[ad_1]

Since bottoming round $16,800, Bitcoin (BTC) has displayed resilience all through 2023, posting over 153% positive factors year-to-date and $143% during the last 12 months to outperform main tech corporations.

Regardless of this spectacular efficiency, the flagship cryptocurrency’s value continues to be 39% under the all-time excessive (ATH) stage reached in November 2021.

In the meantime, Bitcoin continues to hit new ATHs in Argentina, Turkey, Egypt, Nigeria, Lebanon and Pakistan.

That is what #Bitcoin seems to be like for the residents of Turkey, Egypt, Nigeria, Argentina, Lebanon and Pakistan.

A mixed inhabitants of

725 MILLION individuals

Attempt to persuade them Bitcoin will not be helpful. Good luck pic.twitter.com/z8poh2C7Wb— Tahini’s (@TheRealTahinis) December 13, 2023

In accordance with the Dec. 13 submit, at one level on Dec. 12, a single Bitcoin has reached ATHs in opposition to the Argentine peso at 15,176,100.12 ARS. BTC was price 1,202,109.40 Turkish liras (TRY), 32,703,517.06 Nigerian nairas (NGN), and 1,280,955.47 Egyptian kilos (EGP).

The chart additionally confirmed that BTC has reached ATHs in opposition to the Lebanese pound and the Pakistani Rupee at 622,548,74.67 LBP and 11,736,063.26 PKR respectively.

It’s price mentioning that these figures are equal to the present value of Bitcoin.

It’s price noting that the meteoric rise of Bitcoin in these nations is because of excessive inflationary pressures, ensuing within the devaluation of their respective currencies.

