Bitcoin (BTC) shrugged off positive aspects on the March 13 Wall Avenue open as US inflation markers continued to fall.

BTC/USD 1-hour chart. Supply: Cointelegraph/TradingView

Excellent news is unhealthy information? Bitcoin follows shares decrease

Information from Cointelegraph Markets Pro and TradingView confirmed BTC/USD circling $81,500, down 2.3% on the day.

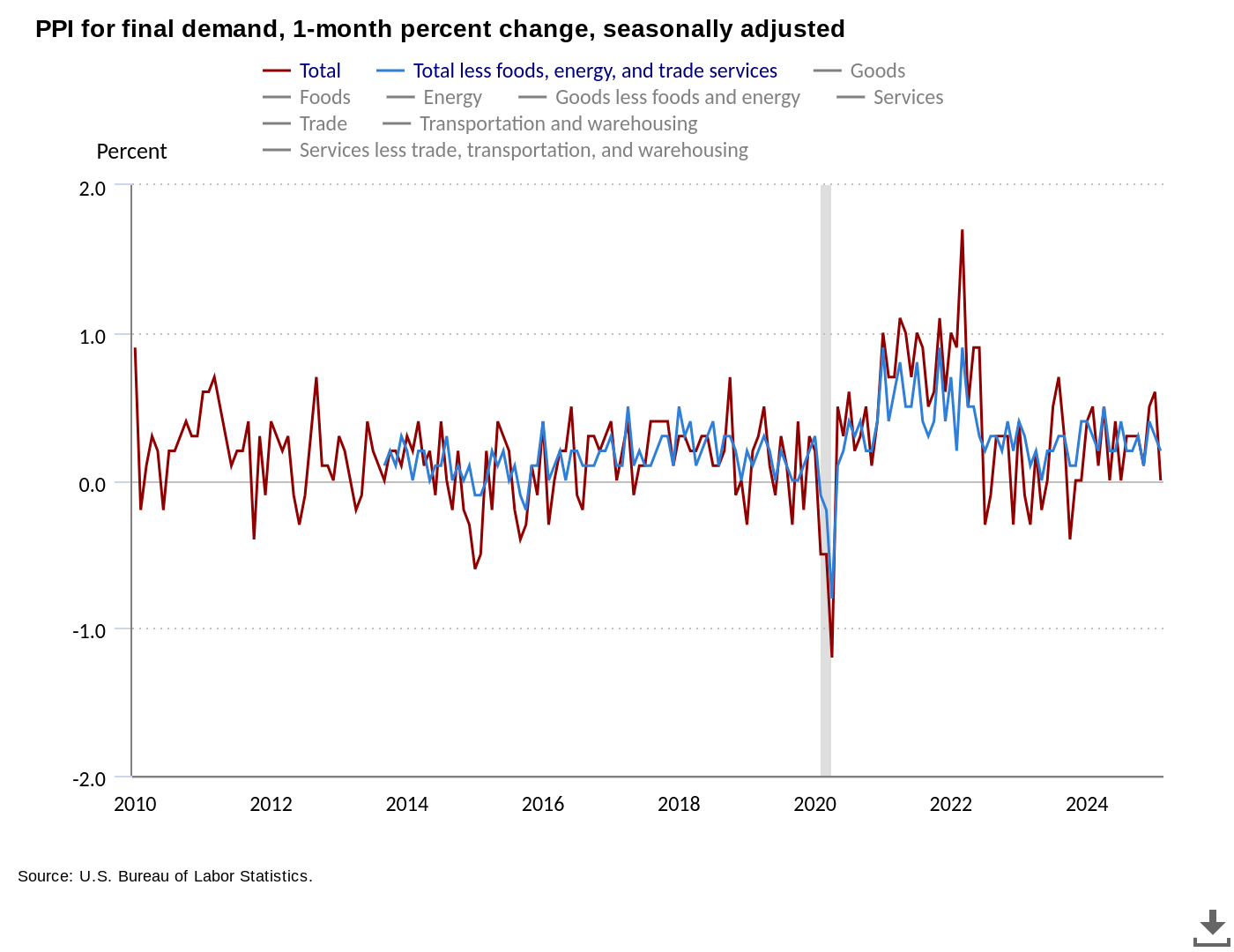

The February print of the Producer Value Index (PPI) got here in under median expectations, copying the Shopper Value Index (CPI) outcomes from the day prior.

“On an unadjusted foundation, the index for remaining demand superior 3.2 % for the 12 months resulted in February,” an accompanying press release from the US Bureau of Labor Statistics (BLS) acknowledged.

“In February, a 0.3-percent enhance in costs for remaining demand items offset a 0.2-percent decline within the index for remaining demand companies.”

US PPI 1-month % change. Supply: BLS

Already a double tailwind for crypto and danger belongings, cooling inflation additionally stunted a rebound in US greenback energy, as seen via the US Greenback Index (DXY).

