Key takeaways

- Shopping for Bitcoin with a bank card gives practically instantaneous transactions and comfort, nevertheless it prices you greater charges and potential blocked transactions from card suppliers.

- Centralized exchanges like Coinbase and Kraken are the simplest respected platforms on which to purchase Bitcoin with bank cards.

- To guard your self throughout transactions, solely use trusted exchanges and use safety protocols like 2FA.

- Bank card purchases can supply some additional safety in opposition to fraud in comparison with different cost strategies, however buy limits could be extra restrictive

On the lookout for the quickest and best approach to buy Bitcoin? Shopping for Bitcoin with a bank card is sort of instantaneous on many platforms. Earlier than you begin your digital procuring spree, you need to take a couple of minutes to learn to purchase Bitcoin (BTC) with a bank card in essentially the most environment friendly manner.

Nonetheless, if you happen to’re not cautious, you would find yourself damaging your credit score rating and even getting scammed out of your investments.

Beneath, one can find a step-by-step course of for buying Bitcoin on a good alternate, plus learn to shield your self from pointless monetary misery alongside the way in which.

Why use a bank card for Bitcoin purchases?

Shopping for Bitcoin by way of a bank card is sort of instantaneous on main exchanges. It may be carried out simply on a cellular machine or internet, permitting consumers and merchants to shortly benefit from market strikes.

Usually, the cryptocurrency exchanges that settle for bank cards are regulated and can use excessive ranges of encryption. These exchanges would require Know Your Customer (KYC) and Anti-Cash Laundering (AML) checks for safety and compliance.

Buying Bitcoin with a bank card is a beginner-friendly possibility for brand spanking new cryptocurrency buyers already acquainted with utilizing their bank cards for on-line transactions. There could also be some safety from the bank card firm if one thing goes awry.

Will shopping for Bitcoin with a bank card have an effect on my credit score rating?

Each buying determination you make along with your bank card will affect your credit score rating, both constructive or unfavorable. Crypto is more likely to do extra hurt than good to a credit score rating. Right here’s why:

- Significantly with giant Bitcoin purchases, it is going to enhance your credit score utilization ratio. Banks don’t replicate kindly to excessive credit score utilization above 50% of a credit score restrict.

- Conventional banks and card issuers classify crypto purchases as money advances and dangerous transactions.

- Fee historical past nonetheless stays the important thing consider your credit score rating. Credit score issuers could effectively frown upon common Bitcoin purchases.

Do you know? Over 85% of shops internationally settle for bank cards, whereas solely 25% of on-line retailers settle for crypto funds. Bank cards are nonetheless extra broadly accepted; nonetheless, crypto acceptance is rising shortly.

The place to purchase Bitcoin (BTC) with a bank card

You may purchase Bitcoin with bank cards on centralized crypto exchanges (CEXs). Properly-known world platforms like Coinbase, Kraken and Binance all allow their customers to purchase Bitcoin with a bank card. Including to this, you need to use instantaneous purchase options to buy Bitcoin with a bank card with out depositing fiat forex into your account first.

Nonetheless, the regional availability for CEXs varies from platform to platform. That is often depending on native rules and compliance. So, earlier than choosing a platform, you need to test if it operates in your location and along with your card issuer.

What if a bank card transaction is declined?

Many conventional banks actively block crypto-related transactions, which suggests you would possibly discover your bank card declined when making an attempt to buy Bitcoin or different cryptocurrencies. That is usually as a result of financial institution’s coverage in opposition to facilitating cryptocurrency transactions.

Nonetheless, there may be excellent news: Trendy fintech banking options, comparable to digital banks and crypto-friendly cost platforms, are more and more supportive of cryptocurrency purchases, providing a smoother transaction expertise.

Other than financial institution restrictions, different causes for declined crypto transactions can embody fraud prevention measures, the place the transaction is flagged as suspicious. Moreover, exceeding your bank card’s spending restrict or encountering points along with your card’s authorization settings also can result in a declined transaction.

