[ad_1]

Jack Dorsey-led Block, a Bitcoin-focused fintech firm, revealed its third-quarter earnings report on Nov. 2 that exposed a worthwhile quarter for the agency, surpassing analyst estimates.

The agency noticed $5.62 billion in income within the third quarter of 2023, boosted by sturdy income development in Money App and Sq. and made $44 million in revenue on its Bitcoin holdings due to the surge in value of BTC over the previous three months.

In a shareholder letter, Jack Dorsey make clear the corporate’s focus and future plans, particularly with Sq., together with key monetary metrics of the third quarter. Dorsey mentioned the corporate has licensed the repurchase of $1 billion in shares to offset a portion of dilution from share-based compensation.

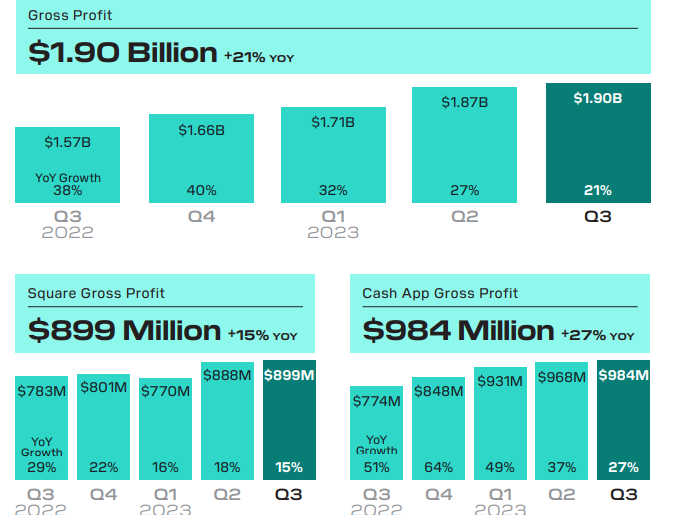

Within the third quarter of 2023, Block generated a gross revenue of $1.90 billion, up 21% yr over yr. However, Money App, the cellular cost service, generated a gross revenue of $984 million, up 27% yearly, and Sq. generated a gross revenue of $899 million, up 15% yr over yr.

Bitcoin income accounted for about 43% of the entire $5.6 billion in income for Block. The fintech corporations’ development within the third quarter was additionally aided by sturdy shopper demand and optimistic spending

Associated: Jack Dorsey tips pro-crypto candidate Robert Kennedy to win presidency

Block’s Bitcoin gross revenue stood at $45 million, up by 22% yr on yr, the place the agency offered $2.42 billion value of BTC to clients through Money App. The corporate’s Bitcoin gross revenue stood at 2% of Bitcoin income. The agency claimed that the rise in BTC income was fueled by a rise within the common market value of Bitcoin and the amount of Bitcoin offered to clients.

Block acknowledged it has not seen any impairment loss on its Bitcoin holding for the reason that earlier quarter. Block’s funding in Bitcoin had a carrying worth of $102 million as of September 30, 2023, however its truthful worth, decided by observable market costs, was $216 million, or $114 million greater than its carrying worth.

Journal: Crypto regulation — Does SEC Chair Gary Gensler have the final say?

[ad_2]

Source link