US Greenback Index (DXY) 1-hour chart. Supply: Cointelegraph/TradingView

Regardless of this, each shares and crypto remained unmoved, main buying and selling useful resource The Kobeissi Letter to tie within the ongoing US commerce warfare.

“As we've got seen, the market has had a really MUTED response to inflation information that will've beforehand despatched the S&P 500 SHARPLY larger,” it wrote in a part of its latest analysis on X

“Why is that this the case? This information gives President Trump a motive to maintain doing what he's at present doing.”

S&P 500 1-hour chart. Supply: Cointelegraph/TradingView

Kobeissi defined that dealer warfare efforts could now intensify given slowing inflation.

“That is precisely why markets should not recovering losses following a number of the greatest inflation information in months,” it continued, suggesting merchants ought to “buckle up for extra volatility.”

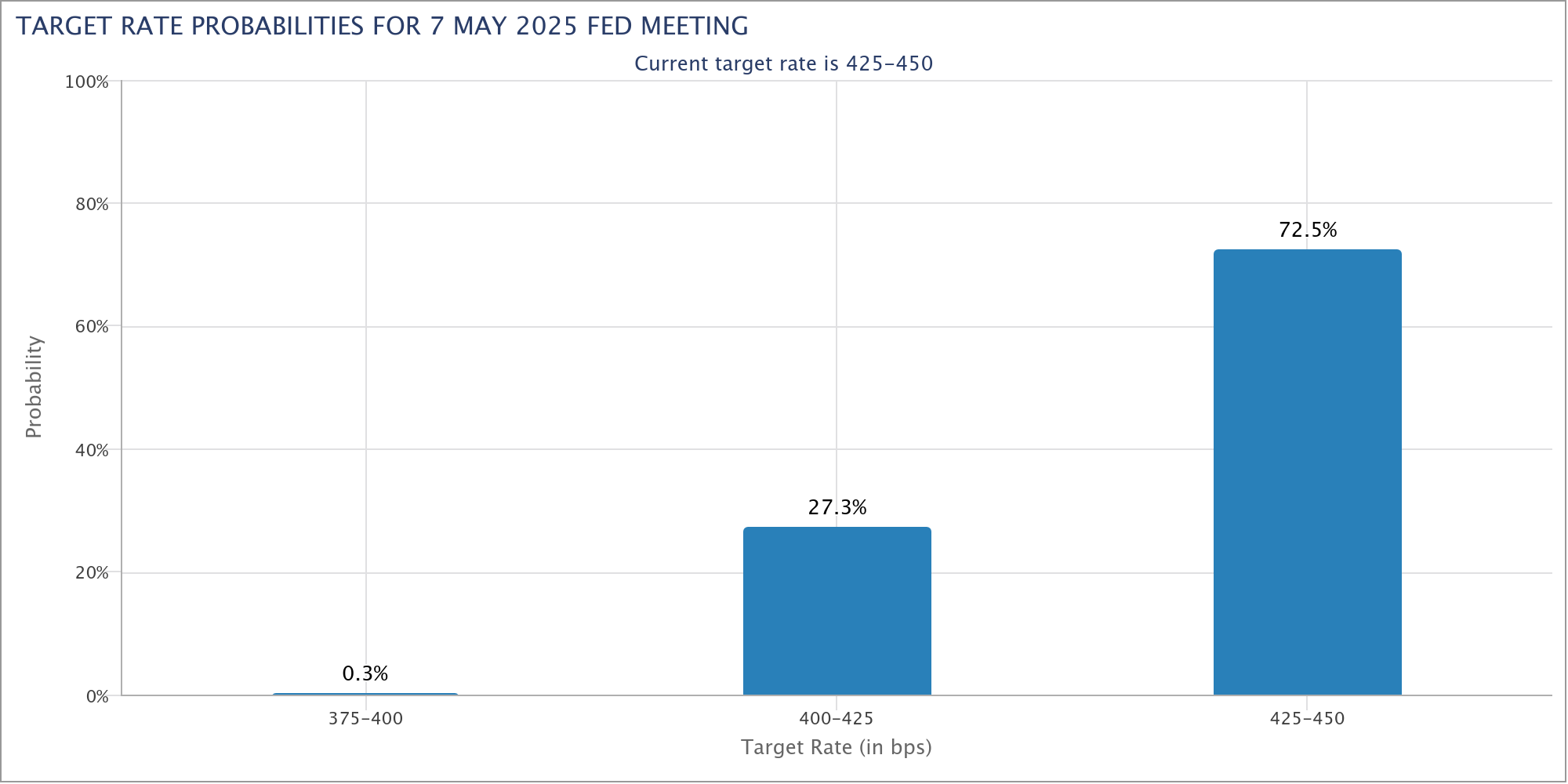

Every week earlier than the Federal Reserve’s subsequent rate of interest choice, market expectations for monetary easing remained equally lackluster, with the possibility of a minimize at simply 1%, per information from CME Group’s FedWatch Tool. Odds for the Fed’s Might assembly had been at 28%.

