Bitcoin (BTC) has been buying and selling inside a slender 4.5% vary over the previous two weeks, indicating a degree of consolidation across the $34,700 mark.

Regardless of the stagnant costs, the 24.2% beneficial properties since Oct. 7 instill confidence, pushed by the approaching results of the 2024 halving and the potential approval of a Bitcoin spot exchange-traded fund (ETF) in the US.

Buyers fear in regards to the bearish international financial outlook

Bears anticipate additional macroeconomic knowledge supporting a world financial contraction because the U.S. Federal Reserve holds their rate of interest above 5.25% in an effort to curb inflation. As an illustration, on Nov. 6, China exports shrank 6.4% from a yr earlier in October. Moreover, Germany reported October industrial manufacturing down 1.4% versus prior month on Nov. 7.

The weaker international financial exercise has led to WTI oil costs dipping beneath $78 for the primary time since late July, regardless of the potential for provide cuts from main oil producers. Remarks by U.S. Federal Reserve Financial institution of Minneapolis President Neel Kashkari on Nov. 6 has set a bearish tone, prompting a 'flight-to-quality' response.

Kashkari acknowledged:

“ We haven’t fully solved the inflation downside. We nonetheless have extra work forward of us to get it completed."

Buyers have sought refuge in U.S. Treasuries, ensuing within the 10-year be aware yield dropping to 4.55%, its lowest degree in six weeks. Curiously, the S&P 500 inventory market index has reached 4,383 factors, its highest degree in almost seven weeks, defying expectations throughout a world financial slowdown.

This phenomenon will be attributed to the truth that the corporations throughout the S&P 500 collectively maintain $2.6 trillion in money and equivalents, providing some safety as rates of interest stay excessive. Regardless of growing publicity to main tech firms, the inventory market gives each shortage and dividend yield, aligning with investor preferences throughout occasions of uncertainty.

In the meantime, Bitcoin's futures open curiosity has reached its highest degree since April 2022, standing at $16.3 billion. This milestone beneficial properties much more significance because the Chicago Mercantile Alternate (CME) solidifies its place because the second-largest marketplace for BTC derivatives.

Wholesome demand for Bitcoin choices and futures

Latest use of Bitcoin futures and choices have made media headlines. The demand for leverage is probably going fueled by what buyers imagine are the 2 most bullish catalyst for 2024: the potential for a spot BTC ETF and the Bitcoin halving.

One strategy to gauge market well being is by analyzing the Bitcoin futures premium, which measures the distinction between two-month futures contracts and the present spot value. In a strong market, the annualized premium, often known as the premise charge, ought to usually fall throughout the 5% to 10% vary.

Discover how this indicator has reached its highest degree in over a yr, at 11%. This means a robust demand for Bitcoin futures primarily pushed by leveraged lengthy positions. If the alternative have been true, with buyers closely betting on Bitcoin's value decline, the premium would have remained at 5% or decrease.

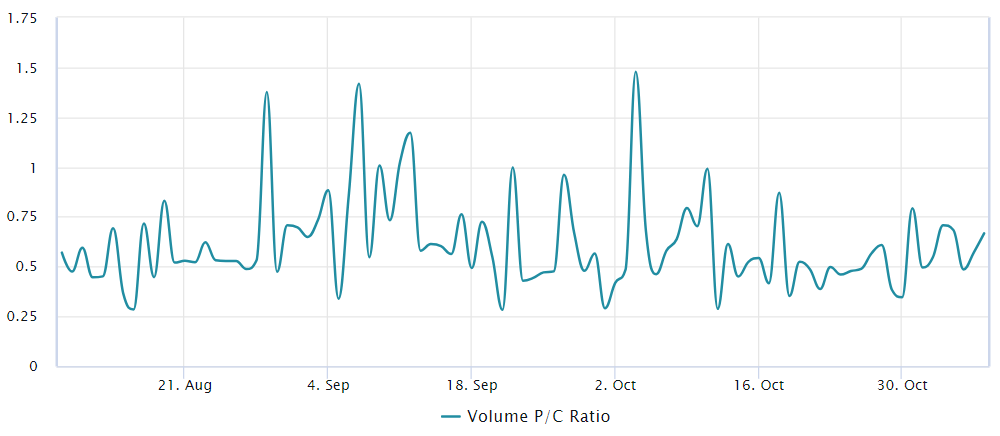

One other piece of proof will be derived from the Bitcoin choices markets, evaluating the demand between name (purchase) and put (promote) choices. Whereas this evaluation does not embody extra intricate methods, it affords a broad context for understanding investor sentiment.

Associated: Bitcoin Ordinals see resurgence from Binance listing

Over the previous week, this indicator has averaged 0.60, reflecting a 40% bias favoring name (purchase) choices. Apparently, Bitcoin choices open curiosity has seen a 51% improve over the previous 30 days, reaching $15.6 billion, and this development has additionally been pushed by bullish devices, as indicated by the put-to-call quantity knowledge.

As Bitcoin's value reaches its highest degree in 18 months, some extent of skepticism and hedging is likely to be anticipated. Nevertheless, the present circumstances within the derivatives market reveal wholesome development with no indicators of extreme optimism, aligning with the bullish outlook focusing on $40,000 and better costs by year-end.

This text is for common info functions and isn't supposed to be and shouldn't be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the writer’s alone and don't essentially replicate or signify the views and opinions of Cointelegraph.