The primary six weeks of US President Donald Trump’s second administration have been a wrecking ball for cryptocurrency markets.

Since peaking above $109,000 on Inauguration Day, Bitcoin (BTC) crashed to a low of round $78,000 in late February earlier than swiftly rebounding to $96,000 a couple of days in a while Trump’s crypto reserve plans. Nevertheless, 24 hours later, these features have been utterly reversed in a transfer that some have attributed to outright market manipulation.

Regardless of the short-term volatility, Bitcoin’s trajectory shifting ahead will be higher understood by means of the lens of the enterprise cycle and international liquidity. Each variables are trekking increased as of February.

Associated: MSTR stock pops 15% following Bitcoin weekend rally

Supply: Peter Schiff

What the PMI says about Bitcoin

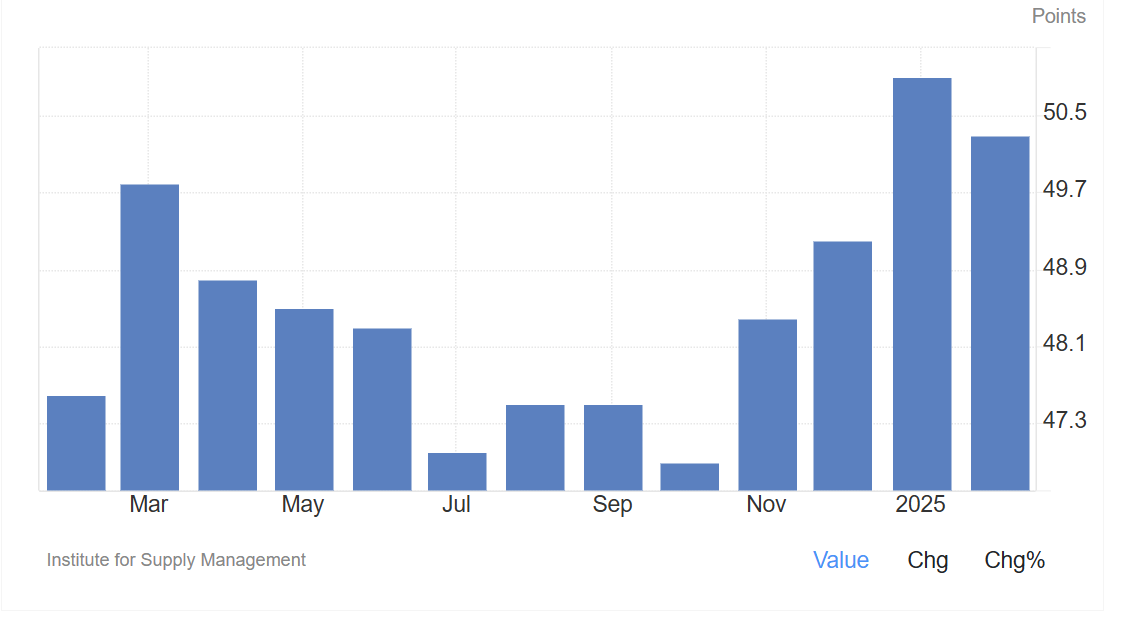

For the previous seven a long time, the Institute for Provide Administration’s (ISM) Buying Managers Index (PMI) has been a useful useful resource for understanding the well being of the US economic system. Every month, ISM releases a producing and non-manufacturing PMI to gauge the well being of the goods-producing and service-producing economies.

Economists place extra emphasis on the manufacturing PMI as a result of it’s seen as a number one indicator of the broader economic system and is extra delicate to adjustments in demand.

The PMI information relies on quantitative and qualitative assessments of the economic system by means of the lens of “buying managers,” or executives in every business.

The survey gauges their perceptions of total enterprise situations, new orders, export demand, inventories, work backlogs and employment traits, that are tabulated in a single index that ranges from 0 to 100, with 50 being the cutoff level between enlargement and contraction.

After 26 consecutive months of contraction, ISM’s manufacturing PMI jumped above 50 in January. It remained above that vital stage for a second straight month in February.

Though demand stays comparatively weak total, with many panelists experiencing “the primary operational shock of the brand new administration’s tariff coverage,” the trend-change in PMI is critical inside the context of the enterprise cycle.

The manufacturing PMI has now been above 50 for 2 consecutive months. Supply: Trading Economics

“ISM leads the economic system by a couple of month,” according to Actual Imaginative and prescient founder Raoul Pal. “But it surely’s not simply the economic system — it’s each asset.”

Pal’s feedback are backed up by research by S&P International Market Intelligence, which mentioned PMI information had anticipated “each turning level in earnings over the previous 14 years.”

S&P International recognized a 74% correlation between its PMI-based earnings indicator and the earnings of US corporations.

It’s not simply shares which can be strongly correlated with the PMI — it’s just about each danger asset, together with Bitcoin.

