Bitcoin (BTC) registered a each day and weekly shut at $80,688 on March 9, the bottom shut since Nov. 11, 2024.

Bitcoin additionally dropped under its key 200-day exponential transferring common (200-D EMA) for the second time in two weeks, indicating additional excessive time-frame (HTF) weak point within the charts.

Bitcoin 1-day chart. Supply: Cointelegraph/TradingView

Whereas the Crypto Concern & Greed Index continues to indicate “excessive concern” on March 10, one BTC market simulation nonetheless highlights bullish projections for the latter half of 2025.

Monte Carlo mannequin alerts an 800% BTC worth rise

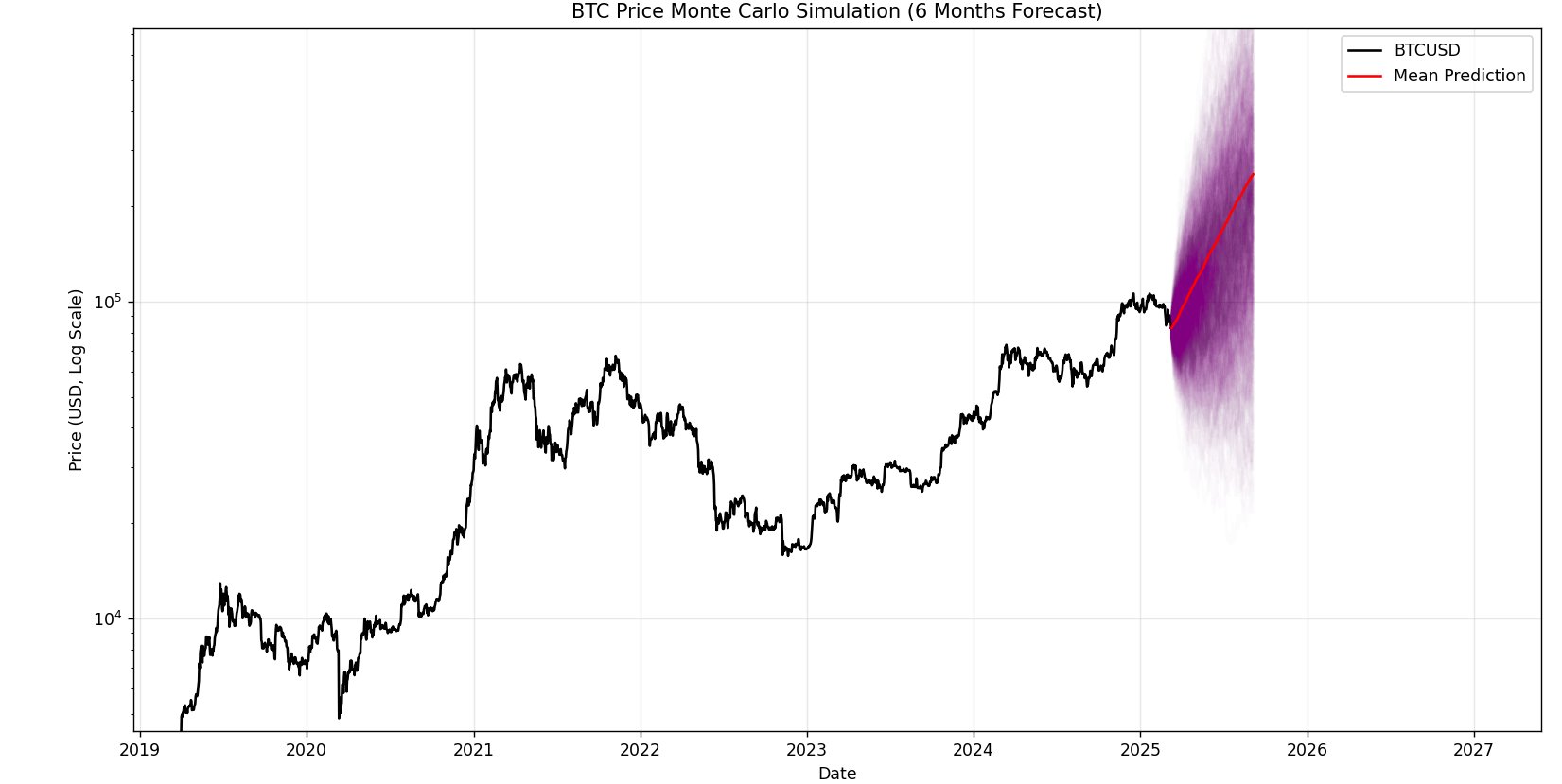

Mark Quant, a crypto researcher, performed a Monte Carlo simulation to research Bitcoin's worth, offering a six-month forecast for the crypto asset.

The Monte Carlo mannequin is a computational technique utilizing random sampling to simulate worth projections and assess danger. It will probably generate a number of doable situations primarily based on variable components akin to volatility and market tendencies.

Bitcoin Monte Carlo projections by Mark Quant. Supply: X.com

Primarily based on the preliminary worth of $82,655, the research estimated a imply ultimate worth of $258,445 by the top of September 2025. Nevertheless, on a broader scale, the worth was anticipated to fluctuate between $51,430, i.e., a fifth percentile return and $713,000 on the ninety fifth percentile.

Related: Bitcoin slides another 3% — Is BTC price headed for $69K next?

Nevertheless, you will need to notice {that a} Monte Carlo mannequin depends strongly on the Geometric Brownian Movement (GBM) mannequin, which assumes that the asset worth follows a random path with a relentless parameter drift.

On this evaluation, Bitcoin's inherent volatility is constructed into the mannequin, capturing long-term historic efficiency and patterns whereas adapting to future shifts. Primarily, the Monte Carlo evaluation stays as becoming as “rolling the cube."

Final week, Quant additionally highlighted a correlation between the whole crypto market cap and the worldwide liquidity index, indicating that the TOTAL market cap worth could attain new highs above $4 trillion in Q2 2025.

Bitcoin eyes new CME hole after $80K retest

Bitcoin worth dropped 6.38% over the weekend, making a recent CME futures gap within the charts. The CME Bitcoin futures hole describes the worth distinction between the closing of CME Bitcoin futures buying and selling on Friday and its reopening on Sunday night.

Bitcoin CME hole. Supply: Cointelegraph/TradingView

As illustrated within the chart, the CME hole at the moment lies between $83,000 and $86,000, a reasonably large hole of $3,000. Primarily based on previous habits, Bitcoin tends to “fill” or return into these gaps on the upper time-frame charts, with the earlier seven gaps crammed out previously 4 months.

Mark Cullen, a technical analyst, additionally highlighted the CME hole, which took type over the weekend, and speculated the potential for a brief squeeze earlier than the US markets open on March 10. Nevertheless, the dealer added,

“Lose the weekly open at ~80K and there's a hole right down to low 70K's.”

Related: US dollar plunge powers Bitcoin bull case, but other metrics concern: Analyst

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.