Bitcoin (BTC) tapped $83,700 throughout the early Asian hours on March 12 after reaching a low of $76,600 on March 11 amid a slight enchancment in market sentiment.

BTC/USD dealing with rejection from the $84,000 degree raises questions on whether or not BTC value may drop additional over the subsequent few days.

BTC/USD hourly chart. Supply: Cointelegraph/TradingView

Demand for Bitcoin stays weak

Spot Bitcoin exchange-traded funds (ETF) outflows have performed an enormous position within the BTC value drop since late February, surpassing $1.5 billion over the past two weeks.

Associated: Why is Bitcoin price up today?

In the meantime, Bitcoin’s obvious demand stays low, implying a decline in danger urge for food from potential buyers, in line with data from market intelligence agency CryptoQuant,

What to know:

-

Obvious demand is the distinction between manufacturing and modifications in stock.

-

Manufacturing refers to BTC mining issuance, whereas stock refers to inactive provide for over a yr.

-

Obvious demand weakens if manufacturing exceeds stock discount.

-

After a interval of acceleration between November 2024 and December 2024, fueled by President Donald Trump’s victory, Bitcoin obvious demand dropped from 279,000 BTC on Dec. 4 to 10,000 on Feb. 26.

-

On Feb. 27, the metric turned unfavourable for the primary time since September 2024.

-

It presently stands at -93,700 BTC on the time of writing.

-

If the pattern continues, the worth may dip decrease, simply because it occurred in July 2024.

-

The chart beneath reveals that Bitcoin obvious demand was at comparable ranges on July 27, 2024, after which BTC price dropped a further 30% to $49,000 on Aug. 5, 2024.

Bitcoin obvious demand. Supply: CryptoQuant

Nonetheless, this metric doesn't all the time assure extra draw back sooner or later. For instance, it was additionally unfavourable in late Could 2024 and late October 2024 earlier than the worth rallied 7% and 73%, respectively.

Bitcoin valuation metrics trace at deeper correction

Knowledge from Cointelegraph Markets Pro and TradingView present Bitcoin value buying and selling 7% above its four-month low of $76,600 reached on March 12.

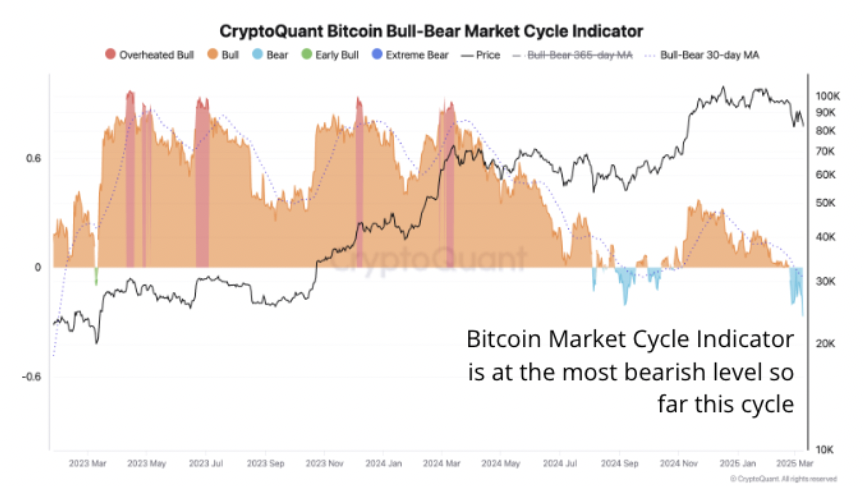

Regardless of this rebound, a number of valuation metrics are nonetheless leaning bearish, suggesting a deeper correction is feasible, in line with CryptoQuant.

-

The Bitcoin bull-bear market cycle Indicator is at its “most bearish degree" of this cycle.

-

The bull/bear market cycle indicator is a momentum metric that measures the distinction between the P&L Index and its 365-day transferring common.

-

Values above 0 present that BTC is in a bull market, whereas values beneath 0 point out a bear market.

-

The present worth of -0.067 is on the lowest degree since Could 2023, when Bitcoin’s value launched into a sustained restoration.

Bitcoin: Bull-bear market cycle indicator. Supply: CryptoQuant

-

In the meantime, the MVRV ratio Z-score has crossed beneath its 365-day transferring common, indicating that the upward value pattern has misplaced momentum.

-

The MVRV ratio Z-score is a key metric used to evaluate whether or not Bitcoin is overvalued or undervalued.

“Traditionally, valuation metrics at these ranges have signaled both a pointy correction or the beginning of a bear market.”

Bitcoin value bear flag hints at $68,400

From a technical perspective, BTC value is buying and selling inside a bearish continuation sample that signifies a possible correction forward.

Key factors:

-

BTC is buying and selling inside a bear flag sample, indicating the opportunity of extra draw back if key help ranges don’t maintain.

-

The bear flag developed after Bitcoin dropped from $92,000 to an area low of $76,600 between March 6 and 11.

-

The consolidation inside the bear flag has BTC buying and selling in an ascending parallel channel, with at the moment’s drop testing vital help ranges, together with the decrease boundary of the flag at $82,000.

BTC/USD four-hour chart. Supply: Cointelegraph/TradingView

-

A breakdown of this degree may set off one other value crash.

-

The bear flag’s draw back goal, derived from the peak of the earlier drop, is roughly $68,400, representing a 17% drop from the present value.

CryptoQuant analysts, in the meantime, say that if the present help zone between $75,000 and $78,000 doesn’t maintain, Bitcoin may go even decrease to $63,000.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.