REX Shares, an exchange-traded fund (ETF) supplier with over $6 billion in property underneath administration (AUM), launched its Bitcoin (BTC) Company Treasury Convertible Bond (BMAX) ETF that invests within the convertible bonds of corporations with a BTC company reserve technique.

In accordance with the March 14 announcement, the ETF will buy the convertible notes of companies such as Strategy. Convertible notes are industrial paper that may be transformed into fairness at a predetermined charge if an investor chooses.

Usually, these convertible bonds are bought by institutional traders, together with pension funds, a few of which concentrate on convertible observe investing. Greg King, CEO of REX Monetary, stated:

“Till now, these bonds have been tough for particular person traders to achieve. BMAX removes these limitations, making it simpler to spend money on the technique pioneered by Michael Saylor — leveraging company debt to accumulate Bitcoin as a treasury asset.”

Investing in convertible bonds, ETFs and the fairness of corporations similar to Technique, MARA and Metaplanet supplies traders with indirect exposure to Bitcoin that removes the technical barrier to entry and self-custodial dangers of holding BTC immediately.

Technique co-founder Michael Saylor, who popularized company Bitcoin treasuries, speaks concerning the deserves of BTC. Supply: Cointelegraph

Associated: Michael Saylor’s Strategy to raise up to $21B to purchase more Bitcoin

Technique a proxy Bitcoin wager for institutional traders

Institutional traders might lack the technical sophistication to carry BTC immediately or have authorized or fiduciary constraints stopping them from investing in digital property.

At the least 12 US states currently hold Strategy stock as a part of their state pension funds and treasuries. Collectively, these states maintain over $271 million in Technique inventory utilizing present market costs.

The checklist contains Arizona, California, Colorado, Florida, Illinois, Louisiana, Maryland, North Carolina, New Jersey, Texas, Utah and Wisconsin.

California’s State Academics’ Retirement Fund and its Public Staff Retirement System maintain $67.2 million and $62.8 million in Technique inventory, respectively.

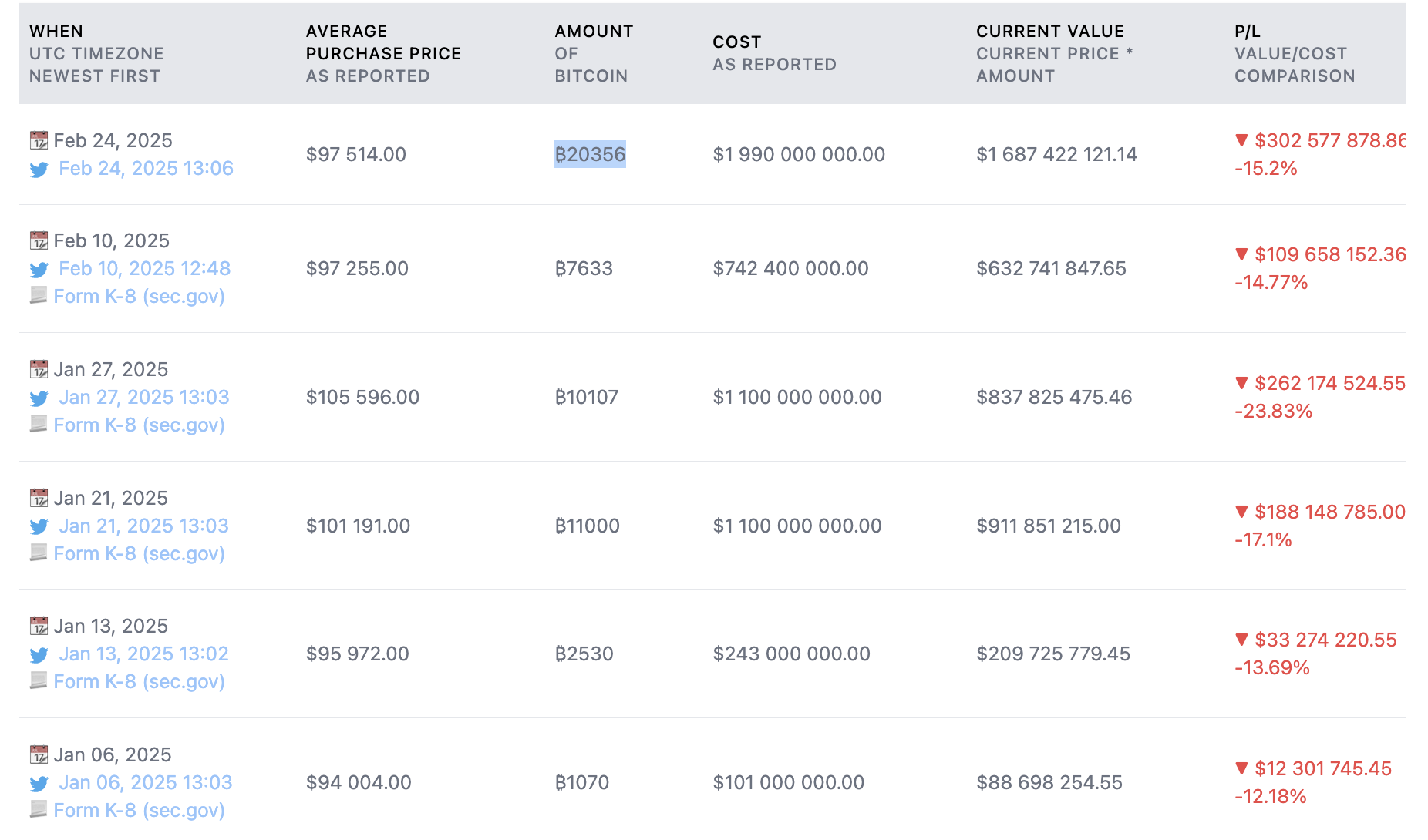

Technique’s Bitcoin purchases in 2025. Supply: SaylorTracker

In accordance with SaylorTracker, Technique presently holds 499,096 BTC, valued at over $41.4 billion, making the corporate one of many largest company BTC holders on the planet — eclipsing the US authorities’s estimated 198,000 BTC.

Technique’s most recent Bitcoin purchase occurred on Feb. 24, when the corporate acquired 20,356 BTC for almost $2 billion.

Journal: ‘China’s MicroStrategy’ Meitu sells all its Bitcoin and Ethereum: Asia Express