“It is because sturdy financial development, sturdy company earnings and low chance of recession permits traders to ‘transfer out alongside the chance curve,’” said macro analyst TomasOnMarkets.

Viewing Bitcoin inside the context of the PMI removes loads of the confusion surrounding BTC’s truncated cycle in 2021, which lacked the blow-off prime that many business veterans had anticipated. In 2021, Bitcoin’s value mainly peaked with the enterprise cycle.

Bitcoin displays a robust correlation with the ISM manufacturing PMI. Supply: TomasOnMarkets

With the enterprise cycle now turning up, Pal expects Bitcoin to prime in late 2025 and even early 2026. This cycle peak ought to coincide with the highest of the ISM enterprise cycle, which has traditionally been within the excessive 50s and low 60s.

Associated: Is crypto’s ‘Trump effect’ short-lived?

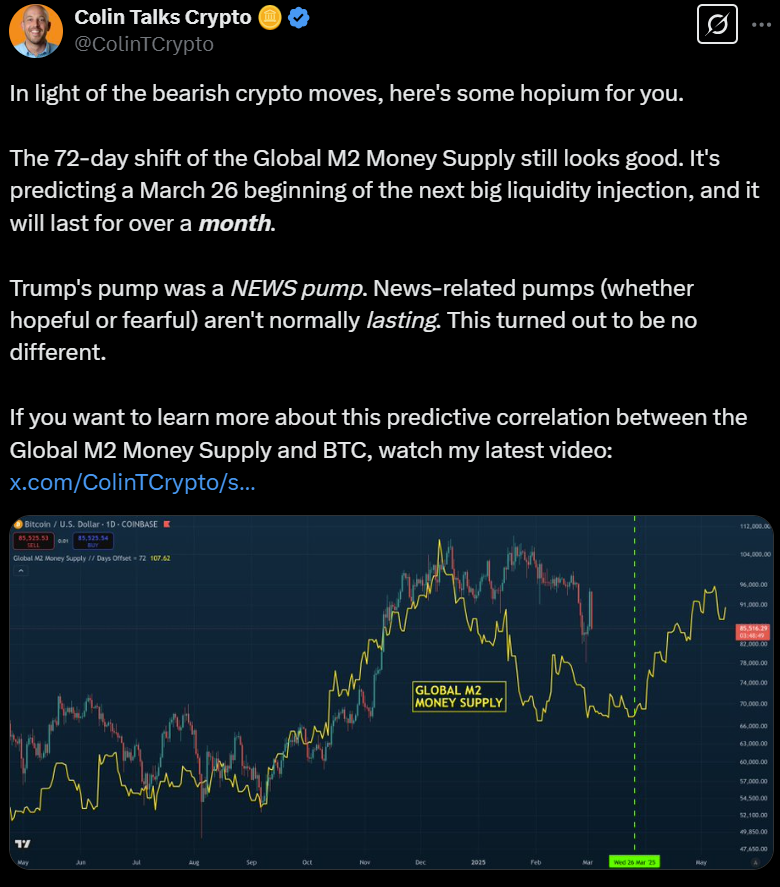

International M2: The opposite Bitcoin catalyst

The turning level within the enterprise cycle can also be being influenced by a rising M2 cash provide, which refers to a broad measure of how a lot cash is circulating by means of the economic system. As Actual Imaginative and prescient’s analysis has proven, it takes Bitcoin’s value about 10 weeks to replicate adjustments in international M2.

The worldwide M2 cash provide has turned up sharply in 2025, which implies Bitcoin ought to observe swimsuit. Supply: Raoul Pal

Analyst Colin Talks Crypto has plotted 46-day and 72-day shifts in international M2 influencing Bitcoin’s value. Based mostly on his newest revision, he offers extra credence to the latter timeline.

Supply: Colin Talks Crypto

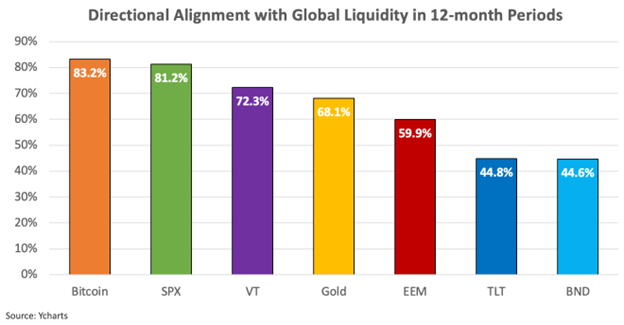

Analyst Lyn Alden has additionally drawn consideration to the predictive energy of world M2 on Bitcoin.

“Bitcoin strikes within the path of world liquidity 83% of the time in any given 12-month interval, which is increased than another main asset class, making it a robust barometer of liquidity situations,” she wrote in September.

Most main belongings exhibit a robust correlation with international liquidity, however none greater than Bitcoin. Supply: Lyn Alden

X Corridor of Flame: DeFi will rise again after memecoins die down: Sasha Ivanov