The XRP (XRP) market is flashing warning indicators as a bearish technical sample emerges on its weekly chart, coinciding with macroeconomic pressures from anticipated US tariffs in April.

XRP descending triangle sample hints at 40% drop

Since its late 2024 rally, the XRP worth chart has been forming a possible triangle sample on its weekly chart, characterised by a flat assist degree combined with a downward-sloping resistance line.

A descending triangle sample forming after a robust uptrend is seen as a bearish reversal indicator. As a rule, the setup resolves when the worth breaks under the flat assist degree and falls by as a lot because the triangle’s most peak.

XRP/USD weekly worth chart. Supply: TradingView

As of March 28, XRP was testing the triangle’s assist for a possible breakdown transfer. On this case, the worth could fall towards the draw back goal at round $1.32 by April, down 40% from present worth ranges.

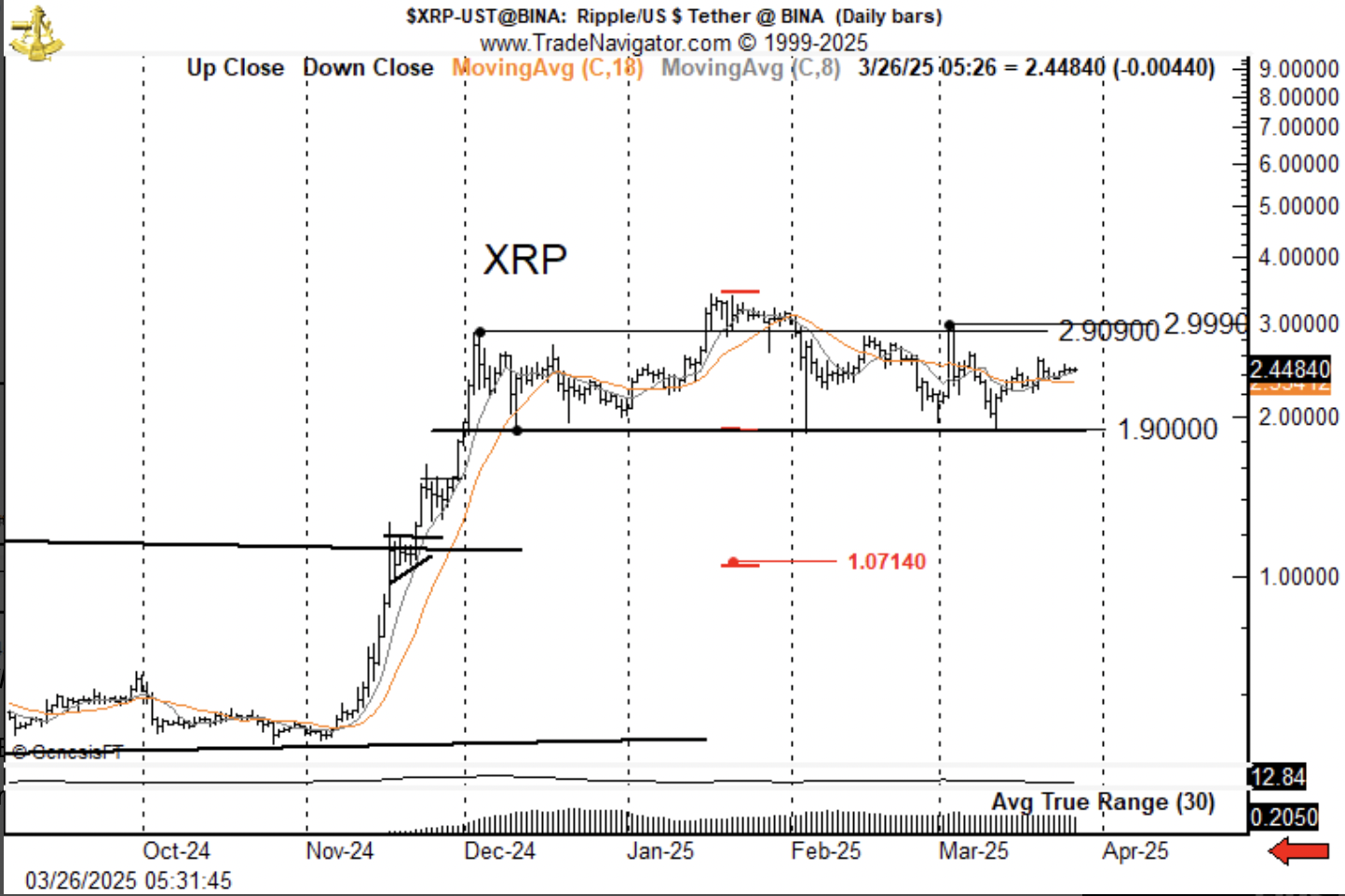

XRP’s descending triangle goal echoes veteran dealer Peter Brandt’s prediction. He warned of a potential decline to as little as $1.07 resulting from a “textbook” head-and-shoulders sample forming on the every day chart.

XRP/USD every day worth chart. Supply: Peter Brandt

Conversely, a rebound from the triangle’s assist degree may lead the worth towards its higher trendline at round $2.55. A clear breakout above this resistance degree dangers invalidating the bearish buildings altogether, as an alternative sending the worth towards the earlier excessive of $3.35.

Trump tariffs may amplify XRP sell-off

The broader market, in the meantime, has turned more and more cautious in response to President Donald Trump’s 25% tariffs on auto imports, set to go dwell on April 3.

These tariffs are prone to lead to larger costs for US producers and shoppers. The February 2025 US CPI report already confirmed a 0.2% month-over-month improve.

Associated: Is altseason dead? Bitcoin ETFs rewrite crypto investment playbook

St. Louis Federal Reserve President Alberto Musalem estimated that these tariffs may contribute roughly 1.2 share factors to inflation, with about 0.5 share factors stemming from direct results and 0.7 share factors from oblique results.

In response to the CME FedWatch Tool, the likelihood of the Federal Reserve slicing charges to a goal vary of 400–425 foundation factors in June has fallen to 55.7% as of March 28, down from 67.3% per week earlier and 58.4% simply sooner or later in the past.

Goal price possibilities for the June Fed assembly. Supply: CME

A delayed price minimize would scale back the stream of capital into speculative markets, stalling momentum for XRP and different digital belongings that thrive in a low-rate, risk-on setting.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.