Actual-world asset (RWA) tokenization firm Securitize has chosen RedStone as the first oracle supplier for its tokenized merchandise, which embody BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) and the Apollo Diversified Credit score Securitize Fund (ACRED).

In keeping with a March 12 announcement, RedStone will ship worth feeds for present and future tokenized merchandise supplied by Securitize. As a DeFi-focused oracle supplier, RedStone will purportedly increase the use circumstances of BUIDL and ACRED into cash market exchanges and collateralized DeFi platforms, Securitize stated.

RedStone supplies crosschain knowledge feeds for decentralized finance protocols on Ethereum, Avalanche and Polygon. In keeping with DefiLlama knowledge, it has amassed $4.3 billion in whole worth secured throughout all purchasers.

RedStone’s whole worth secured as of March 11. Supply: DefiLlama

In July, RedStone raised $15 million in a Series A funding round led by Arrington Capital, with further participation from Spartan, IOSG Ventures, HTX Ventures and others.

Securitize chosen RedStone as its oracle supplier due to its “modular design,” which implies it “can scale to hundreds of chains and assist new implementations in a matter of days,” RedStone chief working officer Marcin Kazmierczak informed Cointelegraph in a written assertion.

Through the use of the RedStone oracle worth feeds, Securitize’s funds “can now be utilized throughout DeFi protocols akin to Morpho, Compound or Spark,” he stated.

Associated: BlackRock CEO wants SEC to ‘rapidly approve’ tokenization of bonds, stocks: What it means for crypto

Institutional curiosity in tokenized property on the rise

Securitize co-founder and CEO Carlos Domingo informed Cointelegraph that demand for tokenized funds is rising throughout a “numerous vary of buyers and customers” spanning conventional finance and crypto-native companies.

“Institutional buyers, non-public fairness companies, and credit score managers are turning to tokenization to boost effectivity, scale back operational friction, and enhance liquidity for personal markets,” he stated.

On the crypto-native aspect, firms “see tokenized RWAs as a safe and environment friendly approach to handle treasury reserves whereas benefiting from secure yields,” stated Domingo.

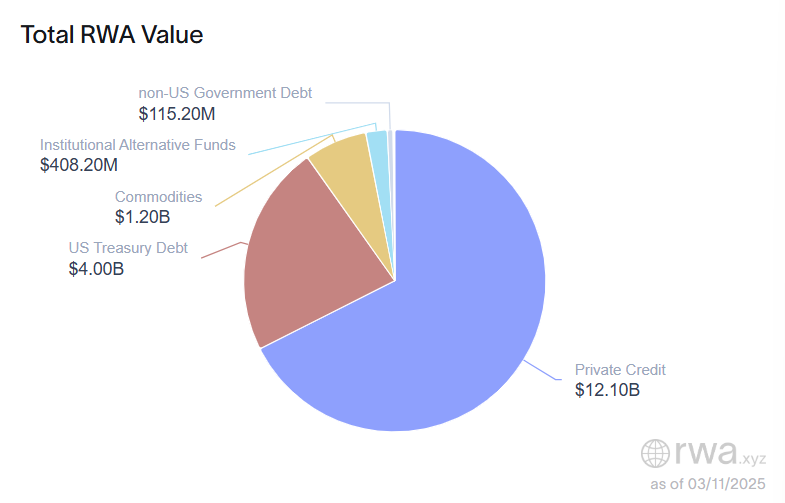

To date, the tokenization of personal credit score and US Treasury bonds have seen the biggest uptake, in keeping with trade knowledge. The whole marketplace for onchain RWAs is approaching $18 billion, having grown by 16.8% over the previous 30 days, in keeping with RWA.xyz.

At $12.1 billion, non-public credit score accounts for 68% of the tokenized RWA market. Supply: RWA.xyz

Separate knowledge from Safety Token Market confirmed that more than $50 billion worth of assets had been tokenized by the tip of 2024, with the bulk coming from actual property.

The tokenization market has attracted significant players in recent times, with the likes of Ondo Finance, Tradable and Brickken coming into the fray.

Associated: Trump-era policies may fuel tokenized real-world assets surge