Speculative urge for food is vanishing from the crypto markets, as traders are in search of safer digital asset investments following the current wave of memecoin scams and macroeconomic uncertainty.

Bitcoin’s sizzling provide metric, which measures the Bitcoin (BTC) aged one week or much less, is down over 50%, from 5.9% on the finish of November to simply 2.3% on March 20, Glassnode information reveals.

The metric’s decline alerts an investor shift to safer funding positioning amid the current market volatility, in keeping with Ryan Lee, chief analyst at Bitget Analysis.

Bitcoin sizzling provide metric. Supply: Glassnode

Global trade tensions and fluctuating market dynamics are making traders rethink their methods, the analyst instructed Cointelegraph, including:

“Throughout unsure instances, traders aren't solely searching for safety however are additionally centered on rational decision-making. In lots of situations, that rational selection is represented by Bitcoin.”

“This development is not solely rooted in concern, it additionally displays a extra pragmatic method to investing,” defined Lee.

Associated: Bitcoin experiencing ‘shakeout,’ not end of 4-year cycle: Analysts

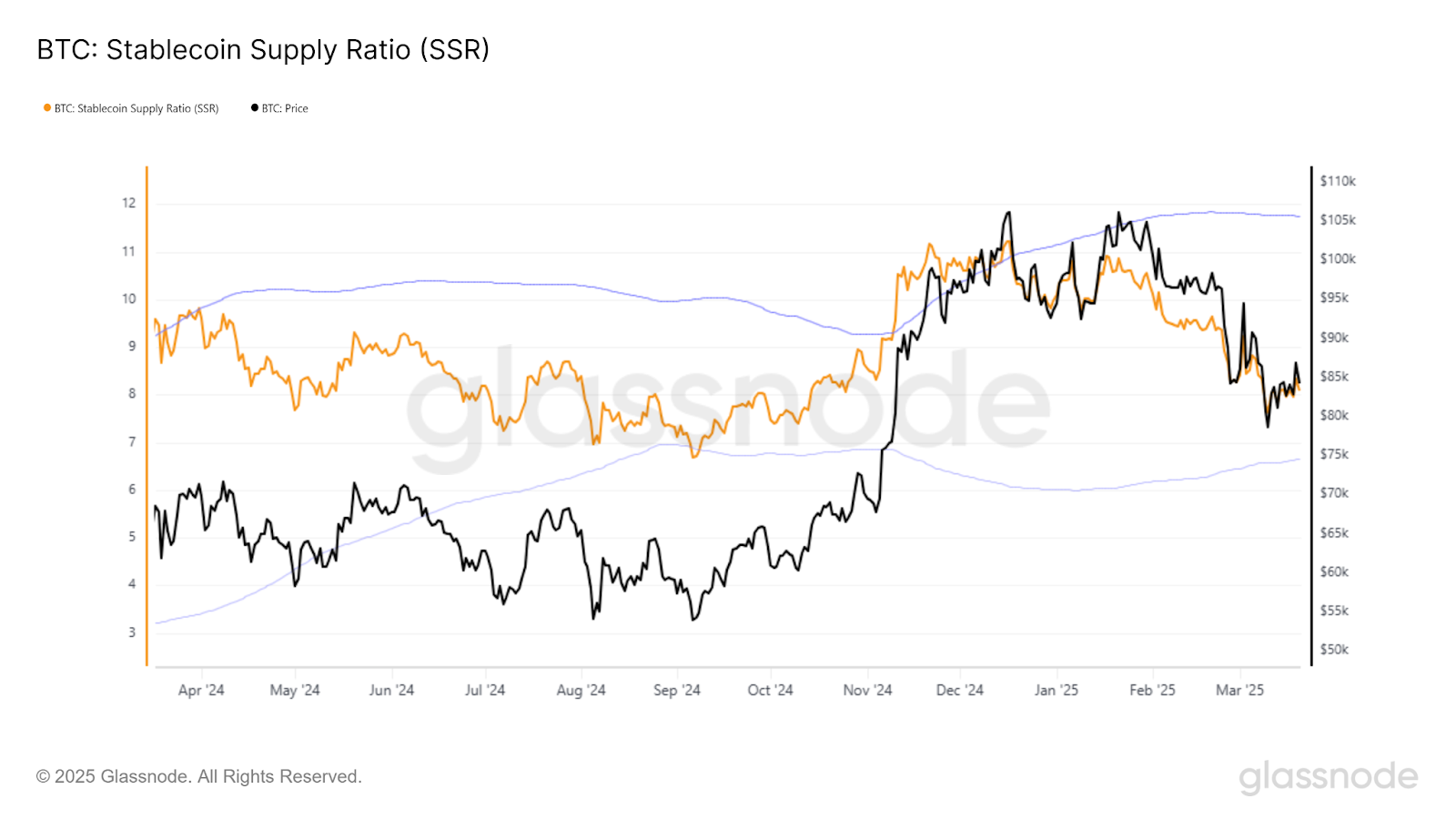

The stablecoin provide ratio (SSR), which measures the ratio between Bitcoin and stablecoin provide, additionally means that traders are nonetheless hesitant to tackle vital new positions.

BTC SSR ratio, 1-year chart. Supply: Glassnode

The SSR ratio stood at an over four-month low of 8, final seen in the beginning of November 2024, when Bitcoin was buying and selling at $67,000, simply earlier than the post-election rally took BTC to a brand new all-time excessive of $109,000.

Traditionally, SSR values under 10 are thought of low, indicating that there's comparatively low stablecoin shopping for energy amongst traders, in comparison with Bitcoin’s market cap.

