Bitcoin (BTC) breached a rising help trendline towards gold (XAU), which has been intact for over 12 years, on March 14.

XAU/BTC ratio weekly efficiency chart. Supply: TradingView/NorthStar

Widespread analyst NorthStar says this breakdown may spell the tip of Bitcoin’s 12-year bull run if it stays beneath the gold trendline for even per week or—worse—a month.

Is Bitcoin’s bull market over? Let’s take a better take a look at BTC’s correlation with gold.

Gold hits new file excessive as Bitcoin’s uptrend cools

The BTC/XAU ratio breakdown occurred as spot gold charges hit a brand new file excessive above $3,000 per ounce on March 14, after rising by about 12.80% year-to-date.

In distinction, Bitcoin, which is commonly referred to as “digital gold,” has dropped by 11% to date in 2025.

BTC/USD vs. XAU/USD YTD efficiency chart. Supply: TradingView

The performances replicate the contrasting web flows into US-based spot exchange-traded funds (ETF) monitoring Bitcoin and gold.

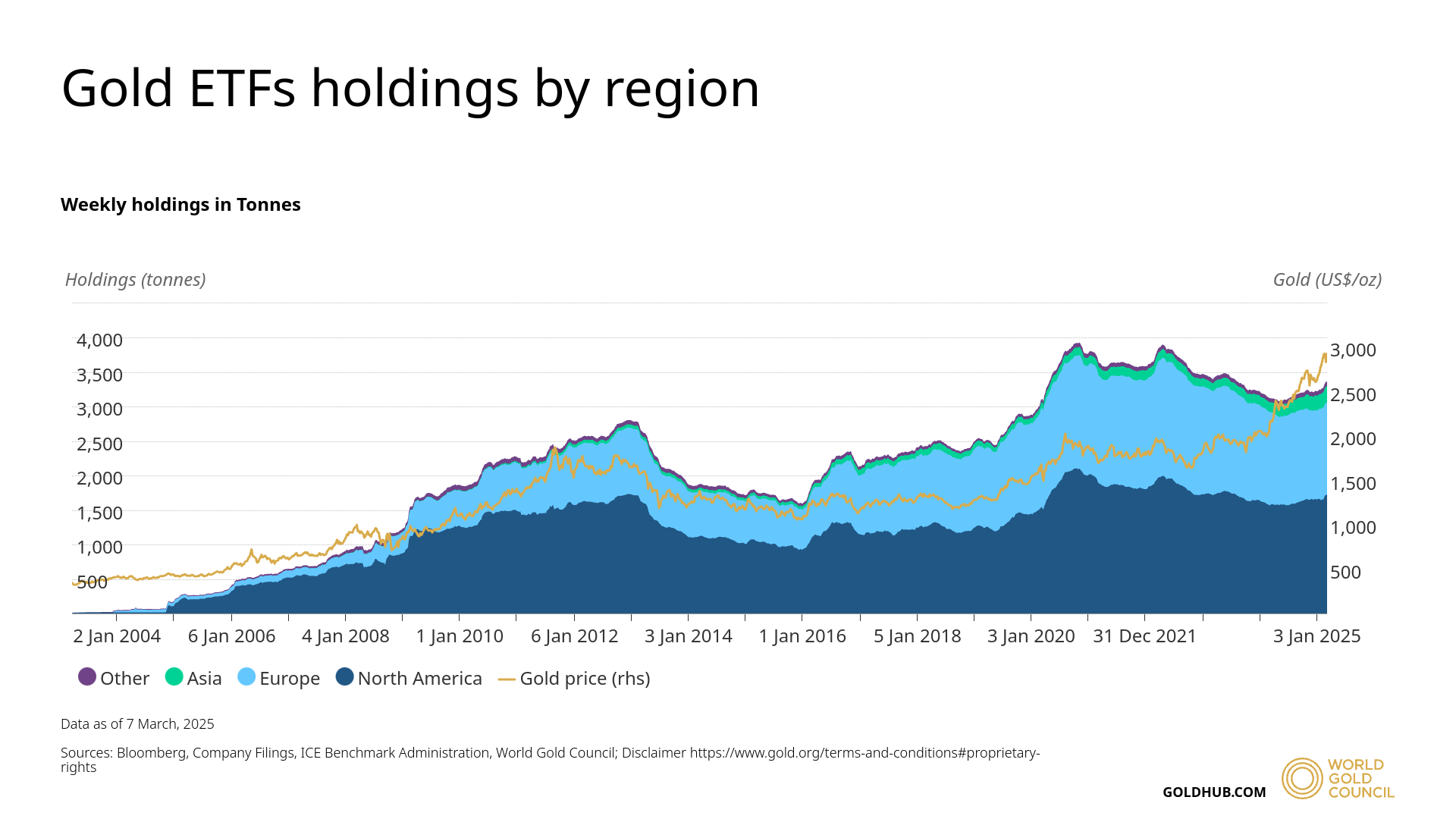

For example, as of March 14, the US-based spot gold ETFs had collectively attracted over $6.48 billion YTD, based on knowledge useful resource World Gold Council. Globally, gold ETFs have seen $23.18 billion in inflows.

