Bitcoin consumers who bought round when it hit a $109,000 all-time peak in January at the moment are panic-selling because the cryptocurrency declines, says onchain analytics agency Glassnode, which isn’t ruling out that Bitcoin may slide to $70,000.

Glassnode said in a March 11 markets report {that a} latest sell-off by prime consumers has pushed “intense loss realization and a reasonable capitulation occasion.”

Quick-term holders fled as Bitcoin dropped from peak

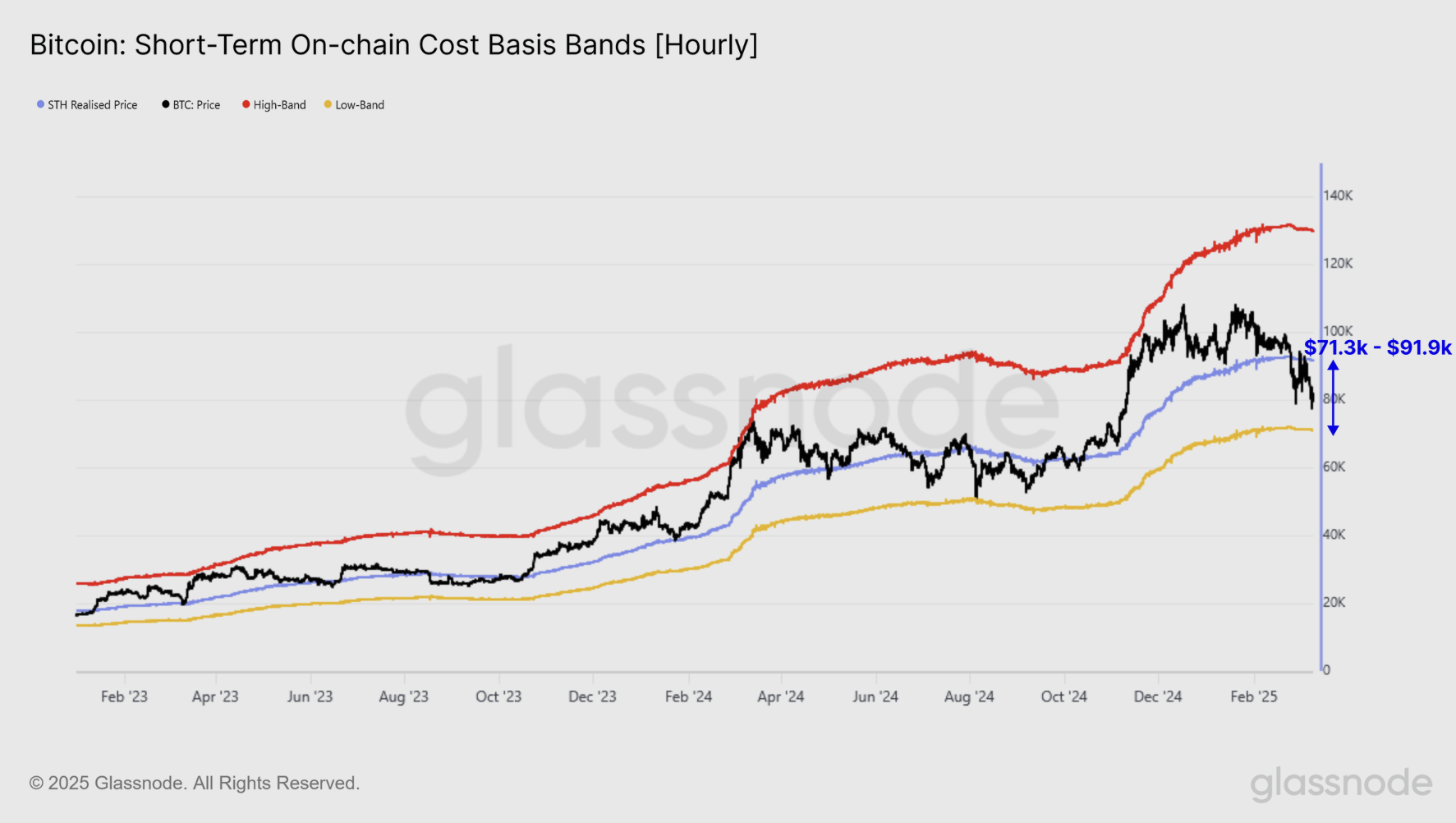

The surge in consumers paying greater costs for Bitcoin (BTC) in latest months is mirrored within the short-term holder realized value — the common buy value for these holding Bitcoin for lower than 155 days.

In October, the short-term realized value was $62,000. On the time of publication, it’s $91,362 — up about 47% in 5 months, according to Bitbo information.

In the meantime, Bitcoin is buying and selling at $81,930 on the time of publication, according to CoinMarketCap. This leaves the common short-term holder with an unrealized lack of roughly 10.6%.

Bitcoin is down 5.90% over the previous seven days. Supply: CoinMarketCap

Glassnode mentioned that short-term holders’ realized value exhibits it's obvious that “market momentum and capital flows have turned damaging, signaling a decline in demand energy.”

“Investor uncertainty is affecting sentiment and confidence,” it added.

Glassnode mentioned that short-term holders are “deeply underwater” between $71,300 and $91,900 and warns that Bitcoin may backside out as little as $70,000 if promoting persists.

“The chance of forming a short lived ground on this zone is significant, at the very least within the close to time period,” Glassnode mentioned.

Bitcoin short-term holders are “deeply underwater” between $71,300 and $91,900. Supply: Glassnode

Market research firm 10x Research labeled it a “textbook correction” in a March 10 be aware, including that with Bitcoin’s dip under $80,000, “roughly 70% of all promoting got here from traders who purchased throughout the final three months.”

Associated: Bitcoin slides another 3% — Is BTC price headed for $69K next?

On the identical day, BitMEX co-founder Arthur Hayes mentioned that Bitcoin might retest the $78,000 value degree and, if that fails, might head to $75,000 subsequent.

Glassnode defined {that a} comparable sell-off Bitcoin sample was seen in August when Bitcoin fell from $68,000 to round $49,000 amid fears of a recession, poor employment information in america, and sluggish growth among leading tech stocks.

Nonetheless, Bitcoin has spiked 7.5% over the previous 24 hours as the US market steaded on March 11 after plunging a day earlier after US President Donald Trump refused to rule out that a recession was on the playing cards.

Journal:The Sandbox’s Sebastien Borget cringes at the word ‘influencer’: X Hall of Flame

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.