XRP (XRP) worth has recovered by nearly 30% within the final two weeks, led by a crypto market rebound, and Ripple’s long-running authorized battle towards the US Securities and Trade Fee (SEC) comes to an end.

XRP/USD each day worth chart. Supply: TradingView

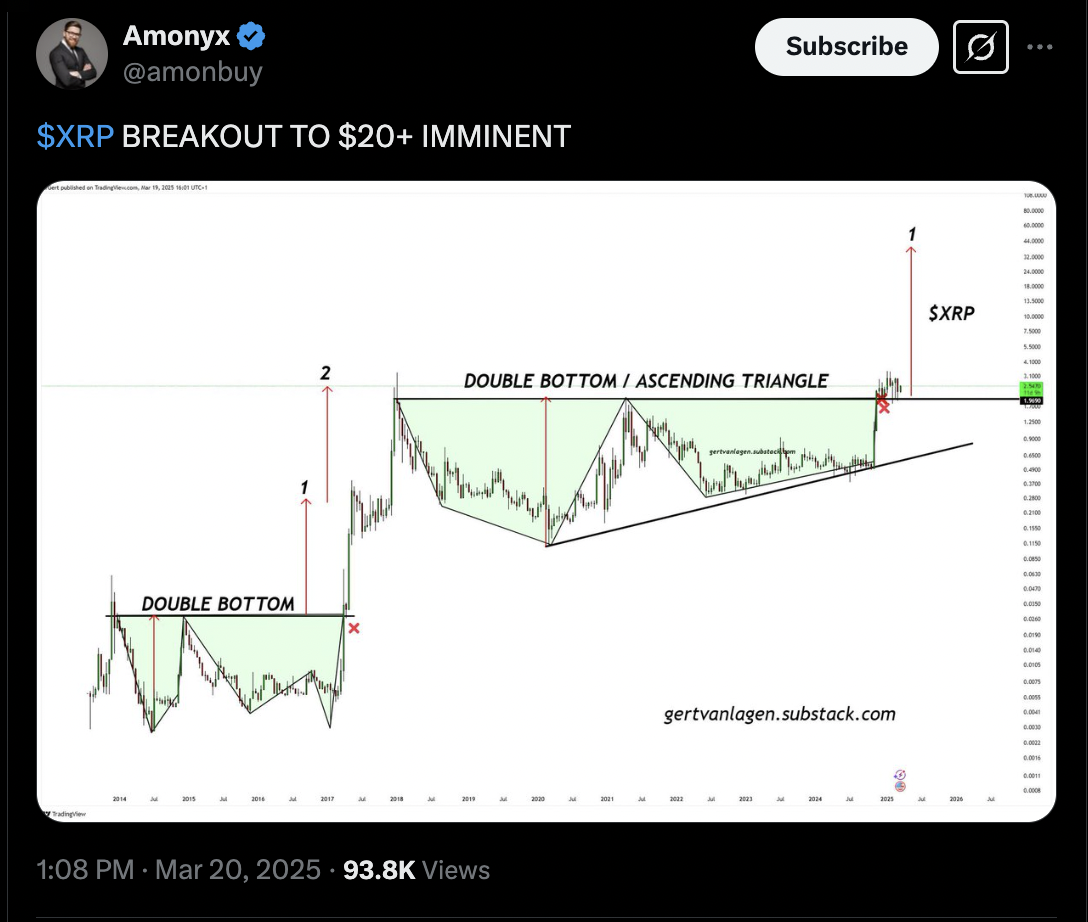

The cryptocurrency’s rebound can be occurring contained in the confines of a basic bullish continuation sample, promising additional features within the coming weeks.

XRP symmetrical triangle places 75% rally in play

XRP’s bullish technicals seem because it varieties what seems to be a symmetrical triangle sample.

A symmetrical triangle is taken into account a basic bullish continuation setup that varieties after the value consolidates inside a spread shaped by converging trendlines after a robust uptrend.

As a rule of technical evaluation, the setup resolves when the value breaks above the higher trendline, probably rising as excessive because the size of the utmost distance between the higher and decrease trendlines.

XRP/USD weekly worth chart. Supply: TradingView

As of March 21, XRP bounced after testing the triangle’s decrease trendline, eyeing an increase towards the higher trendline— across the apex level on the $2.35 degree—by April. The last word goal for this attainable breakout is $4.35 by June, up 75% from the present worth ranges.

Conversely, a drop beneath the decrease trendline may invalidate the bullish setup, setting XRP on the trail towards $1.28. The bearish goal is obtained by subtracting the triangle’s most peak from the potential breakdown level at $2.35.

Supply: Amonyx

XRP fundamentals enhance upside outlook

The bullish technical setup is growing consistent with a current flurry of optimistic occasions round Ripple and XRP.

Notably, the cryptocurrency climbed by as a lot as 7.85% to succeed in $2.41 on March 21, two days after the SEC dropped its enchantment towards Ripple.

The rally gained momentum after crypto change Bitnomial voluntarily dismissed its lawsuit towards the SEC earlier than launching the primary CFTC-regulated XRP futures within the US.

Supply: Alva

Futures contracts permit merchants to take a position on XRP’s worth with out straight holding the asset, growing total market exercise. This deepens liquidity, lowering slippage and making it simpler to execute giant trades.

Nevertheless, in response to crypto lawyer John Deaton, Ripple nonetheless faces a authorized hurdle within the type of an injunction issued by Judge Analisa Torres, which restricts the corporate from promoting XRP to institutional buyers.

Associated: XRP’s role in US Digital Asset Stockpile raises questions on token utility — Does it belong?

He told Cointelegraph that the ruling can probably restrict Ripple’s capability to distribute XRP on to institutional buyers, particularly banks and monetary establishments, including:

“If Ripple clearly needs to have the ability to challenge XRP to banks in America straight, I believe the hang-up is that injunction. How do you get previous that injunction?”

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.