Cryptocurrency corporations spent greater than $134 million on the 2024 US elections, fueling considerations about their rising political affect and potential dangers to regulatory stability, based on a report by the Middle for Political Accountability (CPA).

The rising connection of crypto companies with US politics is elevating newfound considerations for regulators, traders and the broader monetary system, based on a report launched by the Middle for Political Accountability (CPA).

Cryptocurrency companies shelled out a cumulative $134 million on the 2024 US elections in “unchecked political spending,” which presents some important challenges, the March 7 report said.

“Whereas the businesses making these contributions could also be looking for a positive regulatory atmosphere, these political donations additional erode public belief and expose corporations to authorized, reputational, and enterprise dangers that can't be ignored,” the report added.

Cryptocurrency regulation has taken heart stage over the previous week following a historic executive order from US President Donald Trump to create a Strategic Bitcoin (BTC) Reserve forward of the primary White House Crypto Summit on March 7.

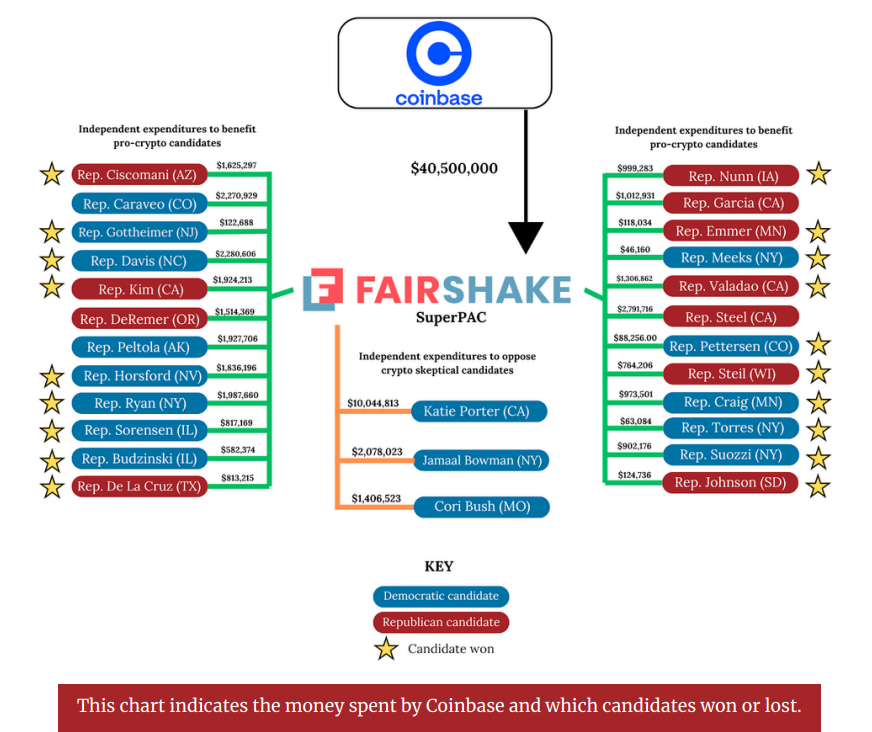

Supply: politicalaccountability.web

Fairshake, a political motion committee (PAC) backed by main crypto companies together with Coinbase, Ripple and Andreessen Horowitz, was one of many largest contributors, spending greater than $40 million to assist candidates aligned with pro-crypto insurance policies.

Fairshake and affiliated PACs have been energetic in key congressional races, making an attempt to form laws favorable to digital property.

“Because the trade continues to hunt affect by means of huge contributions and opaque monetary maneuvers, the dangers of instability, regulatory backlash, and public mistrust solely develop,” the report stated.

Fairshake donations. Supply: politicalaccountability.web

The inflow of crypto cash into politics didn't go unnoticed by regulators. In August 2024, the buyer advocacy group Public Citizen filed a complaint with the Federal Election Fee (FEC), alleging that Coinbase’s company contributions to Fairshake and the Congressional Management Fund constituted a violation of federal election regulation because of their standing as a federal contractor.

Associated: Bitcoin reserve backlash signals unrealistic industry expectations

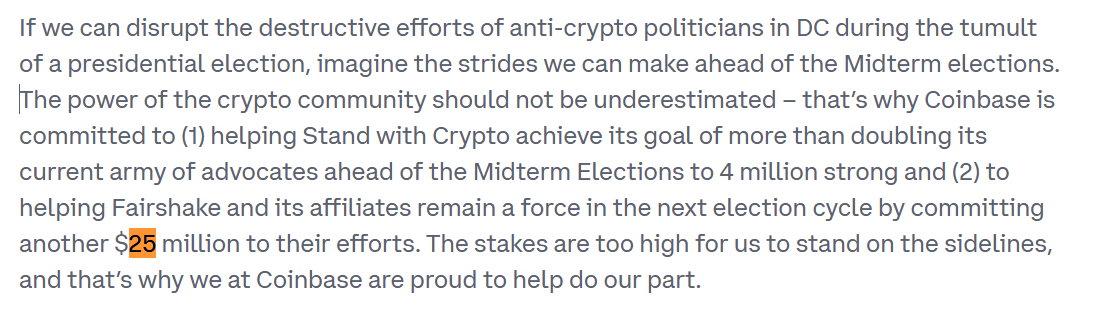

Coinbase has dedicated a further $25 million to Fairshake for the 2026 midterm election cycle.

Coinbase commits $25 million to Fairshake. Supply: Coinbase

“The stakes are too excessive for us to face on the sidelines, and that’s why we at Coinbase are proud to assist do our half,” the corporate wrote in an October 2024 weblog post.

Associated: Bitcoin risks deeper drop if $75K support fails amid macro concerns

Crypto’s political donations could also be vital for regulatory readability

Regardless of the dangers highlighted by the report, some regulatory specialists see the donations as vital for advancing extra innovation-friendly rules.

“As somebody deeply concerned in crypto, I see this spending as vital for regulatory readability, essential for stability and progress,” based on Anndy Lian, creator and intergovernmental blockchain knowledgeable:

“It appears prone to enhance investor confidence by lowering uncertainty, as seen in pro-crypto candidate wins boosting market sentiment, like bitcoin's post-election excessive.”

Nonetheless, dangers, together with “regulatory seize,” the place the pursuits of huge companies take precedence, could current challenges and erode crypto investor belief. Nonetheless, that is a part of the natural progress of the rising crypto trade, Lian stated, including:

“The crypto group’s transparency and decentralization would possibly mitigate this, guaranteeing honest rules. Whereas controversial, I don’t discover it problematic, viewing it because the trade’s maturation, although public backlash might destabilize politics if seen as shopping for favor.”

The talk over crypto’s position in politics follows the high-profile collapse of the Libra (LIBRA) token, a memecoin endorsed by Argentine President Javier Milei. The undertaking’s insiders allegedly siphoned over $107 million worth of liquidity in a rug pull, triggering a 94% value collapse inside hours and wiping out $4 billion.

Over 100 governmental fraud complaints have been opened in Argentina for the reason that Libra memecoin’s scandal, illustrating the dangers of a rustic’s govt department selling “any type of unregulated safety,” the CPA’s report states.

Journal: Unstablecoins: Depegging, bank runs and other risks loom