Bitcoin (BTC) hit $39,000 for the primary time since mid-2022 on Dec. 1 as the USA Federal Reserve boosted hopes of coverage easing.

Powell: Calling finish to hikes could be "untimely"

Information from Cointelegraph Markets Pro and TradingView confirmed a brand new 19-month BTC value excessive of $39,000 on Bitstamp.

Bitcoin bulls, already in a powerful place, beat out resistance as Fed Chair Jerome Powell took to the stage at Spelman Faculty in Atlanta, Georgia for a scheduled look.

“The FOMC is strongly dedicated to bringing inflation all the way down to 2% over time and to holding coverage restrictive till we’re assured that inflation is on a path to that goal,” he said in ready remarks.

“It might be untimely to conclude with confidence that now we have achieved a sufficiently resitrive stance, or to invest on when coverage may ease.”

Whereas holding his tone cautious, Powell appeared to spice up threat asset sentiment along with his feedback on the present state of the U.S. financial system and progress towards decreasing inflation.

Reacting, monetary commentary useful resource The Kobeissi Letter was amongst these with a extra sober tackle what the Fed may do in future.

“Their narrative has not modified since final 12 months, however markets proceed to name for a Fed pivot,” it wrote in a part of a publish on X (previously Twitter.)

“As now we have acknowledged earlier than, the Fed would somewhat spark a gentle recession than threat a resurgence of inflation. Which means that a protracted PAUSE remains to be possible.”

Bitcoin nonetheless took full benefit of the temper, contrasting with a flat response to the week’s earlier U.S. macro information prints.

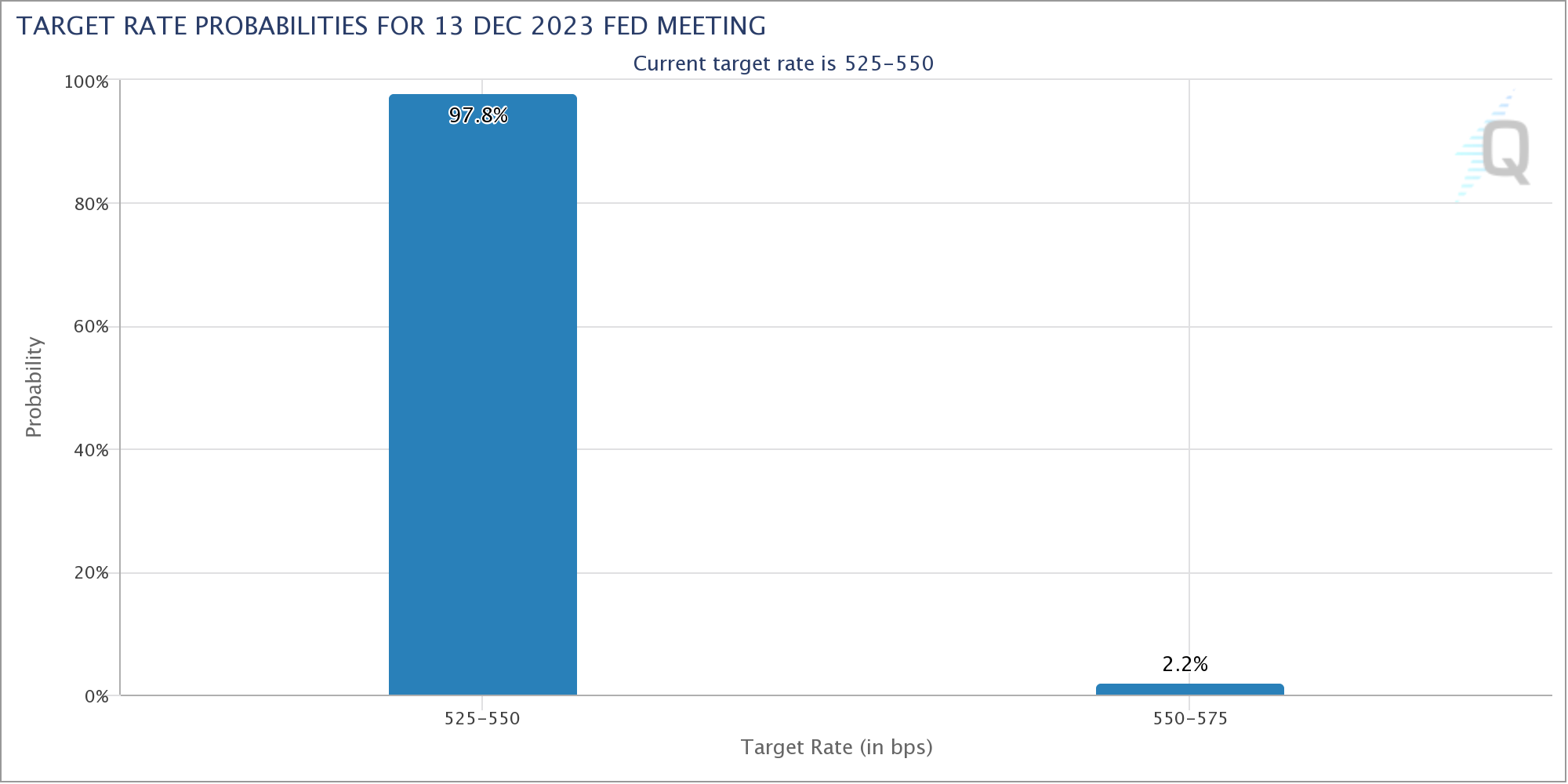

As Cointelegraph reported, the subsequent assembly of the Federal Open Market Committee, or FOMC, is due in mid-December, when any modifications to rates of interest will probably be introduced. Per information from CME Group’s FedWatch Tool, as of Dec. 1, market expectations unilaterally favored a pause in hikes.

BTC value targets prolong past $39,00

Turning to Bitcoin markets, in style dealer Daan Crypto Trades revealed the dimensions of sell-side liquidity concerned within the temporary journey to $39,000.

Associated: ‘Buy the rumor, sell the news’ — Bitcoin ETF may spark TradFi sell-off

#Bitcoin That took actually 2 minutes ✅ https://t.co/JOwOVA3U4S pic.twitter.com/ii8CCoMchW

— Daan Crypto Trades (@DaanCrypto) December 1, 2023

Keith Alan, co-founder of buying and selling useful resource Materials Indicators, in the meantime uploaded a snapshot of BTC/USDT order e book liquidity to X following Powell’s speech.

This confirmed $39,000 and $39,200 remaining as important resistance overhead, whereas the closest substantial purchaser help lay at $38,000.

“I strongly imagine that immediately we'll lastly shut above $38K. A day by day shut above $38K is a robust sign of a god candle,” fellow in style dealer BitQuant forecast earlier on the day.

Daan Crypto Trades added that Bitcoin appeared to be "leaving its earlier buying and selling vary in the interim," whereas for Crypto Ed, founding father of buying and selling and coaching group CryptoTA, predicted upside taking Bitcoin to "at the least" $39,200 subsequent.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.