Bitcoin’s (BTC) each day chart registered a bearish three-blind mice sample over the previous three days, taking BTC’s worth exterior the long-term established vary between $110,000 and $90,000.

Bitcoin 1-day chart. Supply: Cointelegraph/TradingView

Over the previous 24 hours, Bitcoin examined the truthful worth hole, however BTC has struggled to ascertain bullish momentum from the $82,000 vary low.

Spot Bitcoin ETFs bleed $3.4 billion in February

Between Feb. 24 and Feb. 27, Bitcoin registered a big drawdown of 12.48%, which was accompanied by an in depth interval of spot BTC ETF outflows. Information from SoSoValue pointed out that the collective spot ETFs market registered an outflow of $2.4 billion this week, with Feb. 25 recording BTC’s largest ETF outflow of $1.13 billion since inception.

Spot Bitcoin ETF flows in February. Supply: SoSoValue

Total, the spot BTC ETF market witnessed an outflow of $3.4 billion in February.

Demand for the spot BTC ETF declined throughout this week’s correction, and crypto analyst Adam advised historic knowledge factors to cost reversals at any time when giant ETF inflows or outflows have occurred.

Spot Bitcoin ETF inflows/outflows inverse correlation with worth. Supply: X.com

Adam pointed out that in 14 cases of serious inflows or outflows, Bitcoin worth has aligned with the path of these flows solely as soon as. This uncommon incidence occurred on Nov. 7, following Trump’s victory, when a worth surge and substantial inflows have been noticed.

Adam stated,

“Typically, individuals see an enormous purple quantity and begin panic promoting, or vice versa, which finally ends up sending the market in the wrong way.”

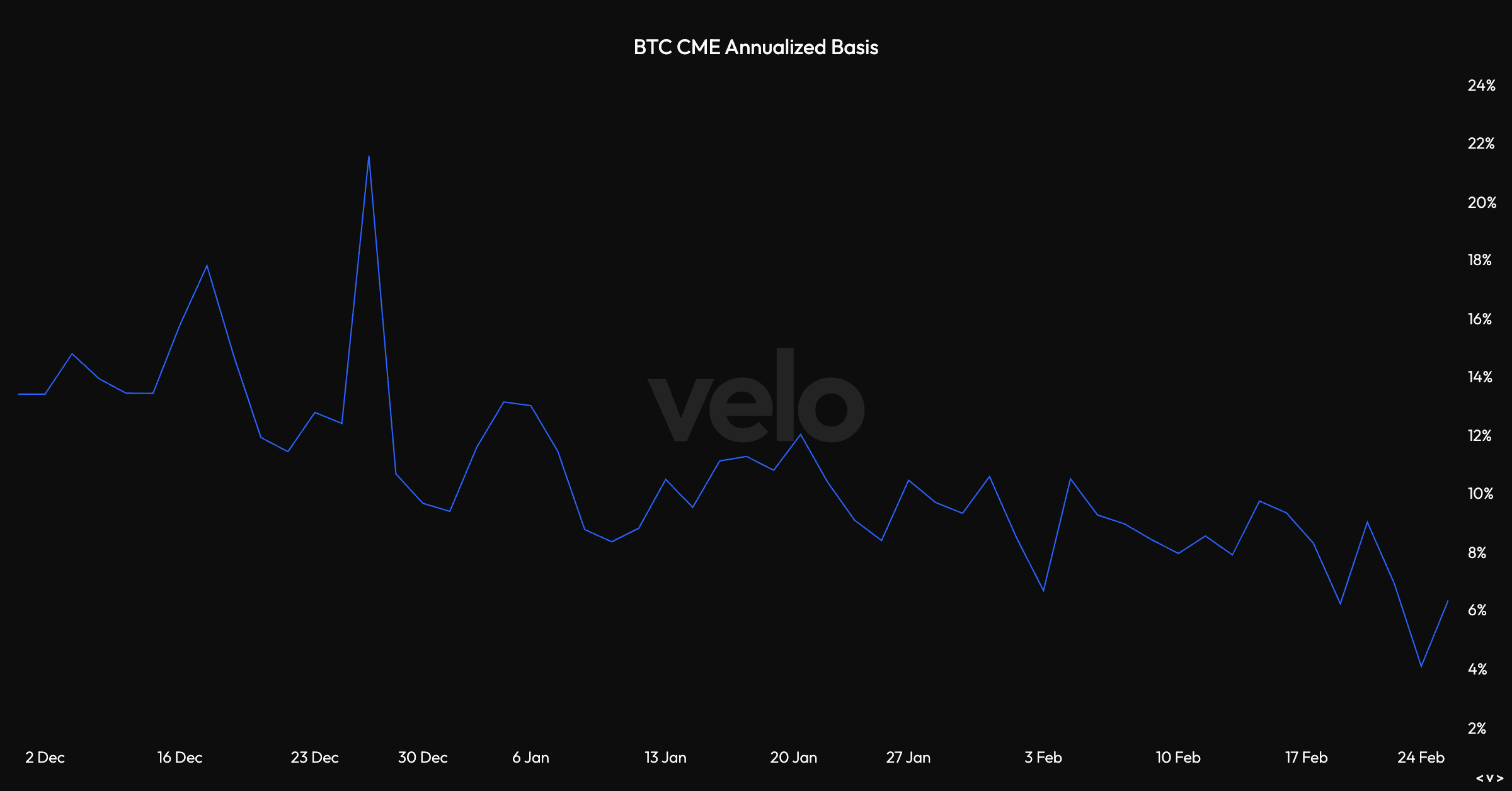

Likewise, the dealer believed that dependent upon different confluent components, “some reduction rally” must be across the nook. Nonetheless, Zaheer, an nameless market analyst, stated that the present drop in spot costs and ETF internet flows was doubtlessly as a result of CME futures foundation falling under 5%.

