[ad_1]

Bitcoin (BTC) held momentum at $38,000 on Nov. 29 as evaluation warned over market corrections.

Bitcoin meets macro knowledge, Fed’s Powell at key value level

Information from Cointelegraph Markets Pro and TradingView confirmed BTC value trajectory persevering with to goal for brand new 18-month highs.

After matching present highs the day prior, the biggest cryptocurrency stunned by protecting a grip on greater ranges as futures markets hit $39,000.

Already a topic of debate, the thrill on derivatives led some to warning that large-volume merchants may nonetheless depart late lengthy positions stranded on the high.

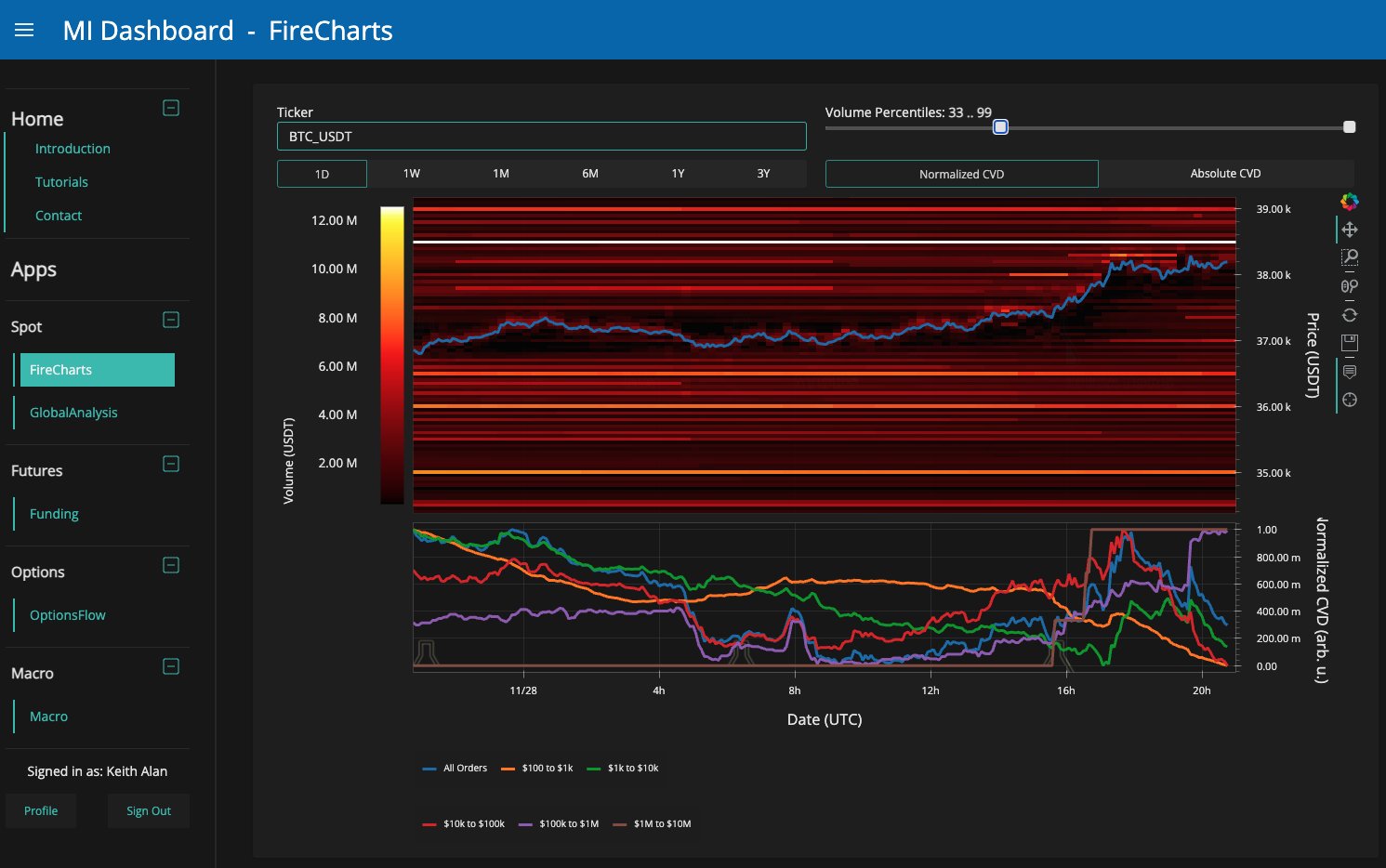

In commentary in a single day, Keith Alan, co-founder of monitoring useful resource Materials Indicators, informed merchants to be cautious of those “whale video games.”

“Earlier in the present day, some ask liquidity at $38k was pulled to open the door to $38.5k. Don’t permit your self to suppose that was a pleasant whale supplying you with enhance. That was a Killer Whale attempting to FOMO you in,” he wrote in regards to the preliminary journey previous $38,000.

Alan continued that phrases due Dec. 1 from Jerome Powell, chair of america Federal Reserve, might present an exterior BTC value catalyst that would even deliver $40,000 into play.

Whales, nevertheless, can be spying on a key degree at which to dump.

“My assumption is that they are going to proceed to take action till there is sufficient to dump into,” he forecast.

“That doesn’t imply that # JPow’s speech can’t be the catalyst that sends value previous $40k, particularly as we see bid liquidity coming in above $37.5k, however when you aren’t ready to comb the native lows between from time to time you haven’t been taking note of how these Whale Video games are likely to play out.”

An accompanying chart confirmed order e book sell-side liquidity concentrated at $38,500 — a degree but to be challenged on the time of writing.

Others remained assured that additional short-term upside was attainable and even probably.

Analyzing present market composition, standard dealer Skew concluded that quantity was all that was lacking for a breakout towards the $40,000 watershed.

$BTC 4H Replace

Pattern nonetheless revered & clear HL precisely the place I anticipated it to happen ($36.7K)Simply want the HH now & quantity supported break of $38K – $40K resistance https://t.co/iPPGzVIbFF pic.twitter.com/SQtKwvBdz0

— Skew Δ (@52kskew) November 29, 2023

Ackman bets on Q1 Fed price minimize

As Cointelegraph reported, previous to Powell’s speech, key U.S. macro knowledge will lend extra weight to Fed policy.

Associated: Bitcoin metric that ‘looks into future’ eyes $48K BTC price around ETF

This comes within the type of Q3 GDP and the October print of the Private Consumption Expenditures Index on Nov. 29 and Nov. 30, respectively.

Beforehand, inflation abating quicker than expectations led markets to imagine that no additional rate of interest hikes would happen on the December assembly of the Federal Open Market Committee.

Talking to Bloomberg on Nov. 28, Invoice Ackman, CEO and founding father of hedge fund Pershing Sq. Capital Administration, acknowledged that the Fed might need no alternative however to pivot on charges in the beginning of 2024.

“I feel they’re going to chop charges; I feel they’re going to chop charges prior to individuals anticipate,” he mentioned.

Ackman continued that not slicing charges “fairly quickly” would improve the danger of a so-called exhausting touchdown for the U.S. financial system as inflation tails off.

“I feel the market expects someday in the midst of subsequent yr; I feel it’s extra probably, most likely, as early as Q1,” he predicted.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link