Bitcoin (BTC) speculators have secured losses of over $100 million in simply six weeks because of panic promoting, new analysis calculates.

Information from onchain analytics platform CryptoQuant reveals the true extent of current capitulation by short-term holders (STHs).

Bitcoin speculators run to the exit “within the purple”

Bitcoin entities hodling cash between one and three months bore the brunt of a brutal bull market drawdown — and lots of didn't keep the course.

CryptoQuant means that this part of the general STH investor cohort, outlined as these shopping for as much as six months in the past, is round $100 million out of pocket.

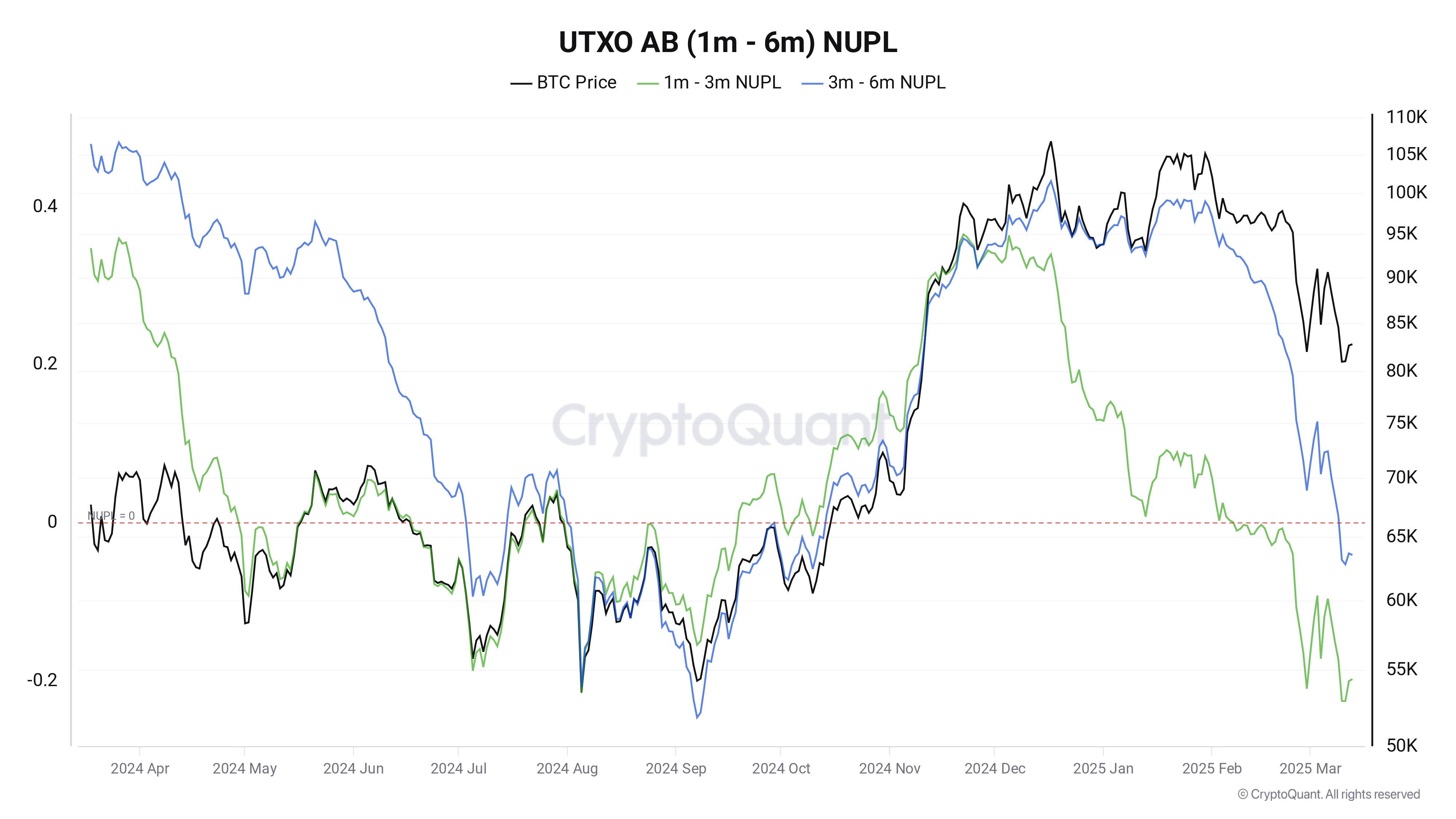

“This represents a major discount within the worth of Bitcoin held by this cohort, who are actually underwater as many purchased at greater costs and are exiting with losses,” contributor Onchained wrote in one in every of its “Quicktake” weblog posts on March 13.

Onchained referenced the market cap and realized cap of the related entities, similar to the present worth of the BTC they personal versus the value at which they final moved onchain.

“The market capitalization (MC) of their holdings is now decrease than the realized capitalization (RC), signaling that these holders are locking in realized losses,” the publish continues.

“This habits is contributing to elevated promoting strain and will result in additional downward value motion within the quick time period.”

Bitcoin 1-3 month investor market cap, realized cap (screenshot). Supply: CryptoQuant

An accompanying chart reveals a dramatic unfavourable weekly change within the realized cap on a scale not seen in lots of months.