Gold ETFs weekly holdings by area. Supply: GoldHub.com

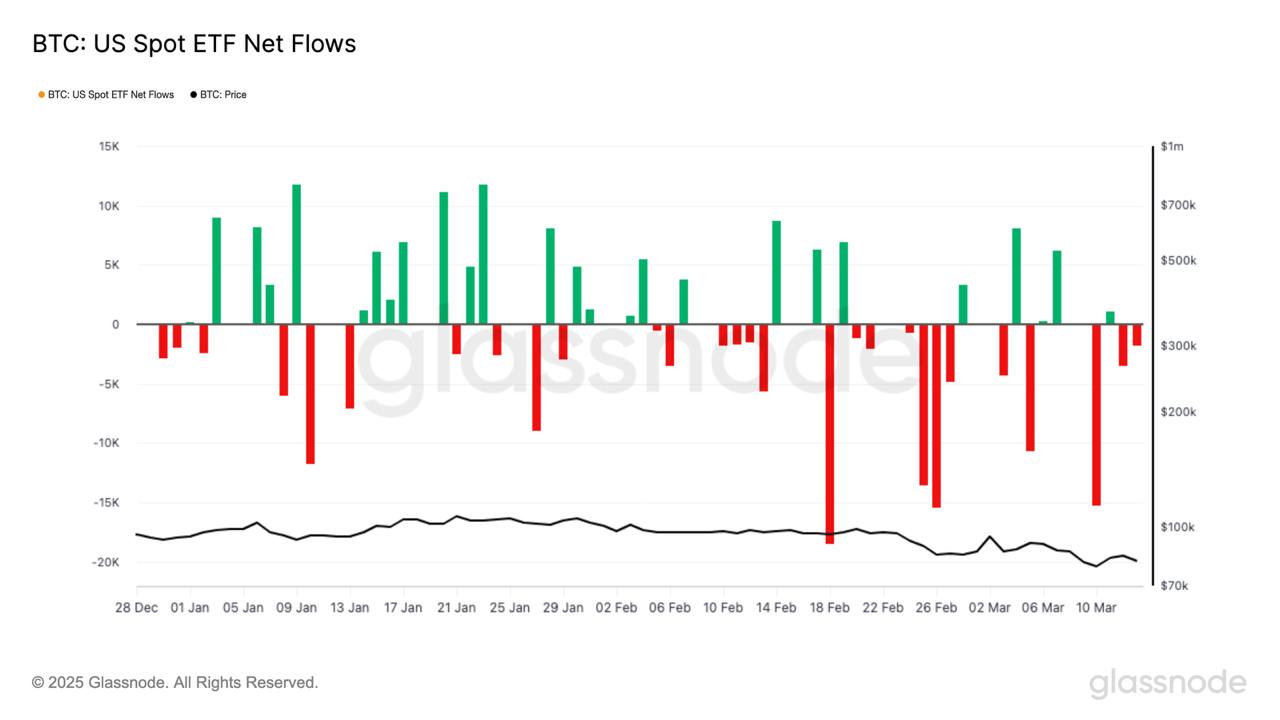

Alternatively, US-based spot Bitcoin ETFs noticed almost $1.46 billion in outflows YTD, based on onchain knowledge platform Glassnode.

US Bitcoin ETFs year-to-date web flows. Supply: Glassnode

The driving drive behind this divergence lies in rising macroeconomic uncertainty and risk-off sentiment, exacerbated by President Donald Trump’s aggressive trade policies.

Associated: Bitcoin panic selling costs new investors $100M in 6 weeks — Research

New tariffs on China, Mexico, and Canada have heightened fears of a worldwide financial slowdown, pushing buyers towards conventional safe-haven property like gold.

