Bitcoin dangers extra draw back if it loses a “key” $75,000 assist amid rising issues over a possible commerce battle between the USA and China.

Bitcoin’s (BTC) value has fallen greater than 6.5% in the course of the previous 24 hours to sink under a low of $78,197, which was final seen on Nov. 10, 2024, Cointelegraph Markets Pro information exhibits.

Analysts attribute the present decline to macroeconomic issues associated to a possible commerce battle between the US and China brought on by US President Donald Trump’s determination to impose import tariffs.

BTC/USD, 1-year chart. Supply: Cointelegraph

These macroeconomic issues have been the primary purpose for Bitcoin shedding the $80,000 assist, in accordance with Ryan Lee, chief analyst at Bitget Analysis.

The analyst advised Cointelegraph:

“Bitcoin’s drop under $80,000 amid investor concern from Trump’s tariffs and market unrest, factors to a correction probably hitting $76,000-$78,000 this week, nearing $75,000 as a key assist stage primarily based on historic patterns and dealer sentiment.”

Nonetheless, some analysts are involved that Bitcoin’s correction might even see the world’s first cryptocurrency revisit $70,000.

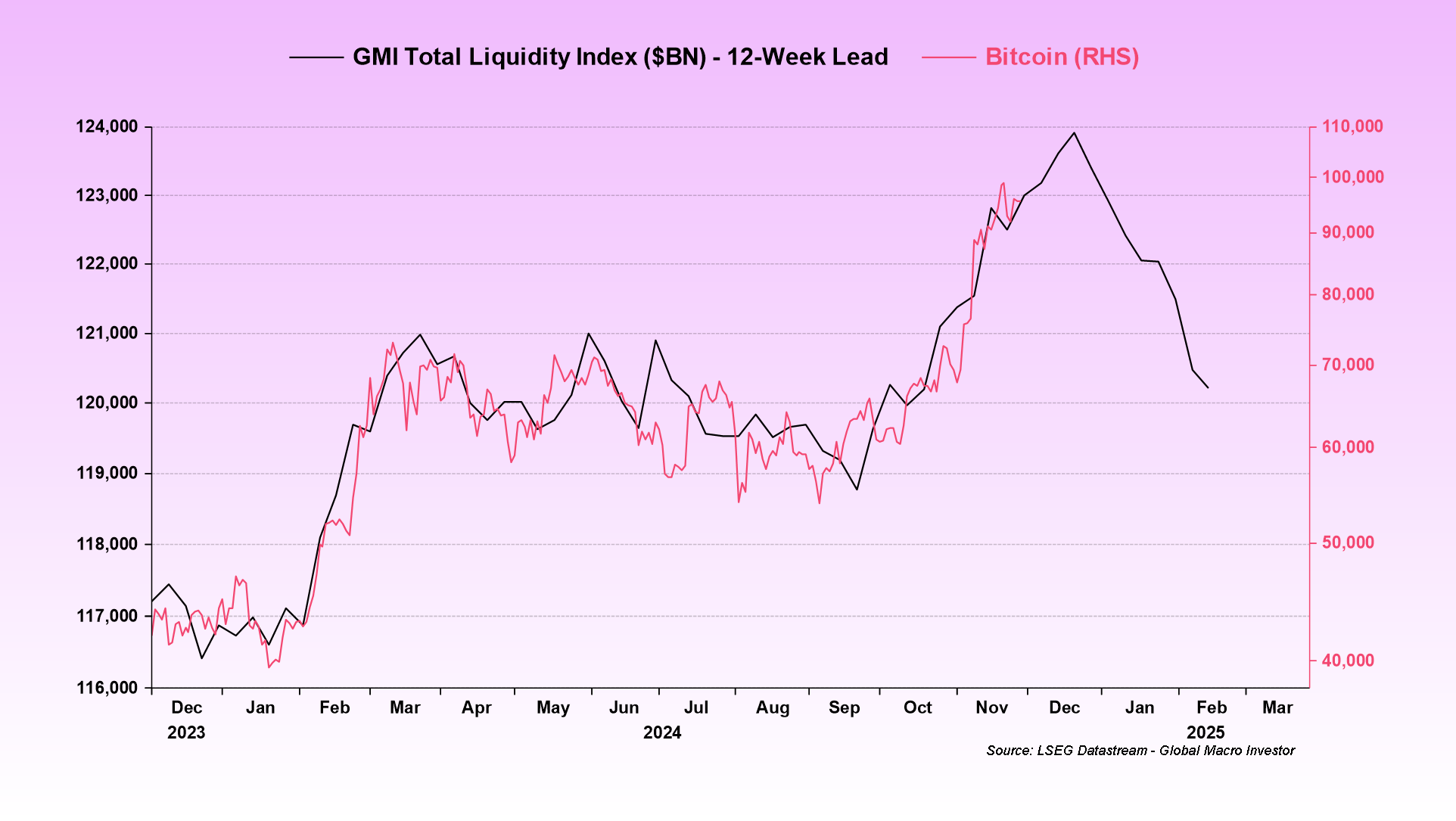

Primarily based on its correlation with the worldwide liquidity index, Bitcoin’s right-hand side (RHS), which marks the bottom bid value somebody is keen to promote the forex for, could fall under $70,000 across the finish of February, after it peaked close to $110,000 in January.