The cautious crypto investor positioning aligns with the sentiment amongst conventional market contributors, in keeping with Enmanuel Cardozo, market analyst at Brickken real-world asset (RWA) tokenization platform.

The market analyst instructed Cointelegraph:

“US inventory market developments usually set the tone for risk-on property like crypto, and proper now, though the macro image remains to be unsure, these corrections are regular and simply spotlight the place the actual worth lies because the market continues to mature and educate itself.”

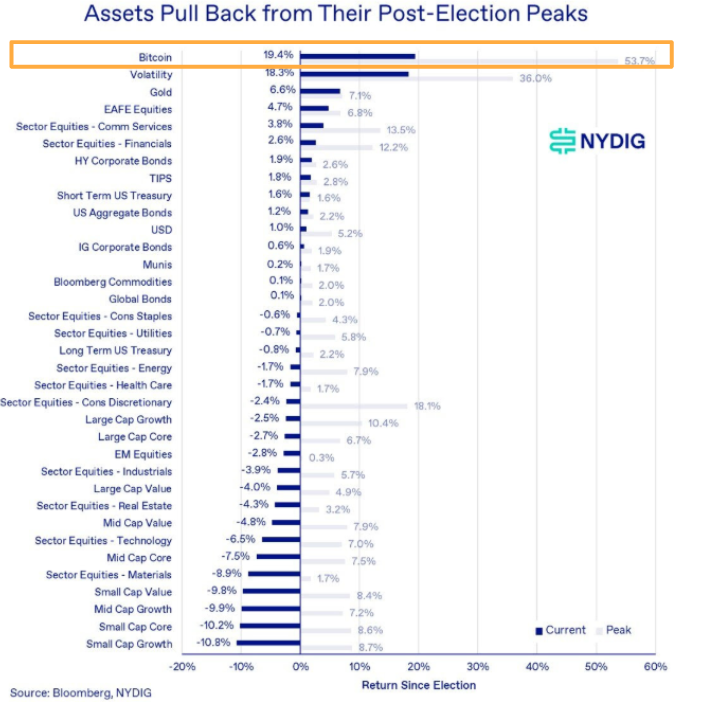

Asset efficiency post-Trump administration takeover. Supply: Thomas Fahrer

Regardless of the rising investor warning, Bitcoin outperformed all major international property since US President Donald Trump’s election, together with the inventory market, equities, US treasuries, actual property and valuable metals.

Associated: Whale closes $516M 40x Bitcoin short, pockets $9.4M profit in 8 days

Speculative urge for food is “fading” amongst crypto traders

The cooldown in Bitcoin’s sizzling provide metric reveals faltering speculative urge for food, in keeping with technical analyst Kyledoops, who wrote in a March 21 X post:

“Speculative urge for food is fading, and the market is cooling off.”

“This implies fewer recent cash in circulation, decreased liquidity, and decrease market participation,” added the analyst.

Regardless of the present lack of threat urge for food, analysts stay optimistic on Bitcoin’s value trajectory for the remainder of 2025, with value predictions ranging from $160,000 to above $180,000.

Journal: ETH may bottom at $1.6K, SEC delays multiple crypto ETFs, and more: Hodler’s Digest, March 9–15

Advertise with Anonymous Ads

Source link Review Overview