[ad_1]

To navigate the method of shopping for Bitcoin successfully, it’s important to discover safe choices. In the UK, buying cryptocurrencies is authorized, but it could actually pose challenges, as the federal government underscores the necessity to comprehend the related dangers.

For an efficient traversal of the crypto panorama, traders ought to comply with key steps, together with choosing the proper crypto alternate or dealer, organising a safe pockets and making knowledgeable choices relating to funds and orders.

This text examines methods to buy Bitcoin (BTC) and Ether (ETH) within the U.Ok. whereas providing data on authorized concerns, safe storage choices, cryptocurrency exchanges and brokers for easy market navigation.

Is it authorized to purchase Bitcoin and Ether within the U.Ok.?

Whereas the authorized standing of cryptocurrencies varies from one nation to a different, shopping for Bitcoin (BTC) and Ether (ETH) is completely authorized within the U.Ok., with a well-defined regulatory framework in place. Cryptocurrencies are categorized as taxable belongings by His Majesty’s Income and Customs (HMRC), and they’re topic to taxation.

Buying Bitcoin and Ether within the U.Ok. triggers the tax reporting and cost obligations related to cryptocurrency transactions. As such, sustaining correct data is essential for people planning to buy BTC and ETH in the UK. This ensures compliance with tax laws for each crypto beneficial properties and crypto losses.

It’s essential to notice that within the U.Ok., cryptocurrencies will not be acknowledged as authorized tender just like the British pound. This regulatory method to cryptocurrencies helps to foster innovation and promote consciousness of related dangers, making a clear, authorized atmosphere for purchasing, promoting and holding Bitcoin and Ether.

In October 2023, the Financial Conduct Authority (FCA) expanded its regulatory oversight to incorporate crypto asset promotions within the U.Ok., emphasizing compliance with correct data and danger warnings. Moreover, beginning in September 2023, the Travel Rule mandates that U.Ok.-based crypto asset companies are required to gather, confirm and share data on transfers, which impacts the pseudonymous nature of cryptocurrencies.

Regardless of trade engagement, some market gamers have exited the U.Ok., highlighting the significance of adhering to guidelines and laws when utilizing exchanges to purchase cryptocurrencies.

Safe pockets practices to safeguard Bitcoin and Ether holdings

Previous to delving into Bitcoin and Ether investments, it’s important to have a safe crypto pockets, obtainable in numerous varieties. Whereas leaving holdings on an alternate account is handy for small portions, transitioning to a safer storage answer could be an possibility for these traders who wish to retailer bigger quantities of tokens.

Furthermore, it’s essential to keep in mind that retaining funds on an alternate means missing management over the keys and, consequently, forfeiting management over the cash, emphasizing the significance of securing non-public keys for the complete management and possession of digital belongings.

Bitcoin wallets, together with {hardware}, software program and paper choices, are used to securely handle and retailer Bitcoin holdings, whereas Ethereum wallets act as safe repositories for ETH, offering management over belongings and facilitating transactions.

Cryptocurrency customers depend on Bitcoin and Ether wallets to safeguard and management their digital belongings, making certain the secure management of private keys important for accessing and managing their holdings.

Associated: A beginner’s guide to filing cryptocurrency taxes in the US, UK and Germany

To scale back danger, an investor can improve safety by transferring their cryptocurrency from an alternate’s default pockets to their very own chilly pockets, which isn’t on-line and thus much less vulnerable to hacking.

It’s price noting that these wallets don’t retailer investor’s cryptocurrencies per se; as an alternative, they safeguard the non-public keys needed for accessing the pockets’s deal with and authorizing transactions. Shedding these digital keys means forfeiting entry to Bitcoin and Ether holdings.

Shopping for Bitcoin and Ether within the U.Ok. by way of crypto exchanges

Buyers want to decide on a dealer or cryptocurrency alternate earlier than they’ll buy cryptocurrencies. Though each allow cryptocurrency purchases within the U.Ok., it’s essential to notice some important distinctions between them. As a result of rising chance of hacks within the cryptocurrency house, selecting the very best cryptocurrency alternate or dealer is usually a difficult course of, with safety being the principle precedence.

Select a crypto alternate

Within the U.Ok., crypto belongings and crypto exchanges function with out formal regulation, however the Monetary Conduct Authority (FCA) mandates registration for crypto exchanges inside the nation. Notably, some crypto exchanges resembling Gemini, Bitpanda, Kraken and Crypto.com are efficiently registered with the FCA.

Given the intense volatility and absence of government-backed safety for cryptocurrency investments, exercising warning and acknowledging the speculative nature of cryptocurrencies is important, even when coping with FCA-authorized and controlled suppliers. To boost safety, an investor also can diversify their digital forex holdings throughout a number of exchanges to mitigate the danger of a single alternate failure.

