[ad_1]

Crypto agency Bakkt seems to be returning to digital asset custody as its major enterprise, adding help for six new cash, in line with an announcement on Nov. 15.

Except for Bitcoin (BTC) and Ethereum (ETH), Bakkt will increase its custodial help to incorporate Bitcoin Money (BCH), Dogecoin (DOGE), Ethereum Traditional (ETC), Litecoin (LTC), Shiba Inu (SHIB), and USD Coin (USDC). The corporate expects so as to add extra cash to its custodial companies early subsequent yr.

The custody of digital property focuses on the safeguarding of cryptographic keys, that are essential for accessing and transferring property. Varied safety measures are employed by custodians, resembling Bakkt, to guard property, together with chilly storage of cash and multi-signature know-how that calls for a number of approvals for entry.

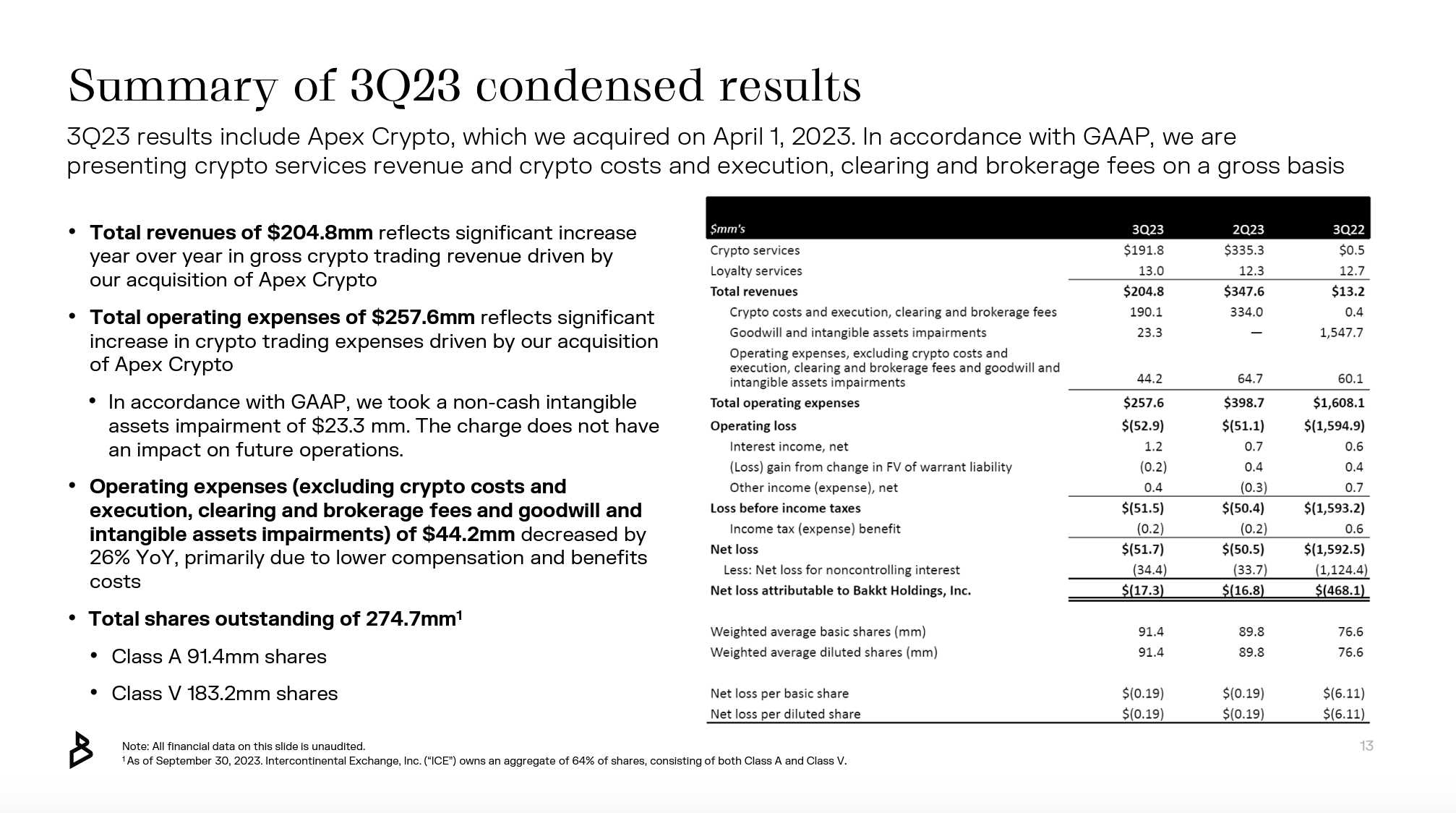

The announcement follows Bakkt’s launch of its quarterly earnings report on Nov. 14, when the corporate disclosed an adjusted EBITDA loss (non-GAAP) of $21.6 million, a 30% lower year-over-year attributable to a discount in compensation and advantages.

In line with the report, Bakkt has seen its crypto income attain $191.8 million within the third quarter of 2023 because of the acquisition of Apex Crypto in April. Over the quarter, the corporate generated a complete of $204.8 million in whole income. By way of property underneath custody, Bakkt reported $505.7 million, a lower of 28% over final yr.

To strengthen its crypto custody arm, Bakkt can be growing partnerships. In line with the corporate’s quarterly report, it plans to supply clearing and custodial companies for the Wall Avenue-backed crypto exchange EDX Markets, initially serving as a back-up certified custodian. Amongst Bakkt’s new purchasers on custodial companies are Bitcoin platform Unchained and LeboBTC, a crypto consulting agency for institutional buyers.

“The occasions of the previous yr have revealed why certified crypto custody is so vital,” stated in a press release Gavin Michael, CEO of Bakkt.

Increasing custody companies can be an necessary facet of Bakkt’s technique for concentrating on business-to-business (B2B) purchasers. In February, the corporate introduced that it might sunset its consumer-facing app launched in 2021 with a view to deal with establishments amid the crypto winter.

The custody of digital property can be being focused by many conventional monetary establishments. Final yr, BNY Mellon, the oldest financial institution in the USA, launched a digital custody platform to safeguard ETH and BTC holdings for chosen purchasers. DZ Financial institution, Germany’s third-largest financial institution, has additionallybegun offering crypto custody to institutional buyers earlier this month.

Journal: Ethereum restaking — Blockchain innovation or dangerous house of cards?

[ad_2]

Source link