Is there a restrict to how a lot Bitcoin could be purchased with a bank card?

The acquisition restrict for Bitcoin varies for every particular person and is influenced by two most important elements. First, the spending restrict in your bank card, which is set by your financial institution or card issuer. Second, the crypto alternate you’re utilizing will impose its personal buy limits.

For first-time consumers, these limits could be comparatively low — usually just some hundred {dollars}. Nonetheless, relying on the alternate and your account historical past, these limits can usually be elevated to $5,000 or extra per week if wanted.

You must also concentrate on the bank card Bitcoin buy charges that may embody:

- Trade charges: Usually 3%–5% for bank card purchases (that is greater than different strategies, which could be as little as 0.1%).

- Card issuer charges: Some deal with crypto purchases as money advances.

- Overseas transaction charges: It might apply to fiat overseas forex transactions.

Do you know? 8%–10% of the grownup world inhabitants is assumed to personal cryptocurrency of some type in 2025. An enormous bounce from 1%–2% in 2018, highlighting the growing adoption price.

Find out how to purchase Bitcoin on CEXs with a bank card

Shopping for Bitcoin with a bank card is without doubt one of the quickest and best methods to make a purchase order. After getting a verified alternate account, you can also make the transaction nearly immediately.

Beneath is a step-by-step information on learn how to purchase Bitcoin with a Visa or Mastercard on Coinbase. Steps on different exchanges could differ, however the course of is mostly very comparable.

Step 1: Create a verified account

Comply with the user-friendly sign-up course of. Guarantee to activate 2-factor authentication (2FA) to double-lock your account.

Throughout the sign-up course of, you’ll have to confirm your id. Crypto rules in lots of international locations require exchanges to adjust to KYC and AML rules. To move these checks, it's essential to add a legitimate authorities ID (passport, driving license or another acceptable ID card).