When selecting a crypto alternate, examine for BTC and ETH availability, but additionally guarantee there’s substantial each day buying and selling quantity to ensure satisfactory liquidity for easy transactions in each cryptocurrencies and fiat forex. Additionally, be careful for charges that may have an effect on returns, particularly for high-frequency merchants, and make sure the alternate affords desired buying and selling sorts resembling restrict orders and margins.

In response to up to date regulatory tips from the FCA and the expanded parameters of the Regime of Monetary Promotions, CEX.IO and Binance announced in 2023 that that they had suspended onboarding new U.Ok.-based shoppers. Due to this fact, verifying an alternate’s availability within the U.Ok. and compliance with regulatory adjustments is important for knowledgeable decision-making.

Select a cryptocurrency dealer

Cryptocurrency brokers, resembling interactive brokers and eToro, simplify the crypto shopping for course of with user-friendly interfaces that work together with exchanges for traders. Whereas some cryptocurrency brokers cost larger charges, others provide their companies without cost however revenue by promoting merchants’ knowledge or executing consumer trades at suboptimal market costs.

Whereas brokers provide comfort, they might restrict the switch of cryptocurrency holdings from their buying and selling platforms. This restriction is usually a concern for traders searching for enhanced safety by way of crypto wallets, together with {hardware} wallets disconnected from the web. Nevertheless, brokers can prohibit traders from shifting their crypto holdings to exterior wallets.

Resolve on a cost possibility

After deciding on a cryptocurrency dealer or alternate, traders can signal as much as open an account and fund it by way of choices like linking a checking account or utilizing debit or bank cards, although the latter could incur excessive charges.

Upon creating an account and deciding on a cost methodology, identification verification is obligatory. For instance, the submission of an identification doc and proof of deal with is a standard requirement in the UK. Buyers may encounter a crypto danger consciousness quiz. Relying on the dealer or alternate, there could be a wait of some days earlier than the deposited funds can be utilized to purchase cryptocurrency.

