Bitcoin (BTC) witnessed stable shopping for over the weekend as US President Donald Trump introduced that Bitcoin, Ether (ETH), XRP (XRP), Solana (SOL), and Cardano (ADA) can be included in a crypto strategic reserve. The announcement massively pumped the chosen cash, which made it dangerous for a recent entry after the rally. The cash on this article have been chosen for his or her technical setups fairly than the Trump-based pump.

Aside from the crypto strategic reserve, in an indication that might create new demand for Bitcoin, BlackRock added the iShares Bitcoin ETF Belief (IBIT) to its $150 billion mannequin portfolio, in accordance with a Bloomberg report. The worldwide funding agency is adding 1% to 2% allocation to portfolios that permit for different belongings. This transfer opens the doorways for a possible new demand for the Bitcoin ETF.

Crypto market information each day view. Supply: Coin360

Nonetheless, some analysts consider that Bitcoin may witness some extra ache within the close to time period. They anticipate Bitcoin to drop near $70,000 earlier than beginning the following leg of the bull transfer. Nexo dispatch analyst Iliya Kalchev advised Cointelegraph that Bitcoin may “set up agency assist within the $72,000 to $80,000 vary.”

Might Bitcoin handle to carry above $90,000? If that occurs, choose altcoins other than those chosen for the crypto strategic reserve could discover patrons. Let’s have a look at the highest cryptocurrencies that look sturdy on the charts.

Bitcoin value evaluation

Bitcoin has reached the 20-day exponential shifting common ($92,366), indicating aggressive shopping for at decrease ranges.

BTC/USDT each day chart. Supply: Cointelegraph/TradingView

Sellers will attempt to stall the aid rally on the 20-day EMA. If the value turns down from the 20-day EMA, the BTC/USDT pair may drop to $85,000, which is an important assist to be careful for.

If the value rebounds off $85,000, the pair may rise above the 20-day EMA. The pair could then rally to the 50-day easy shifting common ($97,704). Such a transfer will sign that the pair could have bottomed out within the close to time period.

If bears wish to retain the benefit, they must swiftly pull the value under $83,000. In the event that they handle to try this, the pair may retest the vital $78,258 assist.

BTC/USDT 4-hour chart. Supply: Cointelegraph/TradingView

The 20-EMA has began to show up on the 4-hour chart, and the relative power index (RSI) has jumped into the overbought zone, indicating that the bulls are on a comeback. If the value stays above $90,000, the pair may climb to $96,000 after which $100,000.

The primary signal of weak spot can be a break under the 50-simple shifting common. That might sink the pair to the 20-EMA, which is prone to entice patrons. The bears can be again within the driver’s seat in the event that they pull the pair under $83,000.

Hedera value evaluation

Hedera (HBAR) rose above the 20-day EMA ($0.22) and reached the 50-day SMA ($0.26) on March 1.

HBAR/USDT each day chart. Supply: Cointelegraph/TradingView

The 20-day EMA is the vital assist to be careful for on the draw back. If the value rebounds off the 20-day EMA, it'll sign a change in sentiment from promoting on rallies to purchasing on dips. The bulls will once more attempt to propel the HBAR/USDT pair above the 50-day SMA. If they will pull it off, the pair could rise to $0.32.

Contrarily, a break and shut under the 20-day EMA means that the bears stay sellers on rallies. The pair could stoop to $0.18, the place the bulls will attempt to arrest the decline.

HBAR/USDT 4-hour chart. Supply: Cointelegraph/TradingView

The pair turned down from $0.26 however is prone to discover assist on the 20-EMA on the 4-hour chart. If the value rebounds off the 20-EMA with drive, it'll sign shopping for on dips. That improves the prospects of a rally to $0.28.

As a substitute, if the value continues decrease and breaks under the 20-EMA, it'll counsel that the bulls are shedding their grip. The pair could tumble to the 50-SMA, which is prone to act as sturdy assist.

Litecoin value evaluation

Litecoin (LTC) has been buying and selling inside a symmetrical triangle sample, indicating indecision between the patrons and sellers.

LTC/USDT each day chart. Supply: Cointelegraph/TradingView

The flattish 20-day EMA ($122) and the RSI close to the midpoint don't give a transparent benefit both to the bulls or the bears. If the value rises and sustains above the 20-day EMA, the bulls will attempt to push the LTC/USDT pair above the resistance line. In the event that they succeed, the pair could rise to $147.

Contrarily, an in depth under the shifting averages means that the short-term benefit has tilted in favor of the bears. The pair could skid to the assist line, which is an important stage for the bulls to defend as a result of a break under it could sink the pair to $86.

LTC/USDT 4-hour chart. Supply: Cointelegraph/TradingView

The pair has dipped under the shifting averages on the 4-hour chart, indicating that the bears try to take cost. If the value sustains under the shifting averages, the pair may descend to $114 after which to the assist line.

Consumers must push and keep the value above the shifting averages to open the doorways for an increase to $132 and later to the resistance line. The up transfer may decide up momentum after the value closes above the resistance line.

