[ad_1]

Bitcoin (BTC) might take pleasure in a well-recognized tailwind within the coming weeks and even past if new macro forces proceed to play out.

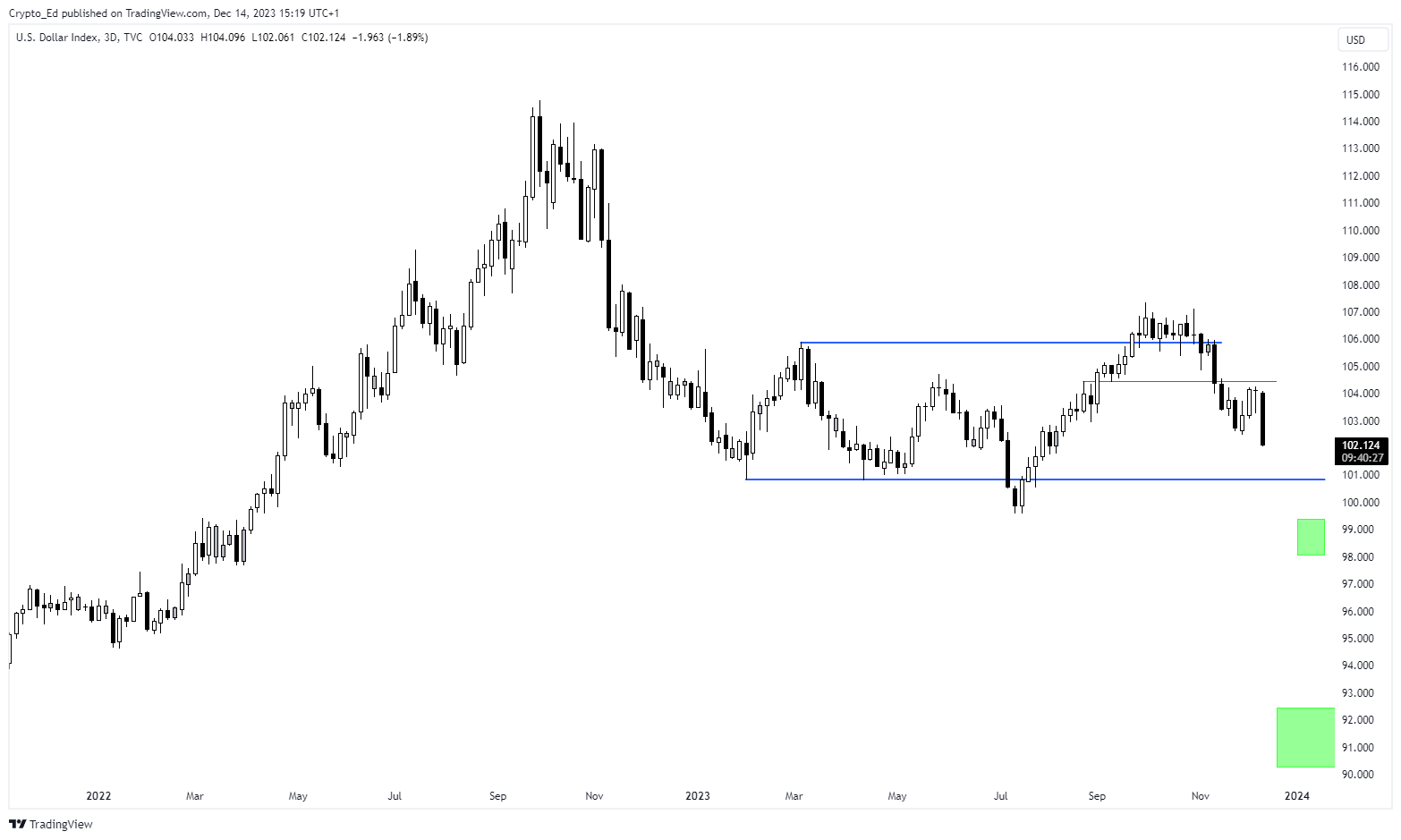

In a post on X (previously Twitter) on Dec. 14, common dealer Crypto Ed, founding father of buying and selling group CryptoTA, eyed multi-month lows in U.S. greenback energy.

Bitcoin dealer targets sub-100 DXY dive

Bitcoin and greenback energy have prior to now exhibited inverse correlation. Whereas this has decreased in recent times, modifications to U.S. macro coverage at the moment are broadly seen to spice up Bitcoin however strain the buck going ahead.

As Cointelegraph reported, the week’s macro information prints, mixed with encouraging indicators from the Federal Reserve, have analysts pointing the way in which to additional crypto market upside subsequent yr.

That is because of declining inflation probably permitting for the Fed to “pivot” on rate of interest hikes, growing liquidity — to the advantage of threat property.

An asset not set to benefit from the aftermath of the swap is the greenback, which has declined precipitously this week as macro figures confirmed the impression of financial tightening on inflation.

The U.S. greenback index (DXY) is down greater than 2% because the begin of the week, at the moment beneath $102 — its lowest ranges since mid-August.

Commenting, Crypto Ed joined those that are optimistic on Bitcoin whereas predicting additional draw back strain on DXY.

“Lengthy Time period Outlook for DXY what is going to assist BTC to teleport to new ATH’s,” he wrote, referring to new all-time highs for BTC/USD.

“DXY to $92.”

An accompanying chart earmarked key ranges to search for on DXY on 3-day timeframes.

Fed steadiness sheet creeps greater

On the subject of liquidity, economist Lyn Alden nonetheless argued that circumstances weren’t but excellent when it comes to supporting a broad risk-asset renaissance.

Associated: Bitcoin bulls eye BTC price comeback as cash inflows echo late 2020

“International liquidity indicators began to stall a bit after their current rise, and reverse repos have not drained within the first half of December, however at the moment’s dovish Fed and drop in DXY probably kickstarted a bit extra liquidity,” she told X subscribers on Dec. 14.

Days later, Alden nonetheless famous a “fairly outstanding repricing” by markets taking a look at how the Fed would possibly decrease charges in 2024.

DXY down once more at the moment thus far, and crude oil and different commodities getting a little bit of a corresponding bounce.

The previous 24 hours has seen a reasonably outstanding repricing by the market of ahead charge expectations. https://t.co/HmrZ8oXEfe pic.twitter.com/Wz9alU3hGe

— Lyn Alden (@LynAldenContact) December 14, 2023

Data from the Fed itself exhibits its steadiness sheet growing for the primary time since August this month — by round $2 billion.

BTC/USD in the meantime traded at $42,700 on the time of writing on Dec. 15, staying comparatively flat after temporary volatility entered the day prior. The pair stays up 13% in December, per information from Cointelegraph Markets Pro and TradingView.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.

[ad_2]

Source link