Hong Kong-based crypto fee platform RedotPay has closed a $40 million Sequence A funding spherical led by Lightspeed, with participation from HSG and Galaxy Ventures.

RedotPay goals to allow cryptocurrency use in on a regular basis transactions whereas simplifying blockchain transactions for spenders, akin to fiat. In November 2023, the corporate launched its personal bodily Visa playing cards, which can be utilized for ATM money withdrawals, together with a digital card that helps digital fee providers like Apple Pay and Google Pay.

The corporate has expanded its blockchain integrations, including Solana in December 2024 and Ethereum layer 2 Arbitrum in February 2025. Moreover, it partnered with StraitX and Visa to assist retail crypto funds in Singapore.

RedotPay seems to have cross-border service restrictions. Guests exterior Hong Kong are greeted with a warning when accessing the corporate’s web site.

RedotPay seems to have cross-border service restrictions. Guests exterior Hong Kong Supply: RedotPay

Crypto funds choices rising in Asia, with stablecoins on the forefront

Direct cryptocurrency fee options are gaining traction throughout Asia. In November 2024, Singapore-based digital asset buying and selling platform Crypto.com partnered with Triple-A to allow direct crypto funds, eliminating the necessity to convert crypto into fiat.

Hong Kong has its share of opponents. Infini, a stablecoin-focused crypto fee agency, gives fee providers whereas incomes yield. Nevertheless, it not too long ago suffered a $50 million USDC exploit, allegedly orchestrated by a rogue developer who swapped USDC for DAI — a decentralized stablecoin that can't be frozen like its centralized counterparts.

Associated: Infini loses $50M in exploit; developer deception suspected

In contrast to unstable cryptocurrencies like Bitcoin (BTC) or Ether (ETH), stablecoins can provide a extra constant choice to carry for individuals who need to use them for funds, because the property are designed to keep up a worth pegged to their fiat counterparts.

Japan, the second-largest Asian financial system by gross home product, is making vital strides in stablecoin adoption. A latest report by Tokyo-based analysis and consulting agency Yuri Group shared with Cointelegraph Magazine means that the Japanese authorities views stablecoins as a possible catalyst to unlock $14 trillion in family financial savings.

Japan’s eyes digital property resurgence behind established monetary establishments. Supply: Yuriy Group

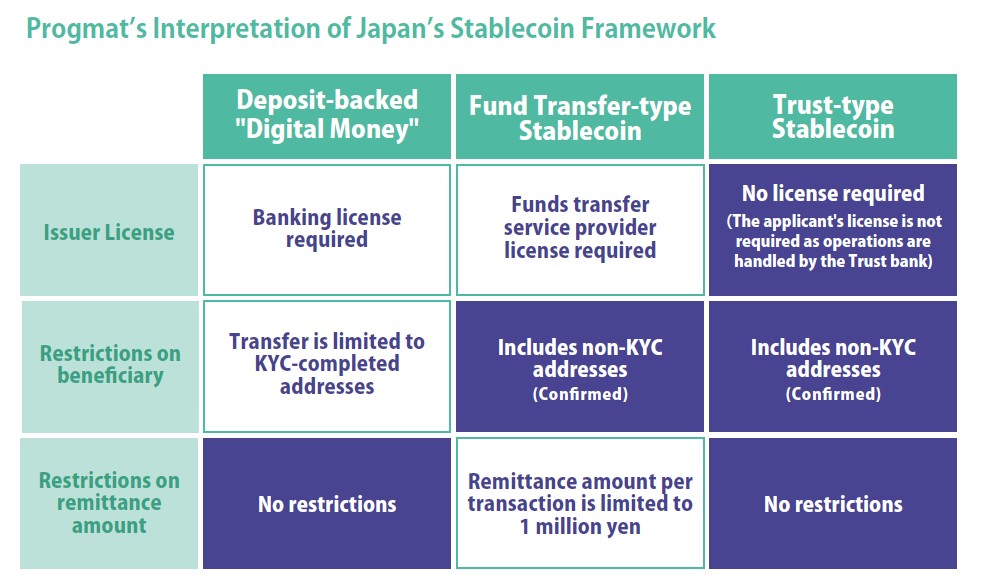

Yuri Group highlights Progmat as a key participant in Japan’s digital asset ecosystem. Backed by the nation’s largest financial institution, Mitsubishi UFJ Progmat operates in compliance with Japan’s strict regulatory framework, which mandates a 1:1 reserve backing. This ensures that Japan’s established monetary establishments stay on the forefront of digital asset administration.

In distinction, China, Asia’s largest financial system, has banned cryptocurrency buying and selling and acknowledges the renminbi because the nation’s sole authorized tender.

Journal: How Chinese traders and miners get around China’s crypto ban