[ad_1]

Because the Inner Income Service (IRS) pushes ahead with its proposal to extend cryptocurrency surveillance, a previous report may provide a clue for the way this data could also be utilized in follow. In brief, with the IRS set to maintain tabs on Individuals’ cryptocurrency utilization by means of an anticipated 8 billion new returns, it appears the Division of Justice (DOJ) might quickly have the instruments it desires to start out confiscating cryptocurrency at an unprecedented price.

The problem stems from a 2022 report written by the DOJ in response to Government Order 14067. For individuals who won’t bear in mind, Government Order 14067 was President Biden’s first main cryptocurrency initiative. Though many individuals initially feared an impending crackdown was coming, the manager order largely delayed making sweeping modifications by first calling on companies to challenge studies to tell future insurance policies round cryptocurrency and associated points.

The report, written by the DOJ, lined an enormous vary of matters. Largely falling into 4 classes, the suggestions spanned methods to assist prosecutions, methods to enhance investigations, methods to increase penalties for cryptocurrency-related crimes, and methods to extend the sources accessible for presidency workers.

Associated: Bitcoin beyond 35K for Christmas? Thank Jerome Powell if it happens

What’s most fascinating for the current dialog, nonetheless, is the place the DOJ argued for growing its means to grab cryptocurrency.

For instance, the report states that “it’s vital that america have the authority to forfeit the proceeds of cryptocurrency fraud and manipulation as a way of deterring such exercise and divesting violators of their ill-gotten good points.” Due to this fact, the DOJ recommends increasing its authority over felony, civil, and administrative forfeiture.

The DOJ has claimed these updates are obligatory as a result of the division’s expertise with cryptocurrency-related circumstances has “revealed limits on the forfeiture instruments used to deprive wrongdoers of ill-gotten good points and, in sure circumstances, restore funds to victims.”

But this argument is obscure contemplating how a lot and the way usually the federal government has been in a position to seize cryptocurrency through the years. Actually, the report itself mentions such circumstances. Between 2014 and 2022, the FBI seized round $427 million in cryptocurrency. The IRS seized one other $3.8 billion between 2018-21.

With greater than $4 billion available, the DOJ’s argument that the U.S. authorities is struggling to grab cryptocurrency is simply not as obvious because the report’s suggestions make it out to be.

Associated: IRS proposes unprecedented data-collection on crypto users

Nonetheless, the IRS’s broker proposal places the DOJ’s report into a brand new mild given the huge surveillance that the proposal would possible create — huge surveillance that may very well be used to start out confiscating cryptocurrency at a fair larger price.

The issue is what’s known as administrative forfeiture. As Nick Sibilla explained in Forbes when the report first got here out, “Beneath ‘administrative’ or ‘nonjudicial’ forfeiture, the seizing company — not a choose — decides whether or not a property needs to be forfeited.” In different phrases, companies don’t must show to a choose {that a} crime was dedicated with a view to seize the property.

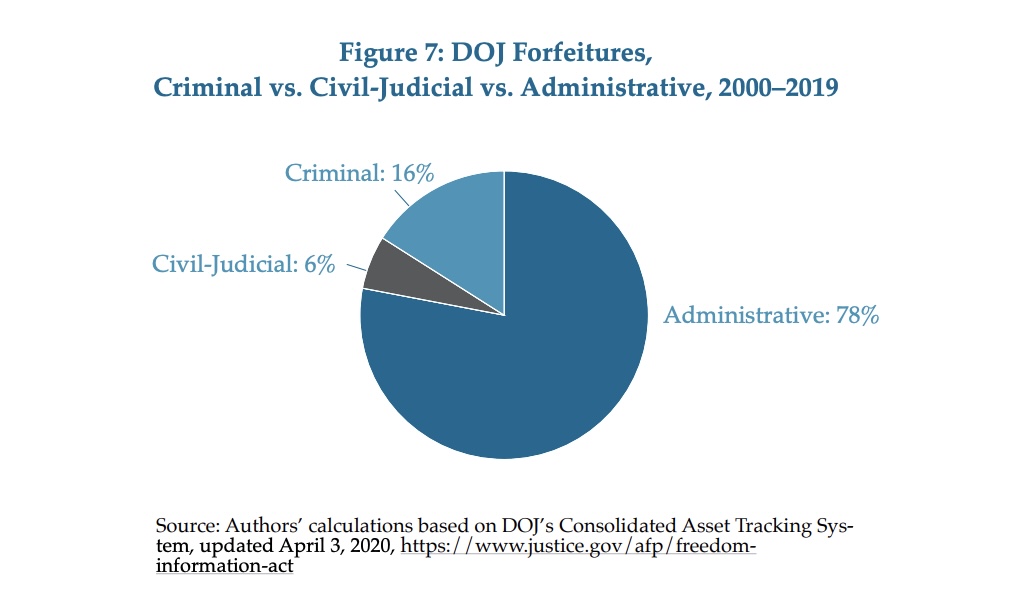

The DOJ recommended this course of for selling an “environment friendly allocation of presidency sources” whereas discouraging “undue burdens on the federal judicial system.” Actually, this course of appears to be the DOJ’s most popular follow provided that administrative forfeitures made up 78 p.c of its forfeitures between 2000 and 2019.

With the IRS amassing huge quantities of latest data on Individuals’ cryptocurrency use, it’s doable that the DOJ might “abruptly” discover huge new arenas for cryptocurrency confiscation. And once more, it’s necessary to emphasize that these confiscations don’t have to start out with an precise crime being dedicated—simply the mere suspicion.

Given how usually misunderstandings surrounding cryptocurrency have fueled headlines, it’s not troublesome to think about how such suspicions might emerge. For instance, it was lower than a month in the past that greater than 100 members of Congress cited a flawed report to name for a crackdown on cryptocurrency.

Contemplating the IRS proposal on this mild helps to showcase one of many main dangers of mass knowledge assortment. Whether or not it’s the DOJ searching for to increase its confiscation actions, the IRS seeking to enhance audits, or a hacker searching for out an exploit, huge authorities databases create tempting targets for each inner and exterior abuse.

If the IRS pushes ahead with its proposal, cryptocurrency customers ought to preserve a cautious eye on how that knowledge is in the end utilized by the federal government at giant.

Nicholas Anthony is a coverage analyst on the Cato Institute’s Heart for Financial and Monetary Options. He’s the creator of The Infrastructure Funding and Jobs Act’s Assault on Crypto: Questioning the Rationale for the Cryptocurrency Provisions and The Proper to Monetary Privateness: Crafting a Higher Framework for Monetary Privateness within the Digital Age.

This text is for common data functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the creator’s alone and don’t essentially mirror or symbolize the views and opinions of Cointelegraph.

[ad_2]

Source link