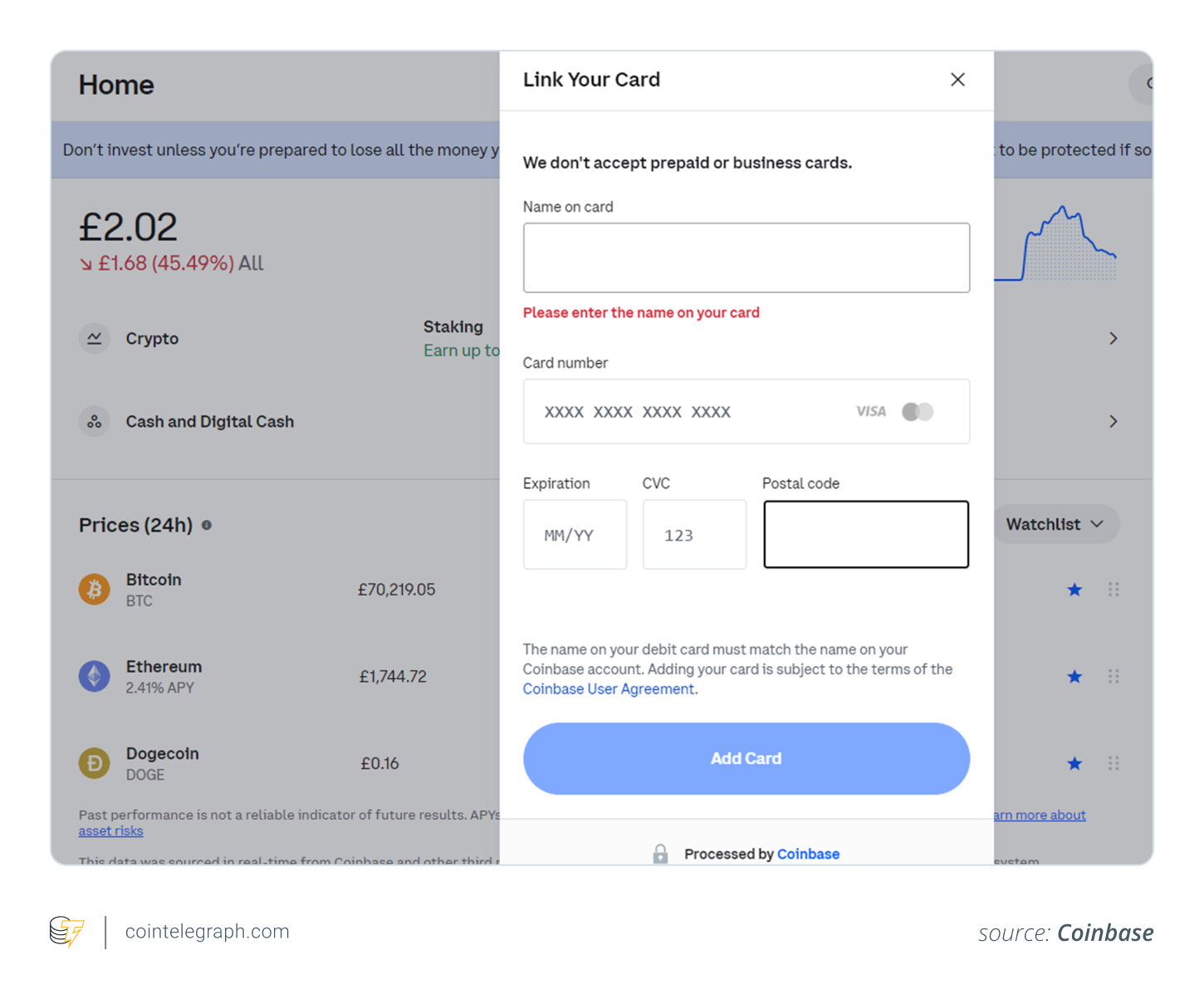

Step 2: Hyperlink your bank card

As soon as your account is accessible, use the right-hand facet panel so as to add your cost methodology. This offers you the choice to hyperlink a bank card. Add your card particulars and click on “Add Card.”