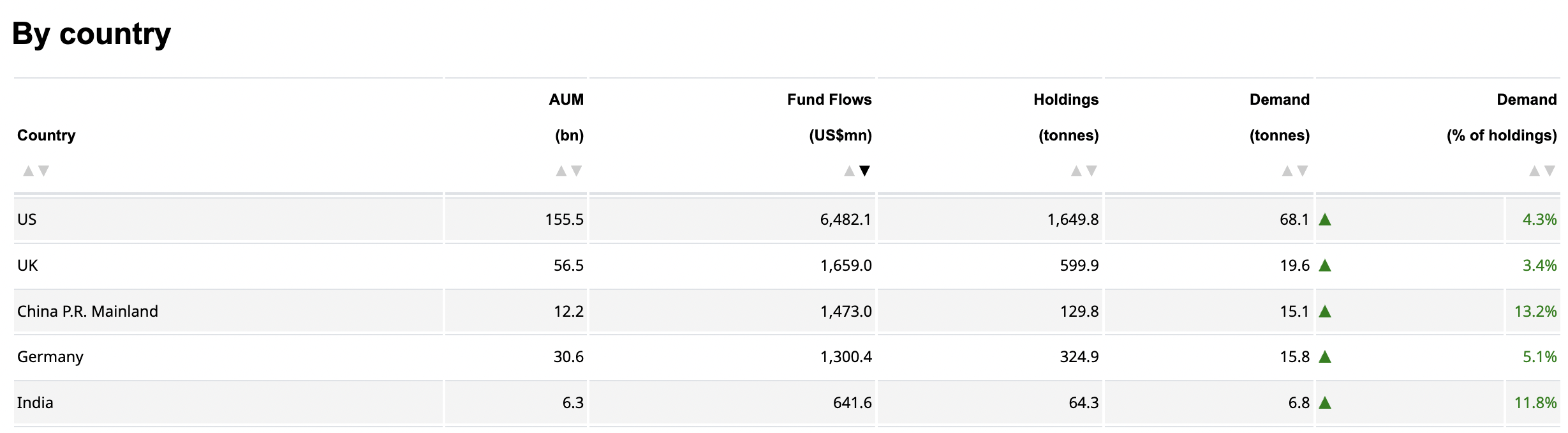

In the meantime, central banks, together with these within the US, China, and the UK, have accelerated their gold purchases, additional boosting gold costs.

Nations that acquired essentially the most gold to date in 2025. Supply: GoldHub.com

