Solana's native token, SOL (SOL), gained 8.5% on March 24, reclaiming the $142 mark for the primary time in two weeks. This rally mirrored the positive factors seen throughout the broader cryptocurrency market as merchants started to anticipate decreased dangers of an financial downturn. The rising threat urge for food may also be seen amongst memecoins, a number of of which rallied by 12% or extra since March 23.

Outdoors of the broad market rally, SOL has its personal deserves, together with an increase in community exercise and the direct involvement of US President Donald Trump with the memecoin market. Moreover, rising curiosity from prime merchants on exchanges and the rising probability of a spot Solana exchange-traded fund (ETF) approval counsel additional potential for SOL’s value progress.

SOL/USD (inexperienced) vs. crypto market cap (orange). Supply: TradingView / Cointelegraph

Regardless of the latest rally, SOL has underperformed the broader crypto market by 23.7% over the previous two months. This weak point is linked to a 93% decline in Solana community charges throughout that interval. The decline doubtless started with merchants’ disappointment within the memecoin sector however progressively affected your complete decentralized software (DApps) market.

SOL nonetheless trades 52% under its all-time excessive

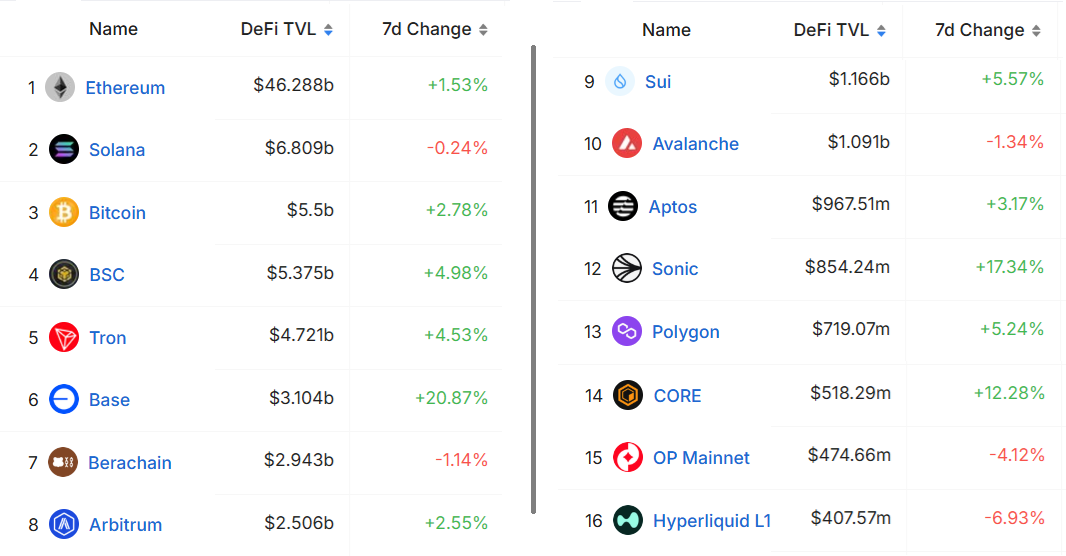

Merchants now query whether or not the promoting was an overreaction, as SOL is at present buying and selling 52% under its all-time excessive of $295. This comes regardless of Solana remaining the second-largest blockchain by way of whole worth locked (TVL) and rating third in onchain volumes. For comparability, BNB is buying and selling 20% under its all-time excessive, and XRP is 28% under its peak.

Blockchains ranked by whole worth locked (TVL), USD. Supply: DefiLlama

Whereas Tron and BNB Chain present competitors by way of onchain volumes, deposits in Solana community’s sensible contracts are valued at $6.8 billion. In third place, BNB Chain holds 21% much less TVL, with $5.4 billion. Key highlights on Solana embody the Jito liquid staking answer, Kamino lending and liquidity platform, and the Jupiter decentralized change.

