[ad_1]

Bitcoin (BTC) recovered above $41,000 on the Dec. 13 Wall Avenue open as eyes centered on the USA Federal Reserve.

PPI goal beat comes hours earlier than Fed charge transfer

Knowledge from Cointelegraph Markets Pro and TradingView confirmed BTC worth power gaining momentum on the newest U.S. macro knowledge releases.

November’s Producer Price Index (PPI) print got here in beneath expectations, additional bolstering the extant narrative of declining inflation. The Consumer Price Index (CPI) print, whereas much less encouraging, didn’t induce contemporary ache for threat belongings.

“That is the bottom PPI inflation studying since December 2021,” buying and selling useful resource The Kobeissi Letter wrote in a part of a response on X (previously Twitter).

“For the reason that final Fed assembly, we have now seen a number of favorable inflation prints. All eyes are on the Fed at this time and a possible trace of a ‘Fed pivot.’”

Kobeissi referenced the week’s major macro occasion, the Federal Open Market Committee (FOMC) gathering and determination on rate of interest modifications. The choice is due at 2pm Japanese time, with Fed Chair Jerome Powell giving a press convention at 2.30pm.

Each occasions are apt to spark non permanent volatility in crypto and past, whereas Bitcoin’s personal reactions to the macro knowledge remained muted.

Per knowledge from CME Group’s FedWatch Tool, on the time of writing, markets remained satisfied that no charge modifications would happen because of the FOMC assembly.

Dealer eyes key BTC worth ranges for “motion”

Low-timeframe BTC worth motion in the meantime lacked a transparent pattern.

Associated: Bitcoin ‘sodlers’ dump $4B in two days as BTC sales hit 18-month high

Current assist and resistance ranges remained in place, with fashionable dealer Jelle likewise reiterating the importance of $48,000 overhead.

“Whereas the decrease timeframes look uneven, Bitcoin appears to be flipping the mid-range stage. $48,000 remains to be the primary stage to beat — after which worth discovery is inside an arms attain,” he told X subscribers on the day.

The day’s evaluation contained a prediction of additional sideways conduct, with Jelle betting on “many of the draw back” already having passed for Bitcoin.

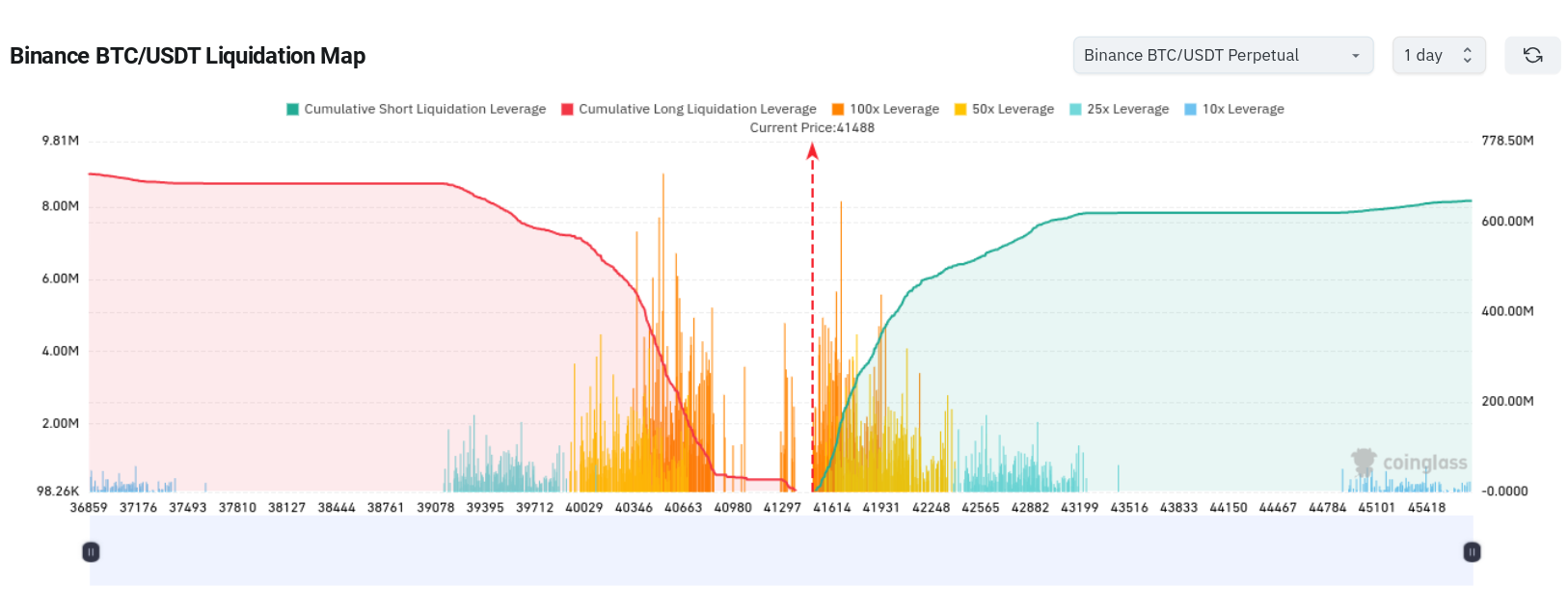

Taking a look at liquidation ranges, fellow dealer Daan Crypto Trades eyed rising leveraged bets in a zone that spot worth was now within the means of clearing.

“Constructing some massive liquidation clusters because it’s chopping sideways,” he wrote alongside knowledge from statistics useful resource CoinGlass.

“Most notably: $40.5K & $41.4K. Count on some motion round these ranges.”

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link