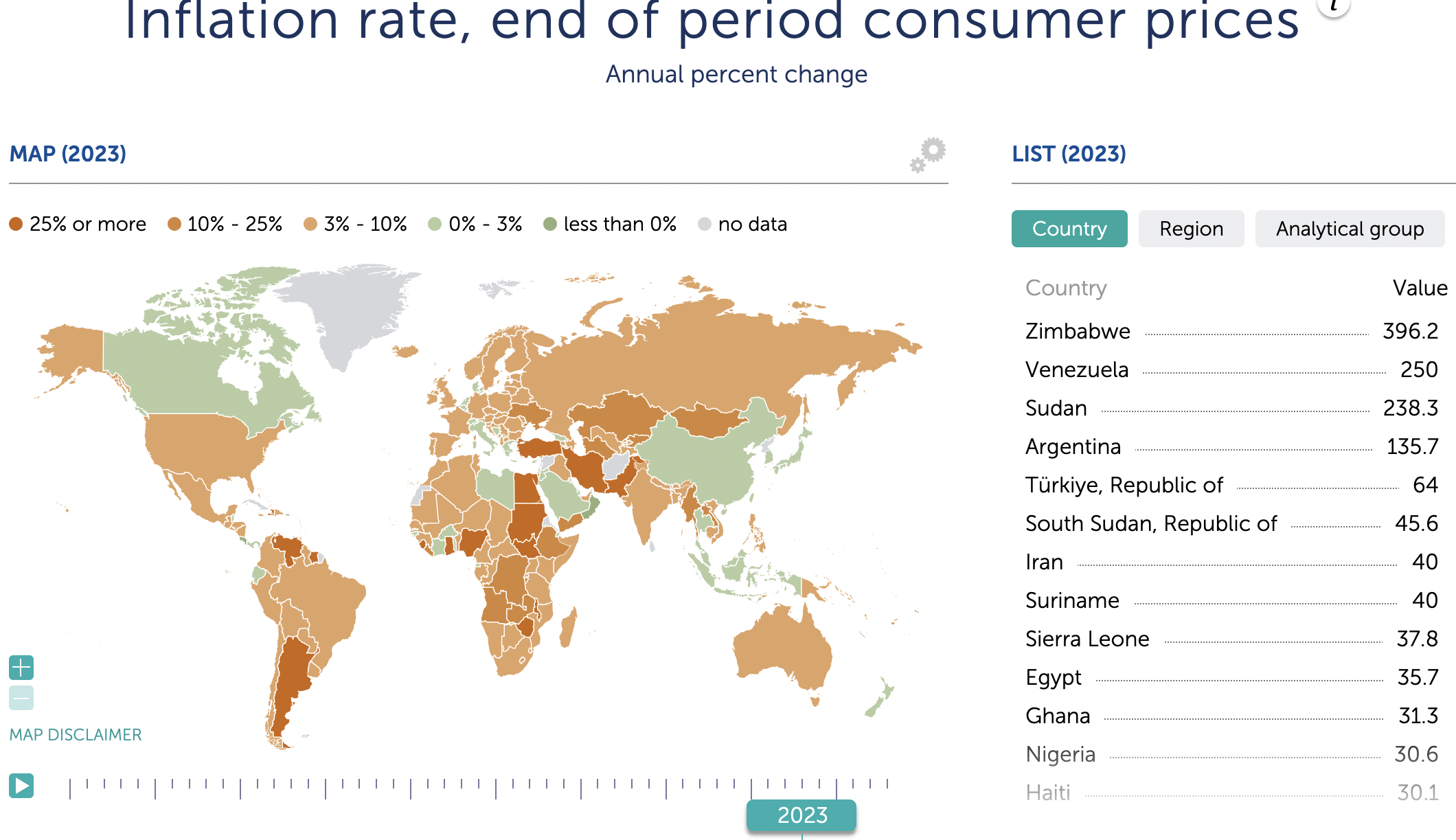

Information from the Worldwide Financial Fund (IMF) ranks nations’ annual share change in inflation charges and end-of-period shopper costs.

In accordance with the chart above, the Zimbabwean greenback at the moment has the best annual inflation charge at 396%, adopted by the Venezuelan bolivar (250%), Sudanese pound (238%) and the Argentine peso (135%).

The Turkish lira and Nigerian naira got here in fifth and twelfth with annual inflation charges of 64% and 30%, respectively, IMF’s information reveals.

For many crypto buyers in these nations, Bitcoin has develop into a dependable retailer of worth and a hedge in opposition to rocketing inflation.

Many of those nations together with Nigeria and Argentina have been readily adopting cryptocurrencies regardless of the regular devaluation of their forex.

Nigeria, Turkey and Argentina boast the second, twelfth and fifteenth highest rates of cryptocurrency adoption worldwide, in line with a Sept. 12 report by Chainalysis.

Argentina’s Bitcoin adoption is prone to get a lift following the result of the Nov. 19 presidential election run-off which noticed pro-Bitcoin candidate Javier Milei emerge the winner.

#Bitcoin is hope for Argentina. Congratulations @JMilei.

— Michael Saylor⚡️ (@saylor) November 20, 2023

After assuming workplace on Dec. 10, Milei appointed Luis Caputo as economic system minister who introduced on Dec. 12 that Argentina was devaluing the peso over 50% to 800 per greenback in an “emergency bundle” aimed toward balancing the finances by 2024. This transfer seems to have been endorsed by the IMF.

NEW: Javier Milei’s economic system minister broadcasts a drastic “emergency bundle” to stability the finances by 2024

Measures embody: layoffs for brand spanking new public workers, chopping authorities positions by 34%, and cancelation of all public infrastructure

To this point the IMF approves pic.twitter.com/MHlIZ79Bz8

— Bitcoin Information (@BitcoinNewsCom) December 13, 2023

The IMF referred to as the measures “daring” including that they’d “considerably enhance public funds in a manner that protects essentially the most weak within the society and strengthen the trade charge regime”.

Whereas on the marketing campaign path, Milei mentioned he would abolish Argentina’s central financial institution if he took over as president.

Associated: Bitcoin derivatives data points to traders’ $50K BTC price target

Bitcoin outperforms tech corporations

Through the prolonged 2022 bear market, Bitcoin fell relentlessly in tandem with tech shares. In accordance with a assessment letter by Pantera Capital – an American crypto hedge fund – Bitcoin has outperformed all of them apart from Meta, which has recorded greater than 172% positive factors YTD in opposition to BTC’s 162%.

The value of bitcoin was down according to tech corporations final 12 months. This 12 months it has massively out-performed most.

That’s the 14-year story of #bitcoin – larger lows and better highs every cycle.

Our year-in-review letter: https://t.co/fy9wy78dVG

I will summarize under:

The… pic.twitter.com/cgvOdHZcBk

— Dan Morehead (@dan_pantera) December 12, 2023

Bitcoin bounced again in 2023 attributable to a “overwhelming majority of serious occasions” which have been “excellent news” with the “blockchain business making significant, essential progress”, in line with Pantera.

The crypto hedge agency lists various these occasions together with elevated institutional adoption courtesy of “spot Bitcoin ETFs sponsored by giant names in conventional finance – like BlackRock and Constancy – and the chief in blockchain ETFs, Bitwise.” The potential approval of Bitcoin ETFs opens a brand new channel for conventional capital to be injected into Bitcoin as “digital gold”.

The letter additionally notes that the power of the market to depend on the U.S. court docket system to be truthful has been “reassuring” citing the ruling by Choose Analisa Torres that XRP is not a security and Grayscale’s win in their lawsuit against the SEC concerning their BTC utility. These level to a positive regulatory panorama for crypto within the U.S., enabling additional innovation to happen onshore, the report famous.

Along with these, the upcoming Bitcoin halving occasion in 2024 can also be contributing to the widespread optimism surrounding the flagship cryptocurrency.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link