Few issues in crypto are as elusive and misunderstood because the idea of an “altcoin season.” Historically, this time period referred to a quick window — normally 2–3 months — following a Bitcoin (BTC) value rally, the place altcoins outperform BTC in cumulative returns. That sample held within the 2015–2018 and 2019–2022 cycles, however the verdict just isn't but in on whether or not the present bull market has had its altcoin season.

The Blockchain Center defines an altcoin season as a interval when 75% of the highest 50 altcoins outperform Bitcoin over a rolling 90-day timeframe. Its Altseason Index registered upticks in March 2024 and once more in January 2025 — however neither lasted lengthy sufficient to qualify as a full-fledged altseason.

Altcoin season index. Supply: Blockchain Middle

Some analysts argue that memecoins drained liquidity from the broader altcoin market. Others blame the oversaturation of crypto funding merchandise — significantly ETFs — which cater to establishments and highlight solely the most important altcoins. A 3rd rationalization requires a deeper rethink of what altcoins truly are. Inside this view, altcoins are perceived as a unified asset class however are a various assortment of crypto belongings with totally different features, worth buildings, and progress potential.

Memecoins stole the highlight

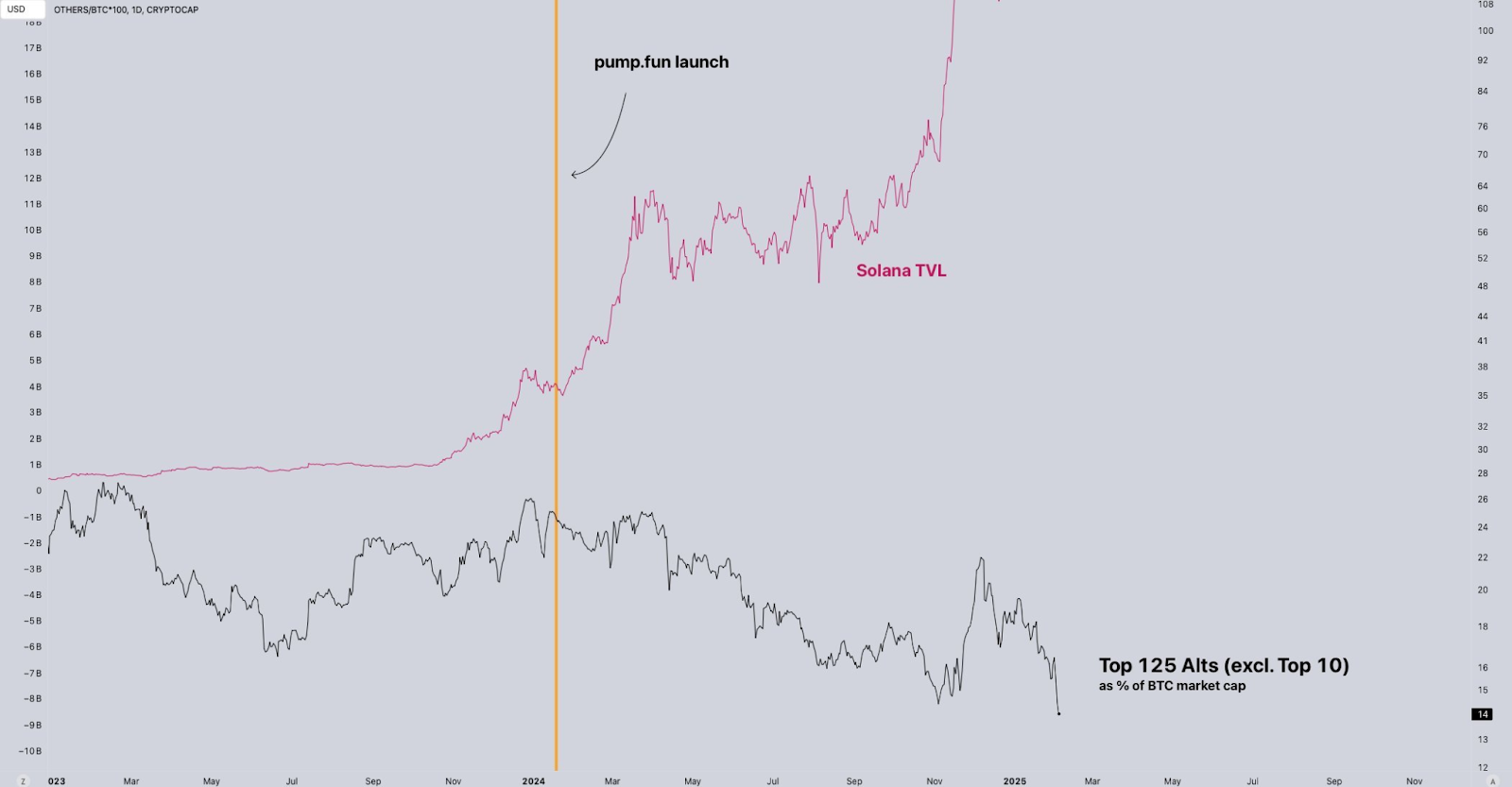

For the crypto analyst Miles Deutscher, the launch of Pump.fun is immediately correlated to the destruction of the altcoin market vs BTC.

“The explanation we’ve seen no main “altseason” throughout majors is as a result of the speculative capital that may’ve as soon as poured into high 200 belongings, as a substitute determined to leap the gun and flood into onchain low caps as a substitute.”

Deutscher notes that the early birds and insiders acquired insanely wealthy from this, however most retail traders who entered late misplaced. This was additionally the case in earlier altcoin cycles. Nonetheless, not like 2022, the place the losses had been primarily restricted to CEX altcoins with stable liquidity, they acquired caught into illiquid onchain memecoins, which shortly retraced 70%-80%. This led to a “wealth destruction occasion larger than the early 2022 bear (LUNA apart),” regardless that BTC (and a few majors) are nonetheless in a macro bull pattern.

Solana TVL vs High 125 Alts (excl. High 10). Supply: Miles Deutscher

Politics in the US added gasoline to the memecoin craze. For instance, President Donald Trump’s public embrace of memecoins sparked momentum — however the outcomes shortly upset. TRUMP and MELANIA tokens have dropped 83% and 95%, respectively, since launching on the finish of January, delivering one other hit to retail sentiment.

Associated: Will new US SEC rules bring crypto companies onshore?