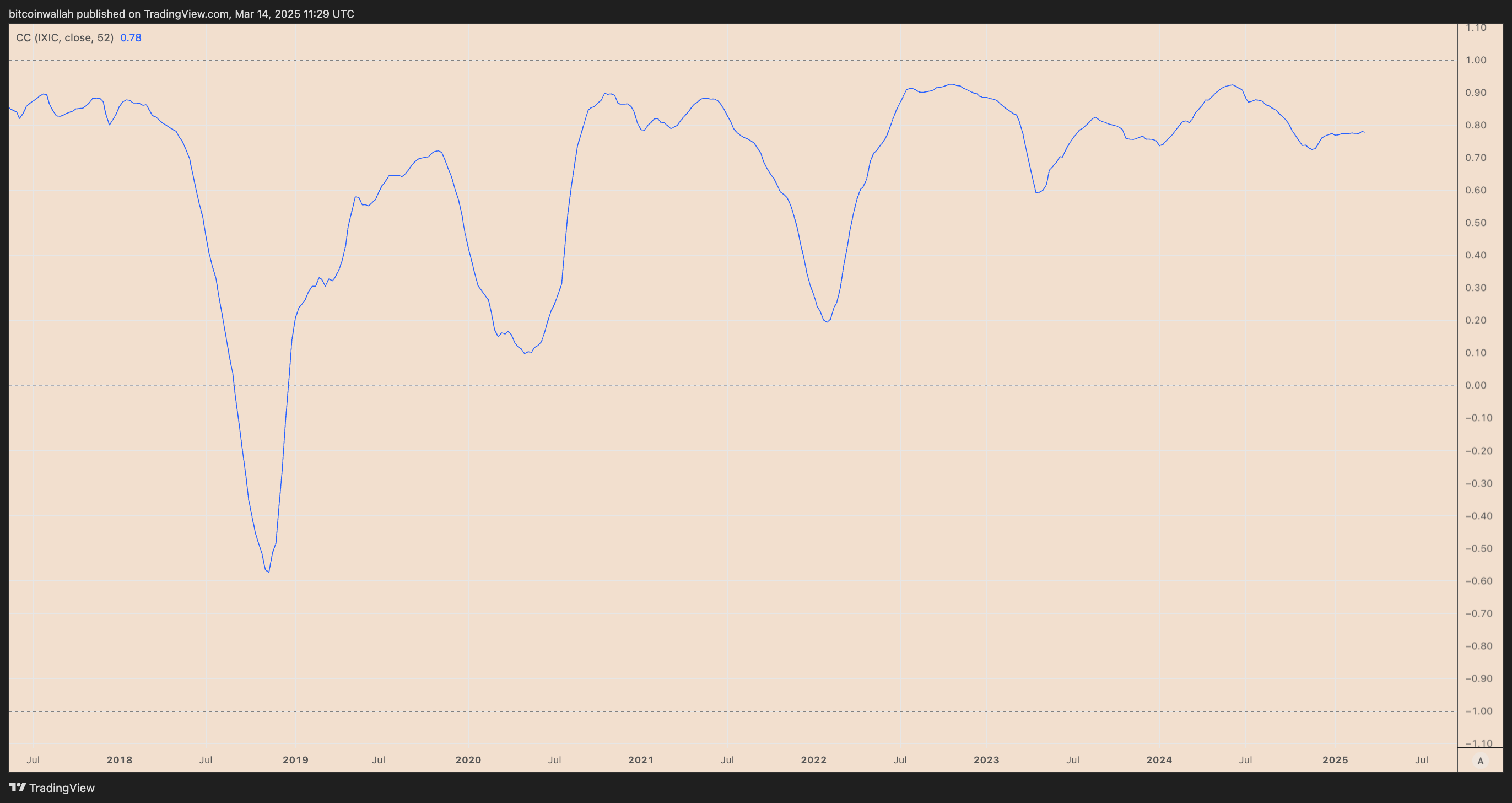

In distinction, Bitcoin is mirroring the broader risk-on market. As of March 14, its 52-week correlation coefficient with the Nasdaq Composite index was 0.76.

BTC/USD vs. Nasdaq Composite 52-week correlation coefficient chart. Supply: TradingView

Has Bitcoin worth topped?

The current Bitcoin-to-gold breakdown aligns with historic patterns, significantly the March 2021–March 2022 fractal, which preceded the final bear market.

At the moment, the BTC/XAU ratio exhibited a bearish divergence, characterised by rising costs juxtaposed towards a declining relative power index (RSI). This sample urged diminishing upward momentum.

BTC/XAU ratio two-week efficiency chart. Supply: TradingView

Consequently, the ratio initially retreated towards the 50-period, two-week exponential transferring common (EMA) help degree earlier than finally plummeting by 60%.

That BTC/XAU breakdown interval coincided with Bitcoin’s 68% correction towards the US greenback.

BTC/USD two-week efficiency chart. Supply: TradingView

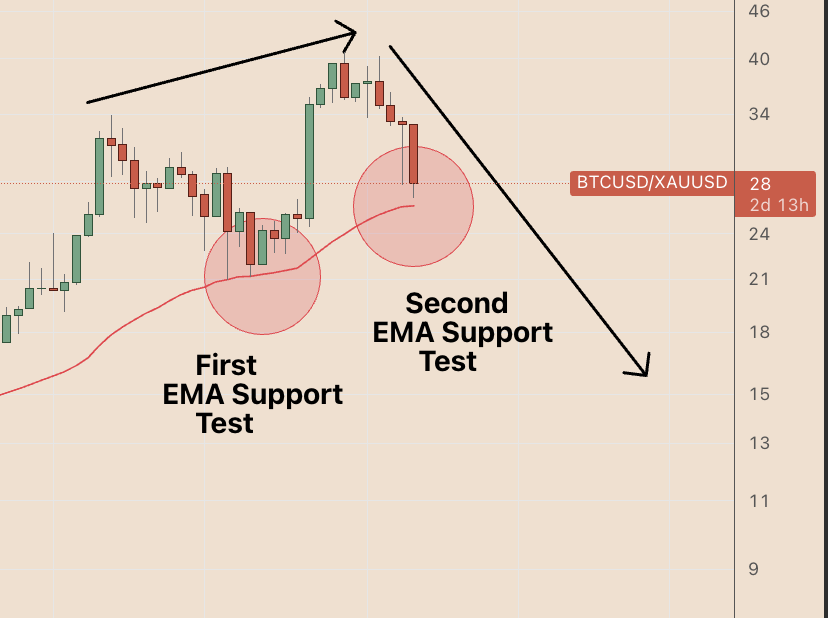

BTC/XAU has as soon as once more accomplished a two-phase EMA retest, echoing the 2021–2022 fractal.

BTC/USD two-week efficiency chart (zoomed). Supply: TradingView

With the RSI exhibiting bearish divergence, momentum seems to be fading, rising the chance of additional declines, particularly if the ratio drops decisively under the 50-2W EMA help (~26 XAU).

Because of this, it may additionally point out Bitcoin’s elevated vulnerability to cost declines in greenback phrases, with the 50-2W EMA under $65,000 performing as the following potential draw back goal.

BTC/USD 2W worth efficiency chart. Supply: TradingView

That's down about 40% from Bitcoin’s file excessive of round $110,000 established in January.

Nonetheless, Nansen analysts consider such a decline as a “correction inside a bull market,” elevating potentialities of a bullish revival if the 50-2W EMA holds as help. Nonetheless, a definitive break under the EMA may thrust Bitcoin into bear market territory.

That might drag Bitcoin’s 2025 draw back goal towards the 200-period two-week EMA (the blue wave) to as little as $34,850 if this Bitcoin-gold fractal repeats.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.