The charges on the Solana community are actually greater than these on the Ethereum base layer, surpassing $1 million per day. Extra importantly, Solana's income has just lately reached its highest ranges in two weeks. Whereas nonetheless removed from the degrees seen two months in the past, the rise in Solana community exercise means that the underside could have been reached because the numbers proceed to enhance steadily.

Solana community day by day charges, USD. Supply: DefilLlama

As a comparability, Ethereum accrued lower than $350,000 in charges on March 23, resulting in a rise in ETH provide because the built-in burn mechanism did not offset weak blockchain exercise. Solana, then again, affords a 7.7% native staking reward charge, surpassing the equal 5.1% inflation charge, based on StakingRewards knowledge.

Solana ETF choice nears whereas Trump tweet boosts memecoin momentum

Regardless of SOL’s value weak point, prime merchants on Binance have elevated their leveraged lengthy (bull) positions on SOL, based on CoinGlass knowledge.

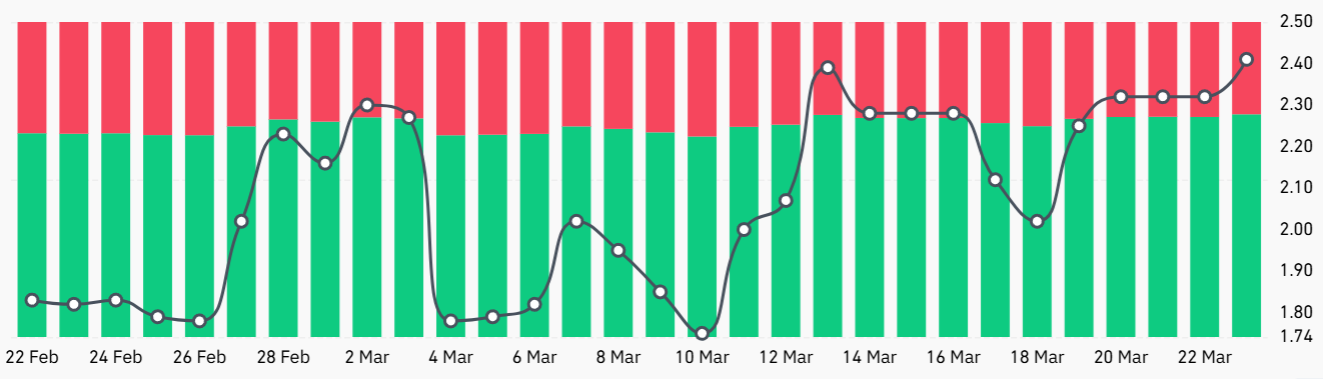

Binance prime merchants' long-to-short SOL ratio. Supply: CoinGlass

The long-to-short ratio amongst prime merchants on Binance surged to 2.40 on March 23, its highest stage in over two months. A part of the joy may be attributed to the anticipation of the spot Solana exchange-traded fund (ETF) approval within the US.

The US Securities and Change Fee is anticipated to challenge its last verdict earlier than the top of the yr, based on Matthew Sigel, VanEck’s head of digital asset analysis. Though success just isn't assured, the eventual spot Solana ETF approval would set SOL aside from its opponents, including legitimacy to the asset, particularly amongst institutional buyers.

One other supply of momentum got here from a weekend social put up by President Trump, which explicitly talked about the TRUMP memecoin and helped to create a buzz within the sector. Within the Solana ecosystem, Fartcoin gained 15% on March 24, Dogwifhat (WIF) rallied 12%, and Pudgy Penguins (PENGU) traded up by 12%.

In the end, SOL has important potential for greater positive factors, given the community’s TVL and charges, particularly compared to opponents, together with bullish positioning from whales utilizing leverage.

This text is for normal info functions and isn't meant to be and shouldn't be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the creator’s alone and don't essentially mirror or signify the views and opinions of Cointelegraph.