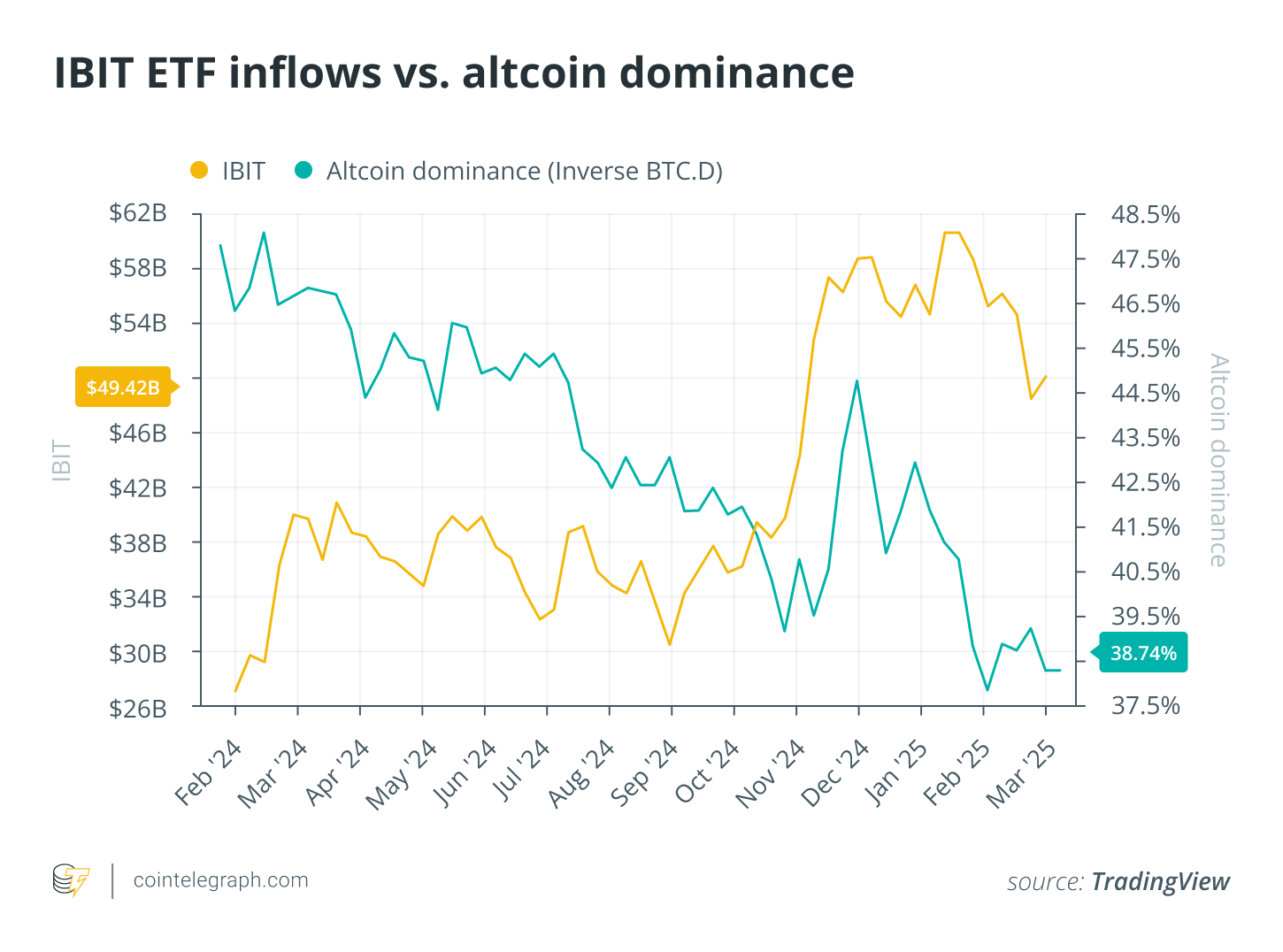

Institutional traders and ETFs shifted the tide

One other issue impacting the power of the present bull market’s altcoin season was the arrival of Wall Road. The launch of spot Bitcoin ETFs in January 2024 introduced $129 billion in inflows as traders rushed into acquainted buildings with custody, regulation, and easy accessibility. BlackRock’s IBIT turned a dominant automobile, and the introduction of ETF choices in July 2024 added much more depth.

Some analysts imagine that the protection and scalability of spot BTC ETFs sucked capital away from speculative belongings. With the flexibility to hedge via choices and futures, the inducement to gamble on illiquid, low-volume altcoins diminishes considerably.

However this rationalization has limits. Crypto just isn't a zero-sum market — world liquidity is rising, and capital getting into the area can stream in lots of instructions. If something, institutional demand may develop the overall crypto pie.

Moreover, some altcoins have already got their ETFs as nicely. Spot Ether ETFs debuted in July 2024 and have since registered a modest internet influx of $565,000, based on CoinGlass. Such a drastic distinction in scale with spot BTC ETFs means that the ETF construction alone isn’t sufficient; investor conviction nonetheless issues.

Altcoin’s operate and their rallies turned extra nuanced