Associated: Here’s what happened in crypto today

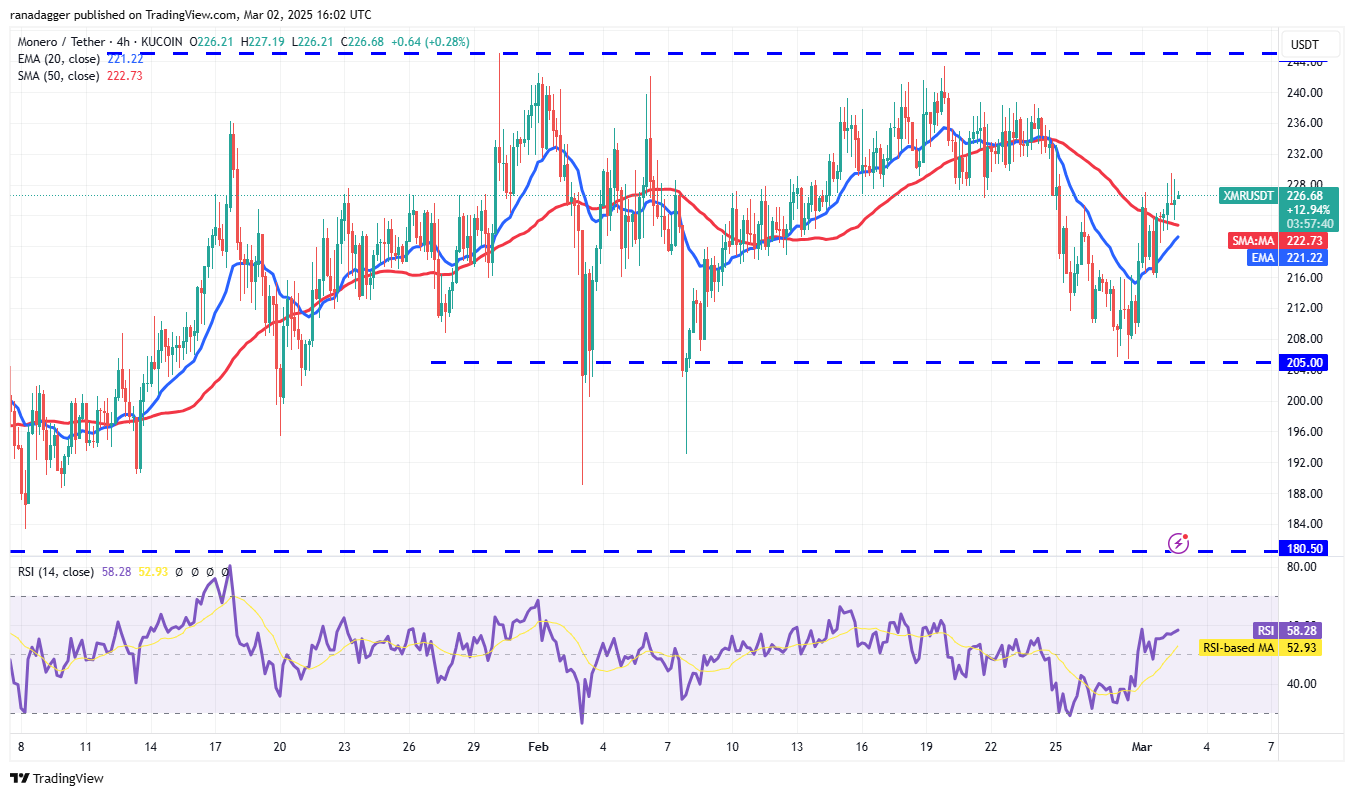

Monero value evaluation

Monero (XMR) bounced off the $205 stage and rose above the shifting averages, signaling stable shopping for on dips.

XMR/USDT each day chart. Supply: Cointelegraph/TradingView

The flattish 20-day EMA ($224) and the RSI close to the midpoint counsel that the XMR/USDT pair could swing between $205 and $245 for a number of days. If the value stays above the 20-day EMA, the pair may retest the $245 resistance.

Quite the opposite, if patrons fail to take care of the value above the shifting averages, it'll counsel a scarcity of demand at greater ranges. The bears will then attempt to pull the value right down to the assist of the vary at $205.

XMR/USDT 4-hour chart. Supply: Cointelegraph/TradingView

The 20-EMA has began to show up on the 4-hour chart, and the RSI is within the optimistic zone, indicating a bonus to patrons. The pair may rise to $238, the place the bears are anticipated to step in.

On the draw back, a break and shut under the 20-EMA means that the bears are again within the sport. The pair could slide to $216, and if this stage cracks, the following cease may very well be the stable assist at $205.

Celestia value evaluation

Celestia (TIA) has risen above the shifting averages, and the bulls try to maintain the value above the breakdown stage of $4.14.

TIA/USDT each day chart. Supply: Cointelegraph/TradingView

In the event that they handle to try this, it'll sign that the markets have rejected the breakdown. There's minor resistance at $4.50, but when the extent is crossed, the TIA/USDT pair may climb to $5.50. Sellers are anticipated to defend the $5.50 stage aggressively.

This optimistic view can be invalidated within the close to time period if the value turns down and breaks under the 20-day EMA ($3.66). That might sink the pair to $3 and subsequently to $2.72. Such a transfer will counsel that the bears have flipped the $4.14 stage into resistance.

TIA/USDT 4-hour chart. Supply: Cointelegraph/TradingView

Each shifting averages have began to show up, and the RSI is within the optimistic territory on the 4-hour chart, indicating a bonus to patrons. The primary signal of weak spot can be a break and shut under the shifting averages. If that occurs, the pair may drop to $3.40 and later to $3.

If patrons wish to retain the benefit, they must defend the 20-EMA and shortly push the value above $4.31. The $4.50 stage could show to be a stiff resistance, but when the patrons overcome it, the pair may bounce to $5.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.