Place an order

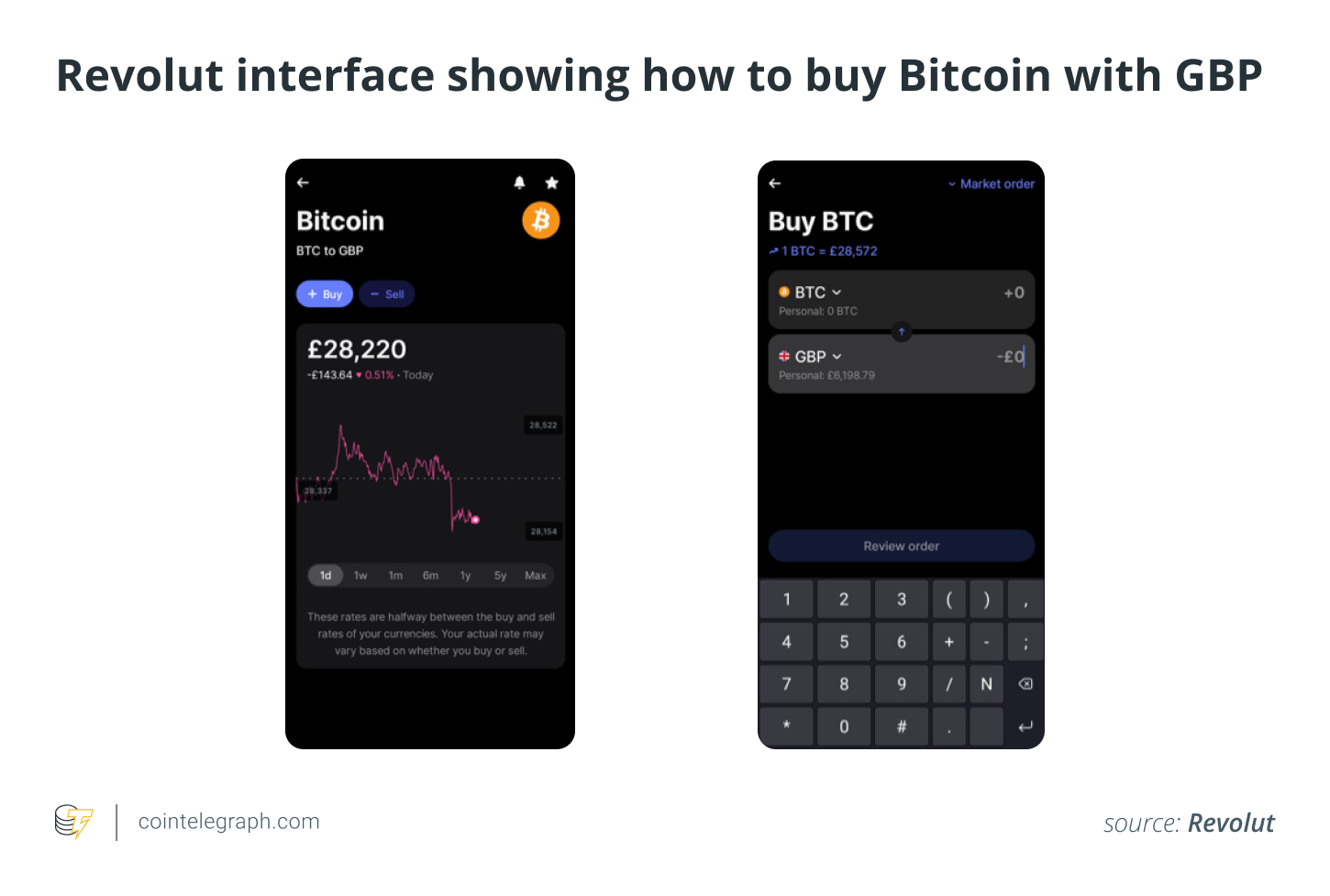

After funding their account, traders can proceed to position their order for buying Bitcoin or Ether by coming into the specified quantity in kilos. The method varies by alternate; some have an easy “Purchase” button for BTC and ETH, which prompts customers to enter the specified quantity.

Most exchanges allow the acquisition of fractional cryptocurrency shares, making it possible to personal parts of higher-priced tokens like Bitcoin or Ethereum that will sometimes require important funding.

Retailer Bitcoin and Ether

As beforehand famous, cryptocurrency exchanges run the extra danger of theft or hacking and will not be protected by the Monetary Companies Compensation Scheme of the UK. If cryptocurrency house owners misplace or neglect their non-public keys or restoration phrases, they may forfeit their total funding.

When buying cryptocurrency on a crypto alternate, it’s sometimes retained in a pockets linked to the alternate. If desired, traders can retailer or withdraw Bitcoin and Ether to a selected exterior pockets for added safety. Nevertheless, traders buying cryptocurrency by way of a dealer may not have a lot management over the place it’s saved.

If an investor is fascinated with transferring their digital forex to a securer place or doesn’t just like the supplier the alternate collaborates with, they might transfer it off the alternate and into an impartial hot or cold wallet. Relying on the alternate and the overall quantity of a switch, traders could also be required to pay a small cost to be able to accomplish this.

Cryptocurrency ATMs

Crypto ATMs have been showing in cities all around the world; nevertheless, in February 2023, the FCA imposed a ban on cryptocurrency ATMs and urged operators to shut down their machines or face enforcement actions.

The FCA warns that utilizing these machines is dangerous, as they function unlawfully and supply no safety in case of points, and communication with operators is commonly difficult. The FCA goals to maintain cautioning the general public and taking enforcement measures towards unregistered crypto ATM operators.

Crypto exchange-traded funds (ETFs): An alternative choice to straight holding Bitcoin and Ether

Exchange-traded funds (ETFs) present diversified publicity to a number of holdings inside a single funding, together with cryptocurrencies like Bitcoin and Ether. Funding trusts pool traders’ funds by way of the sale of a set variety of shares, which can have some preliminary trust-related challenges upon launch. This construction supplies instantaneous diversification and reduces danger in comparison with selecting particular person investments.

Buyers can now entry a number of cryptocurrencies concurrently by way of numerous companies. ETF suppliers resembling Goal Investments and VanEck provide alternatives for traders to interact within the crypto market.

Different strategies to purchase Bitcoin and Ether within the U.Ok.

A number of U.Ok. banking and monetary apps, resembling PayPal, Revolut, Skrill and MoonPay, have launched the power for patrons to buy Bitcoin and Ether straight on their platforms. To buy shares in firms which might be publicly listed, they are going to require an internet account.

Nevertheless, it’s price noting that JPMorgan’s U.Ok. financial institution, Chase, took a special stance in October 2023 by prohibiting cryptocurrency transactions for its British clients as a consequence of a notable enhance in fraud and scams, together with faux investments and misleading movie star endorsements.

Moreover, payment processors, resembling BitPay, can be utilized to purchase BTC and ETH. As soon as linked, customers can provoke transactions by way of the cost processor, changing fiat forex into Bitcoin or Ether.

Furthermore, within the U.Ok., merchants can make the most of peer-to-peer (P2P) crypto platforms, resembling Cash App and Paxful, to commerce digital belongings, though the federal government emphasizes the dangers related to these belongings. P2P platforms allow direct cryptocurrency transactions between people and are a prevalent technique of buying digital currencies in the UK. Nevertheless, it’s essential to remember that U.Ok. traders have restricted authorized protections within the occasion of platform insolvency.

[ad_2]

Source link