downtrend courting again to November 2024,” Rekt Capital confirmed.

BTC/USD 1-day chart. Supply: Rekt Capital/X

Evaluation: Markets could “get up” to hawkish Fed

Persevering with on the macro image, buying and selling agency QCP Capital was cool on the outlook.

Associated: Peak 'FUD' hints at $70K floor — 5 Things to know in Bitcoin this week

It warned that the preliminary risk-asset bounce on the again of the Fed resolution may simply reverse.

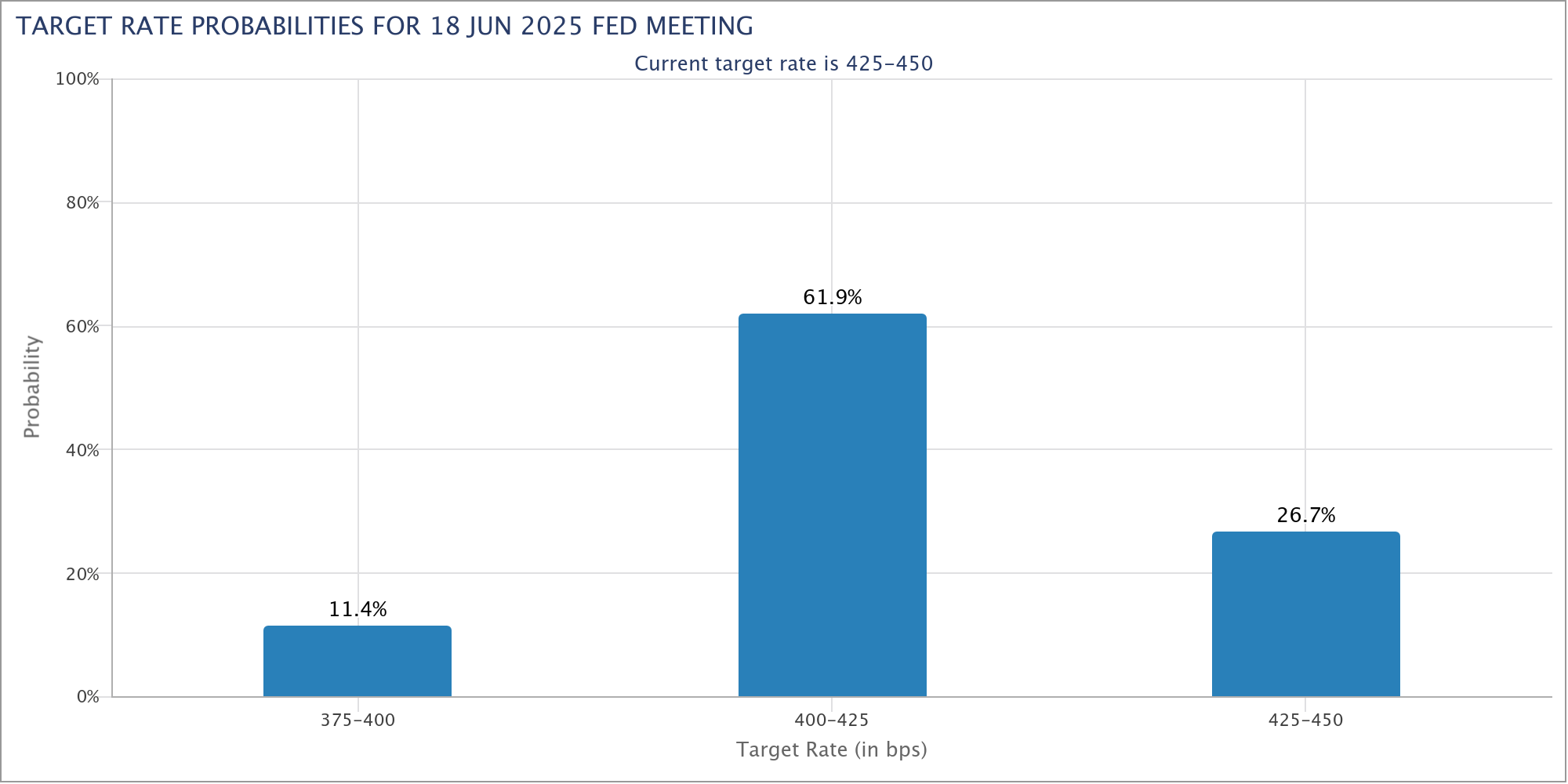

“Past the quick pleasure, the Fed's tone was notably cautious. Policymakers downgraded financial system progress projections to 1.7% (a 0.4% discount), whereas elevating their inflation forecast to 2.8%, signaling a rising threat of stagflation,” it wrote in its newest bulletin to Telegram channel subscribers.

“Moreover, the Fed's dot plot revealed a extra hawkish shift from the one in December, with the variety of officers forecasting no fee cuts in 2025 growing to 4.”

Fed goal fee possibilities for June FOMC assembly. Supply: CME Group

The newest knowledge from CME Group’s FedWatch Tool confirmed markets retaining bets of rate of interest cuts occurring no prior to June.

“Will the rally maintain, or will buyers get up to the truth that dangers stay firmly in play?” QCP queried.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.