Fed goal price chances. Supply: CME Group

“The Fed has already determined: regular course, no cuts this FOMC. Powell made that clear final week,” common crypto dealer Josh Rager told X followers earlier within the week, referencing a latest speech by Fed Chair Jerome Powell.

“Charge cuts? Extra probably in Might/June, not March.”

BTC value inertia leaves key resistance intact

Bitcoin value motion thus sat between bands of purchase and promote liquidity on trade order books, with the 200-day easy shifting common (SMA) in place as resistance.

Associated: Bitcoin whales hint at $80K ‘market rebound’ as Binance inflows cool

For Keith Alan, co-founder of buying and selling useful resource Materials Indicators, this trendline, which usually features as assist throughout Bitcoin bull markets, was the closest vital stage to reclaim.

“Bitcoin faces sturdy resistance on the 200-Day MA for the 4th consecutive day,” he summarized on X.

Referring to Materials Indicators’ proprietary buying and selling instruments, Alan concluded that such a reclaim was unlikely on the day, however shock catalysts within the type of bulletins from the US authorities.

BTC/USD 1-day chart. Supply: Keith Alan/X

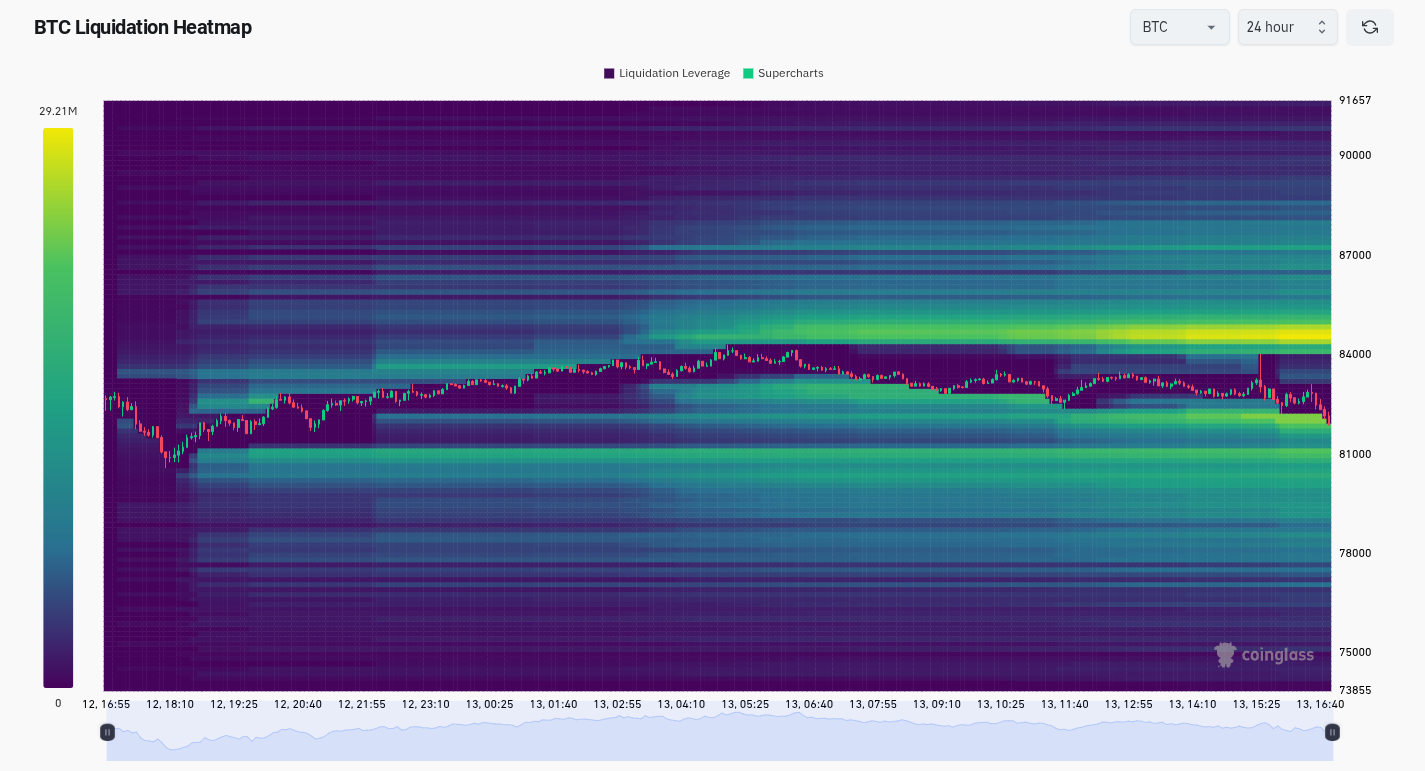

In the meantime, information from monitoring useful resource CoinGlass confirmed key upside resistance clustered instantly under $85,000.

BTC liquidation heatmap (screenshot). Supply: CoinGlass

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.