The time period “altcoin” emerged when any non-Bitcoin token was novel. However in in the present day’s ecosystem, the time period lumps collectively wildly totally different belongings: blockchain-native cash, governance tokens, stablecoins, memecoins, DApp tokens, and real-world asset protocol tokens — every with distinct features and investor profiles. Simply because it wouldn’t make sense to group gold, Nvidia inventory, and the US greenback right into a single index in conventional finance, it makes little sense to deal with all altcoins as one unified class.

A more in-depth take a look at value motion helps this concept. In response to CoinGecko information, main altcoin classes have diverged sharply this cycle. Actual-world asset (RWA) tokens surged 15x. GameFi, in contrast, misplaced half its market cap. This exhibits that narratives play a rising function in driving traders’ capital allocation choices.

Crypto classes market cap. Supply: CoinGecko

Even core blockchain tokens have began to specialize. Ethereum stays the hub for DeFi. Solana dominates memecoins. Tron now holds second place in stablecoin transfers. ImmutableX is carving out its territory within the gaming area. In every case, token efficiency is more and more tied to ecosystem exercise. Which means we'd need to abandon the time period “altseason” and begin to pay extra consideration to particular narratives throughout the crypto area.

Altcoins aren’t shifting as a pack anymore, and that may be the most important sign of how the crypto market is maturing.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.