In February, Nigeria sued Binance for unpaid taxes and launched new cryptocurrency taxations in an effort to spice up its faltering financial system, however it could not have the meant results.

Because the 53rd largest financial system on this planet, Nigeria is predicted to benefit from the highest common GDP progress between 2010 and 2050, in response to Citigroup. Nevertheless, the nation’s financial growth has faltered in recent times, forcing the federal government to introduce vital tax reforms, a minimal wage framework, and extra.

The nation claims pursuing unregulated crypto exchanges like Binance can present greater than $81 billion to refill its coffers, aided by introducing a tax on cryptocurrency transactions.

Nonetheless, in response to Nic Puckrin, founding father of The Coin Bureau, this tax received’t be a clear-cut answer: “Nigeria has one of many largest markets for retail OTC buying and selling. Furthermore, importers have usually resorted to crypto to cope with risky NGN change charges. … they will have a really onerous time amassing that.”

Nigeria’s anticipated gross home product (GDP) till 2029. Supply: Statista.

Nigeria’s corruption hinders crypto taxation

Nigeria is house to Africa’s largest cryptocurrency market. A reported 22% of its inhabitants (about 47 million individuals) owns or makes use of crypto belongings. For the reason that nation reversed its ban on digital currencies in 2021, the Nigerian authorities has not been gradual in responding to the expansion and adoption of cryptocurrencies.

Nigeria’s Securities and Alternate Fee (SEC) issued its Guidelines on Digital Assets in 2022, recognizing crypto as securities and offering pointers for exchanges and custodians.

The federal government appears critical about getting key features from crypto transactions and just lately instituted proceedings towards Binance, searching for to compel the change to pay $81.5 billion for financial losses it claims have been attributable to the change’s operations within the nation and $2 billion in again taxes.

The federal government’s 2023 Nationwide Blockchain Coverage (2023) seeks to combine blockchain into public providers, signaling long-term crypto alignment. The CBN’s eNaira, Africa’s first CBDC, and fintech startups like Flutterwave and Chipper Money have expanded monetary inclusion inside the nation, reaching 64% of adults in 2023.

Maksym Sakharov, co-founder and board member of WeFi, outlined:

“Nigerian regulators perceive the nation’s place inside the international cryptocurrency trade. Apart from being the most important financial system in Africa, it additionally has the best crypto adoption degree, making the prospect of taxing crypto transactions an economically promising transfer.”

Sakharov continued, “Nevertheless, the nation is understood for its poor implementation of market-changing insurance policies like this.” Whereas Nigeria appears eager to maneuver ahead with taxation on transactions, it usually fails relating to implementation, owing to excessive ranges of corruption.

Nigerians primarily use peer-to-peer (P2P) buying and selling platforms to counteract the results of the nation’s forex depreciation and excessive inflation. This degree of crypto adoption, nonetheless, hasn’t produced vital GDP progress — however it has supported Nigeria’s digital financial system, which contributed 18.4% to GDP in This autumn 2023.

