[ad_1]

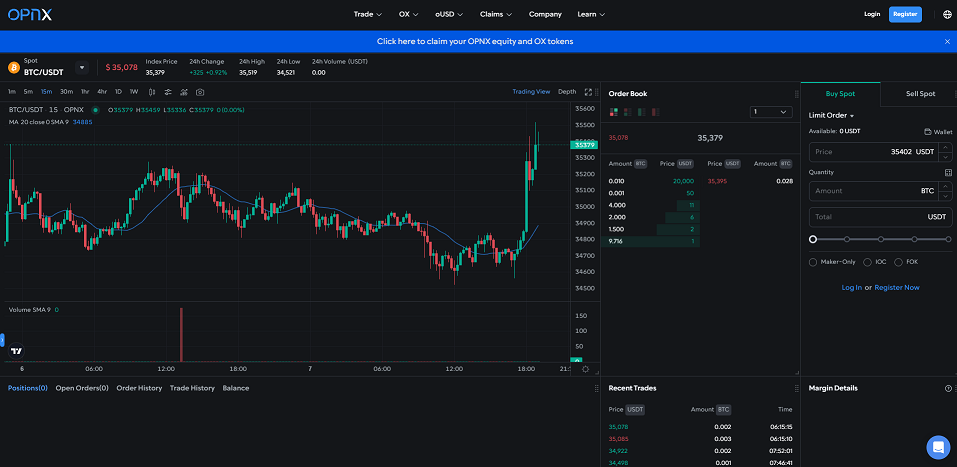

Crypto change OPNX has obtained a digital asset service supplier license (VASP) in Lithuania, permitting it to supply spot crypto change providers all through the European Union, in response to a Nov. 8 announcement seen by Cointelegraph.

The announcement said that this license would require the change to “adhere to the very best requirements of compliance and safety.” The workforce claims they’ve already carried out a “sturdy” Know Your Buyer and Anti-Cash Laundering system to make sure they adjust to EU rules.

“Securing the VASP license from Lithuanian authorities is a big milestone in OPNX’s worldwide enlargement and our mission to serve crypto customers throughout the globe,” mentioned OPNX CEO Leslie Lamb.

In a dialog with Cointelegraph, Lamb clarified that some OPNX providers should still be unavailable in some jurisdictions throughout the EU. “This license offers us the power to service the European area, however there are particular jurisdictions throughout the EU that do require particular licenses as effectively in an effort to function sure providers,” she said, including that OPNX is presently trying to accumulate these licenses. Nevertheless, the present license will permit OPNX to supply spot buying and selling providers all through the EU, with different providers turning into out there as additional licenses are acquired.

Associated: 3AC founders’ OPNX exchange claims to be funded by AppWorks, SIG

OPNX has been a controversial change since its inception. It was based by Kyle Davies and Su Zhu, who additionally based bankrupt crypto hedge fund Three Arrows Capital (3AC), together with Mark Lamb and Sudhu Arumugam, who based bankrupt crypto change CoinFLEX. Due to its affiliation with these prior bankruptcies, OPNX critics have claimed the exchange is unsafe to use. Nevertheless, the change claims that it’s serving to chapter collectors by allowing them to sell bankruptcy claims and receives a commission quicker.

[ad_2]

Source link