BTC CME annualized foundation under 5%. Supply: X.com

The analyst explained that the majority market individuals unwound their positions as soon as the risk-free charge vary is damaged. The gradual drop in CME futures open curiosity highlighted low investor confidence, which was additional evidenced by low futures premiums.

Related: Key metric shows Bitcoin hasn’t peaked, has bullish year ahead: Analyst

Bitcoin Concern & Greed Index conveys investor

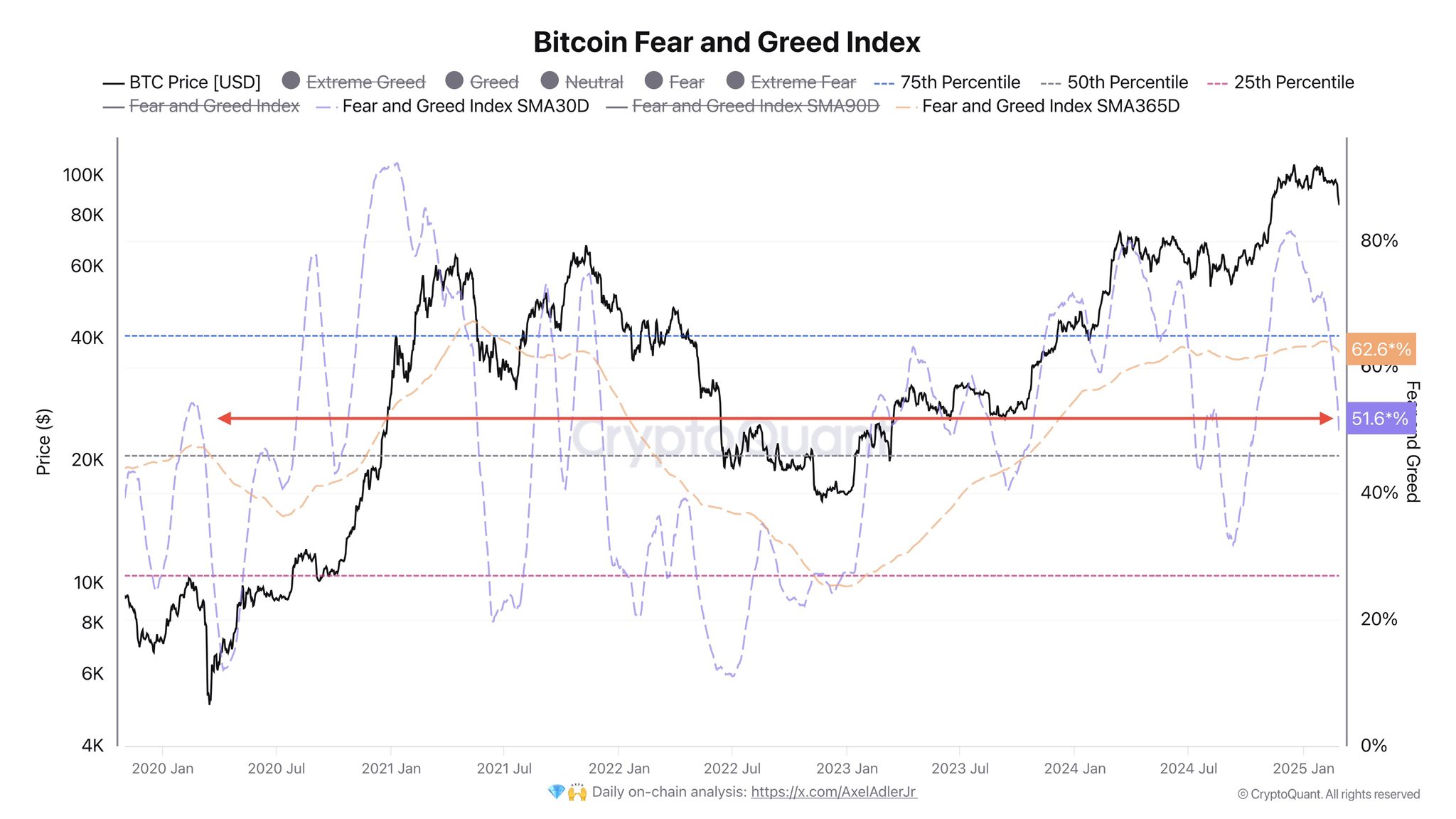

Cointelegraph reported that the Crypto Concern & Greed Index had reached its lowest degree since 2022, projecting a rating of 10 into “excessive concern.” In response to Ben Simpson, the founding father of Collective Shift, the present circumstances may current a shopping for alternative, as the easy technique of shopping for into excessive concern and promoting into greed has been a worthwhile transfer.

Bitcoin Concern & Greed Index by Axel Adler Jr. Supply: X.com

Nonetheless, Axel Adler Jr, an onchain market researcher, identified that the Bitcoin Concern & Greed Index’s 30-day transferring common is but to drop under the fiftieth percentile.

Adler explained that the 30DMA dropping under the fiftieth percentile has traditionally signaled Bitcoin worth reversals and upward developments, however the present index stays above this degree. Adler advised that the most effective plan of action is to “wait” and see how the market developments over the approaching days.

Related: BlackRock Bitcoin fund sheds $420M as ETF losing streak hits day 7

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.