GMI Whole Liquidity Index, Bitcoin (RHS). Supply: Raoul Pal

The primary warning of a correction to $70,000 got here from Raoul Pal, founder and CEO of World Macro Investor, in a November X submit, which additionally predicted that Bitcoin will attain a “local top” above $110,000 in January, earlier than heading into the present correction.

Associated: Altseason 2025: ‘Most altcoins won’t make it,’ CryptoQuant CEO says

Can Bitcoin maintain $75k assist to keep away from a plunge to $70k?

Regardless of the poor investor sentiment, Bitcoin appears unlikely to fall to $70,000 earlier than the tip of the week.

Given continued dip shopping for from giant establishments such as Michael Saylor’s Strategy, a plunge to $70,000 appears “much less possible” with out important new draw back catalysts, mentioned Lee, including:

“An additional plunge to $70,000 is feasible however much less possible by March 2 with no important new shock. The $75,000 stage aligns with technical assist and stablecoin buffers, whereas $70,000 would wish sustained panic or macro deterioration past present pressures.”

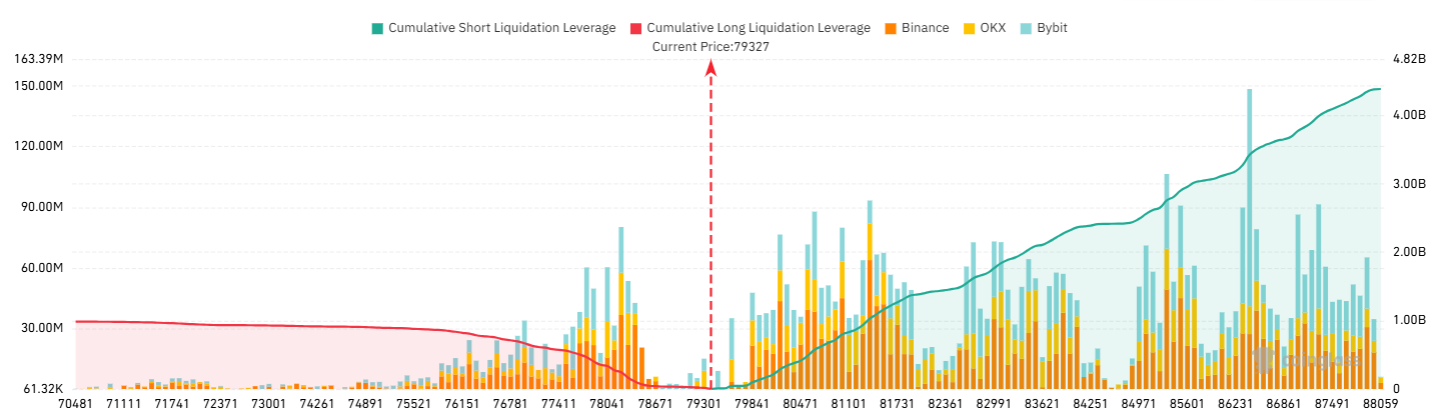

Bitcoin alternate liquidation map. Supply: CoinGlass

Nonetheless, a decline under $75,000 would add important draw back volatility by triggering practically $900 million value of leveraged lengthy liquidations throughout all exchanges, CoinGlass information exhibits.

Associated: Nvidia slump and $100B crypto IPOs could fuel Bitcoin rally

Nonetheless, Bitcoin’s present correction could final one other two weeks, primarily based on historic chart patterns analyzed by crypto analyst Rekt Capital.

“Bitcoin is in its first value discovery correction,” wrote the analyst in a Feb. 27 X post, including:

“Depth-wise, this present -25% Worth Discovery Correction has been shallower by requirements of historical past although nonetheless fairly near the -30% mark. Length-wise nonetheless, this 11 week pullback has been extra consistent with 2013 length.”

Supply: Rekt Capital

Assuming that the present downtrend will mimic the 2013 correction, Bitcoin could face two extra weeks of draw back stress.

Journal: BTC above $150K is ‘speculative fever,’ SAB 121 canceled, and more: Hodlers Digest, Jan. 19 – 25