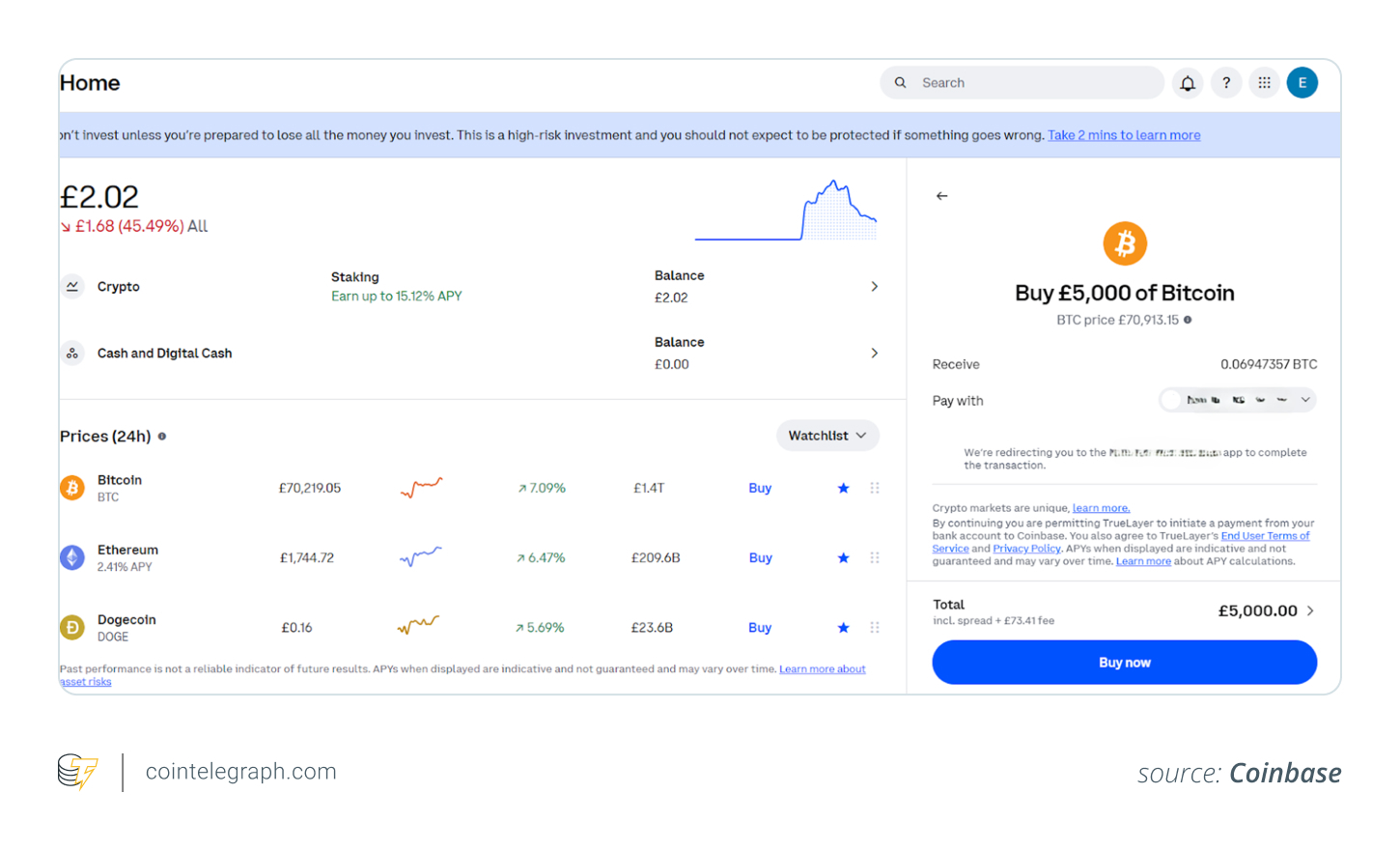

Step 3: Purchase Bitcoin

Utilizing the right-hand facet panel instantaneous purchase function, choose Bitcoin and the quantity you’d wish to buy. The alternate purchase restrict may even be proven subsequent to your bank card cost methodology. That is often restricted to 10,000 British kilos every day on Coinbase. When prepared, click on “Purchase Now.” Affirm the acquisition in your banking app. As soon as permitted, the Bitcoin will probably be added to your alternate account and fiat debited out of your bank card.

Find out how to shield your self from fraud when shopping for Bitcoin with a bank card

The irreversible nature of Bitcoin means safety and fraud prevention must be on the high of your listing. It's your accountability to guard your monetary info and crypto from being compromised. To remain secure when shopping for Bitcoin, you need to:

- Solely use a good and controlled alternate with a powerful safety file.

- Use core safety features, together with distinctive passwords and 2FA.

- Be careful for phishing attempts. Double-check URLs, and don’t click on e mail hyperlinks or unsolicited messages.

- Contemplate shifting Bitcoin right into a self-custody hardware wallet to guard in opposition to alternate hacks and fraud.

Is it secure to purchase BTC with a bank card?

It's usually thought of that purchasing Bitcoin with a bank card is without doubt one of the most secure strategies. It is because it helps to guard your wider monetary info, comparable to direct entry to financial institution accounts.

It's also possible to profit from fraud prevention and spending limits that bank card firms supply. So, in case your card particulars or accounts fall into the mistaken palms, you should have greater ranges of safety. Plus, there may be even some recourse to reverse funds and have fraudulent funds struck off.

Whereas it does supply added safety and comfort, purchases will come at the next price. Bank card firms usually cost greater charges for crypto transactions, and you might face restrictions on the dimensions of Bitcoin purchases.

Many exchanges impose decrease buy limits for bank card transactions, particularly for first-time consumers, which may make it much less interesting for bigger investments. Regardless of these drawbacks, the additional safety and ease of use make it a handy possibility for these new to the crypto house.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.