Key Takeaways:

- Digital secure currencies draw rising curiosity amid wider consumer adoption.

- Coverage makers are defining clearer oversight paths for these digital belongings.

- The evolving market reshapes financial flows in our interconnected system.

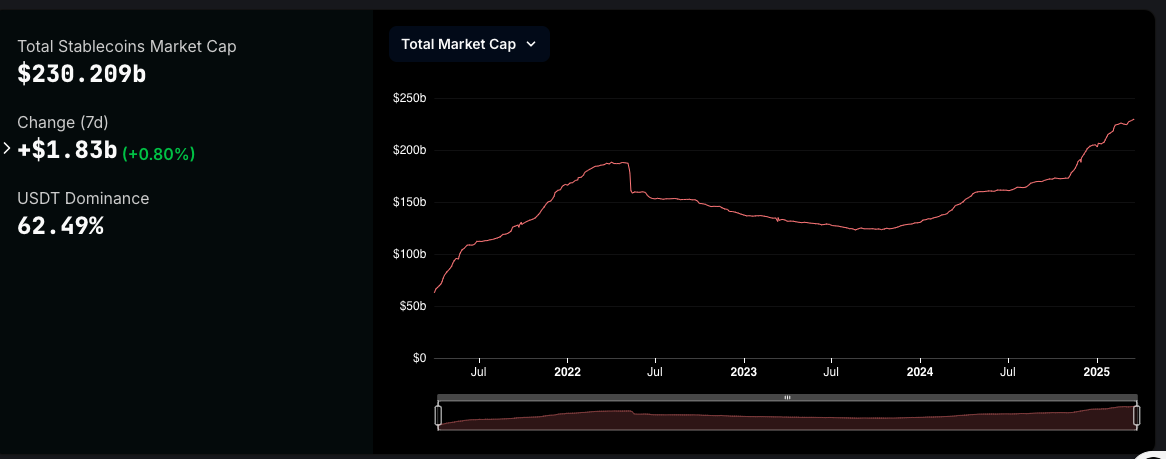

The stablecoin market crossed the $230 billion mark this week, pushed by rising adoption and renewed regulatory efforts within the U.S., according to data from DefiLlama.

Stablecoins’ Position in Finance Amid Surging Adoption and Regulatory Developments

Information reveals the stablecoin market cap now stands at $230.2 billion, including $1.83 billion over the previous week.

This marks a 72% year-to-date enhance from final yr’s $133.25 billion valuation. Tether’s USDT leads the sector, holding 62.5% of the market with almost $144 billion, adopted by Circle’s USDC at $59 billion.

The stablecoin market had beforehand peaked at $187.9 billion in April 2022 earlier than declining because of the collapse of the Terra-Luna ecosystem and crises at main crypto companies like FTX and Celsius.

The sector started rebounding in mid-2023 and has maintained regular progress since.

This rebound has additionally mirrored in rising consumer adoption and pockets exercise. A joint report by Artemis and Dune revealed that energetic stablecoin wallets have surged by over 50% previously yr.

Lively addresses grew from 19.6 million in February 2024 to 30 million in February 2025, marking a 53% year-on-year enhance.

Tether’s dominance has prolonged past crypto markets. The corporate has turn into the seventh-largest purchaser of U.S. Treasuries in 2024.

In line with Tether CEO Paolo Ardoino, the corporate bought a web $33.1 billion in U.S. Treasuries final yr, surpassing nations together with Germany, Canada, and Mexico.

Ardoino additionally famous that USDT’s international adoption now exceeds 400 million customers, with notable progress in growing nations.

U.S. Stablecoin Regulation and Political Assist

The newest growth of the stablecoin market aligns with heightened institutional curiosity and regulatory progress.

On March 20, U.S. President Donald Trump urged Congress to pass stablecoin regulations throughout the Digital Belongings Summit in New York, emphasizing the U.S. position within the digital asset house.

Trump highlighted the necessity for clear guidelines that stability progress with safety.

Only a week prior, the Senate Banking Committee advanced the Generating Necessary Information for Uncovering Stablecoins (GENIUS) Act to the total Senate.

The invoice handed with an 18-6 vote and proposes that stablecoin issuers with over $10 billion in market cap fall below Federal Reserve oversight, whereas smaller issuers stay regulated on the state degree.

Senator Cynthia Lummis expressed assist for the twin oversight construction, citing its potential to supply regulatory readability with out stifling innovation.

Stablecoins’ Rising Position within the Monetary System

A February 2025 report from OurNetwork indicated that stablecoins now account for over 1% of the U.S. greenback M2 cash provide, underscoring their rising position in international finance.

Federal Reserve Governor Christopher Waller famous that U.S. dollar-pegged stablecoins strengthen the dollar’s dominance by streamlining cross-border funds and providing entry to USD in high-inflation economies.

Talking throughout a Senate listening to on February 11, Federal Reserve Chair Jerome Powell reaffirmed assist for a regulatory framework governing stablecoins.

He emphasised the necessity for clear oversight to make sure monetary stability because the stablecoin market continues to increase.

Charting a Clear Regulatory Path

Current actions on Capitol Hill present a framework that many see as the start line for a extra outlined market.

The controversy over stablecoin oversight now occupies a central position in discussions about monetary safety and progress.

This regulatory progress provides a context the place each funding choice takes on added which means.

Observers are invited to replicate on the stability between danger and reward on this rising area.

Take into consideration how these new measures might form your method to digital belongings within the coming years.

Steadily Requested Questions (FAQs)

A rise in stablecoin adoption might ease worldwide commerce by lowering conversion friction and rushing up transactions. Shifting regulatory requirements and market changes will probably affect future commerce practices considerably.

New coverage measures are encouraging nearer ties between digital currencies and traditional banking. This integration might result in smoother fee processes and a gradual reshaping of established monetary interactions.

Buyers might face uncertainties tied to speedy coverage shifts and inherent market volatility. An in depth overview of evolving authorized frameworks and asset efficiency is strongly suggested to handle potential monetary and tech-related dangers successfully.

The publish Stablecoin Market Capitalization Reaches $230 Billion Amid Regulatory Efforts to Increase Adoption: Data appeared first on Cryptonews.

(@paoloardoino)

(@paoloardoino)