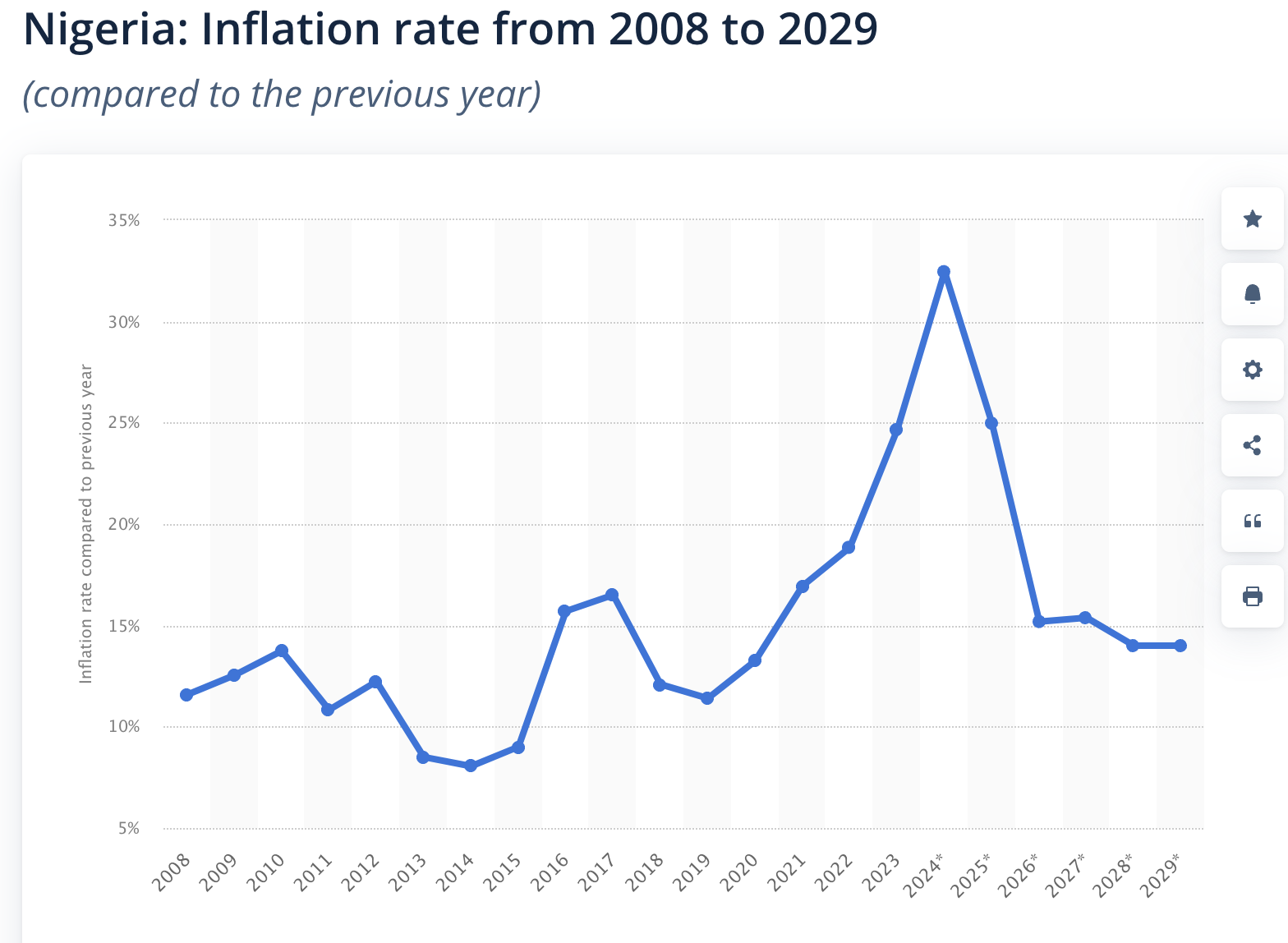

Nigeria, anticipated inflation fee to 2029. Supply: Statista.

A tax on all of your crypto

Based on the World Bank, Nigeria’s tax-to-GDP ratio is among the lowest globally at 6%. Nigeria’s Federal Inland Income Service (FIRS) reported amassing 10.1 trillion Nigerian naira ($12.7 billion) in 2022, with solely 12% of the labor drive formally employed and contributing taxes. VAT and company taxes dominate income, whereas private earnings tax compliance is weak.

With solely 9% of Nigeria’s 70 million taxable adults paying earnings taxes in 2022, this transfer to tax particular person cryptocurrency transactions could have an ulterior motive — amassing taxes from the casual sector and unbanked inhabitants. The casual sector in Nigeria makes up 65% of the nation’s GDP, and presently operates primarily outdoors of the federal government’s tax internet.

Maksym continues: “Whereas taxing crypto shouldn't be misplaced, most crypto merchants within the nation have misplaced religion within the authorities and may discover a option to bypass these taxation provisions. With the largest change, Binance, not absolutely operational within the nation, customers have developed a thriving P2P and OTC desk to conduct their transactions.”

Associated: Nigerian SEC tightens crypto marketing rules

With 45% of Nigerian adults unbanked however 35% utilizing crypto for remittances and financial savings, taxing crypto transactions is a transparent transfer towards tapping into the casual financial system. The proposed 0.5–1% capital features tax on crypto income and 10% VAT on exchanges might generate as much as 200 billion Nigerian naira ($250 million) yearly.

Nevertheless, the chance of over-taxing cryptocurrency customers might push them towards utilizing unregulated P2P platforms, undermining compliance.

Nic Puckrin, founding father of The Coin Bureau, says the federal government will wrestle to gather taxes.

“Nigeria has a thriving P2P ecosystem, so if customers wished to evade having to pay the charges on centralized exchanges, they might simply take it off the platforms. I additionally don’t assume the federal government has the assets to implement this or monitor down those that don’t wish to play ball.”

Nigeria’s crypto tax proposal does replicate a broader push to formalize the digital and casual economies whereas addressing fiscal pressures. Success hinges on balancing regulation with innovation — whereas making certain compliance.

Extreme taxation would stifle adoption, however prudent, well-implemented insurance policies could develop the nation’s income and allow additional monetary inclusion.

Nigeria might strengthen enforcement by adopting blockchain analytics instruments. India collaborated with Chainalysis to combine these as instruments for tracing taxable transactions. The nation’s latest SEC pointers for digital asset service suppliers (VASPs) already align with FATF suggestions, enabling higher oversight of formal exchanges.

Anti-corruption initiatives like digitizing tax processes and increasing the Financial and Monetary Crimes Fee’s (EFCC) mandate might scale back leakages. The EFFC’s mandate states that it seeks to assist Nigeria’s mission to grow to be a rustic freed from financial and monetary crimes. By combining tech-driven transparency measures with public schooling on tax advantages, Nigeria could steadily construct belief and compliance in its crypto financial system.

Journal: Mystery celeb memecoin scam factory, HK firm dumps Bitcoin: Asia Express