Ethereum has dropped to $1,874, testing a key assist stage as promoting stress intensifies throughout the broader crypto market. With costs inching dangerously near essential liquidation thresholds round $1,805, analysts warn {that a} sharper correction might be on the horizon.

This downturn locations $238 million price of ETH in danger, as two main MakerDAO whales face potential liquidation. Because the market braces for volatility, merchants are carefully watching whether or not bulls can defend present ranges—or if bears are getting ready to power a deeper breakdown.

Whales at Danger: $238M ETH Faces Liquidation

The most recent ETH sell-off is testing the resilience of extremely leveraged DeFi positions. In line with blockchain analytics agency Lookonchain, two massive Ethereum holders on MakerDAO are on the verge of liquidation. Mixed, they maintain 125,603 ETH, at present valued at $238 million.

As Ethereum trades close to $1,874, their positions are approaching liquidation triggers at $1,805 and $1,787. The well being price of those vaults—a key indicator of collateral stability—has now dropped to 1.07, elevating the probability of pressured asset gross sales.

If ETH falls beneath these ranges, the Maker protocol will routinely liquidate collateral, doubtlessly flooding the market with ETH and triggering a broader wave of promote stress throughout DeFi.

This state of affairs might amplify bearish momentum and rattle confidence in leveraged on-chain methods.

Ethereum Worth Motion Alerts Additional Weak point

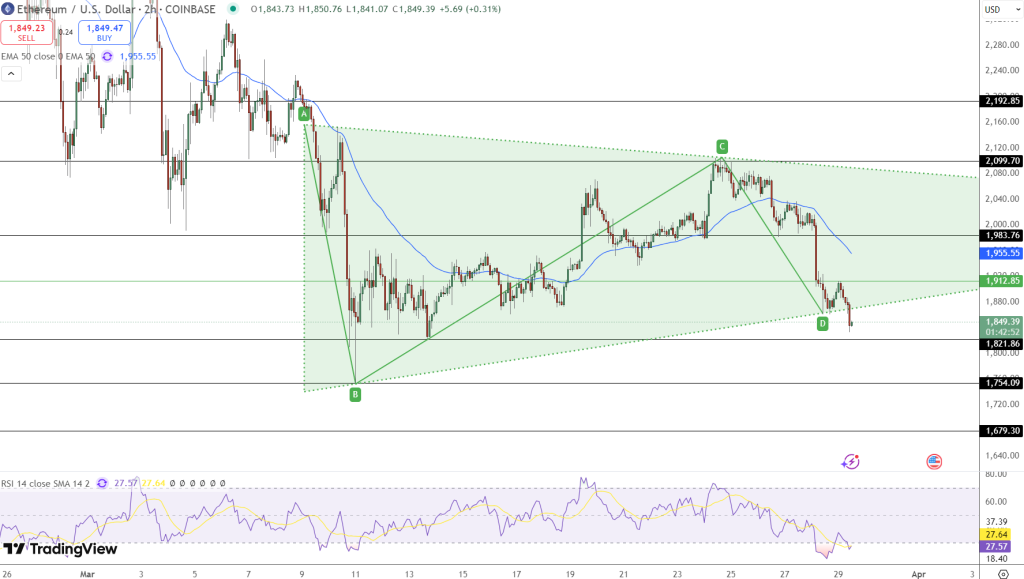

Ethereum has damaged beneath its symmetrical triangle assist close to $1,880, a key stage that had held for weeks. The present value motion round $1,850 suggests rising promoting stress. Technical indicators present little consolation for bulls:

- Relative Power Index (RSI) has plunged to twenty-eight, signaling excessive oversold circumstances.

- The 50-period EMA on the 2-hour chart sits at $1,955, nicely above present value ranges.

- An ABCD harmonic sample accomplished close to the latest low, hinting at continuation of the bearish transfer.

If Ethereum breaks decisively beneath $1,822, the subsequent assist zones lie at $1,754 and $1,680. Solely a restoration above $1,880 and a detailed above $1,955 would point out a significant pattern reversal.

Market Outlook: DeFi Liquidations in Focus

The potential liquidation of whale-sized positions highlights a persistent danger in decentralized finance—automated liquidations with no guide stop-losses. Whereas DeFi provides transparency, its inflexible mechanics can result in sharp, sudden strikes during times of volatility.

Key Factors to Watch:

- A breakdown beneath $1,805 might set off liquidation of 125K ETH.

- RSI suggests circumstances are oversold, however restoration stays unsure.

- ETH should reclaim $1,880–$1,955 to regain bullish construction.

Whereas oversold readings might immediate a brief bounce, the looming risk of main liquidations suggests draw back dangers stay elevated except sentiment shifts swiftly.

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that routinely rewards holders with actual Bitcoin when BTC hits key value milestones. In contrast to conventional meme tokens, BTCBULL is constructed for long-term buyers, providing actual incentives by means of airdropped BTC rewards and staking alternatives.

Staking & Passive Revenue Alternatives

BTC Bull provides a high-yield staking program with a formidable 119% APY, permitting customers to generate passive earnings. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting robust group participation.

Newest Presale Updates:

- Present Presale Worth: $0.002435 per BTCBULL

- Whole Raised: $4.2M / $4.8M goal

With demand surging, this presale offers a possibility to amass BTCBULL at early-stage pricing earlier than the subsequent value improve.

The submit Ethereum Drops to $1,874: Are Bears Pushing for a Breakdown Below Key Support? appeared first on Cryptonews.