The cohort’s internet unrealized revenue/loss (NUPL) rating, at present at -0.19, likewise suggests extra cash being held “underwater” than at any time over the previous 12 months.

Bitcoin 1-3 month investor NUPL. Supply: CryptoQuant

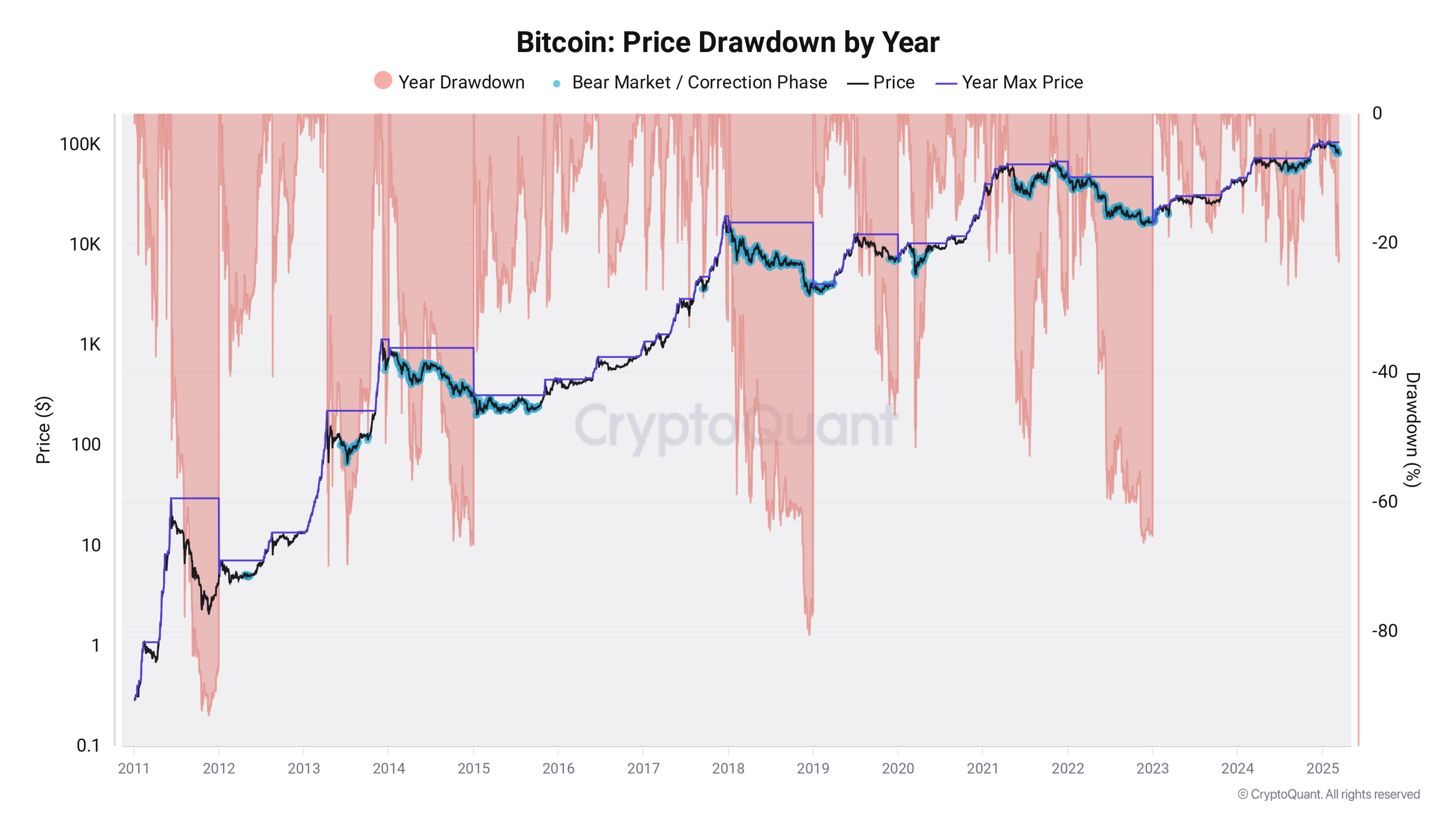

BTC value drawdown belies “broader bearish section”

February marks simply the most recent trial for current Bitcoin patrons, with BTC/USD shedding as much as 30% versus its newest all-time highs seen in mid-January.

Associated: Bitcoin price drops 2% as falling inflation boosts US trade war fears

As Cointelegraph reported, sudden corrections have tended to price speculative buyers closely, with loss-making gross sales commonplace as concern and panic set in.

Giant-volume entities, in the meantime, are increasingly ignoring short-term BTC value fluctuations so as to add publicity at ranges round $80,000.

In its newest weekly report seen by Cointelegraph on March 12, CryptoQuant warned that the present correction could also be extra tenacious than it seems on the floor.

“Traditionally, bull market corrections are typically short-lived and adopted by robust recoveries, however present on-chain indicators level to a possible structural shift that might preclude a broader bearish section,” it summarized.

Bitcoin value drawdowns by 12 months. Supply: CryptoQuant

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.