[ad_1]

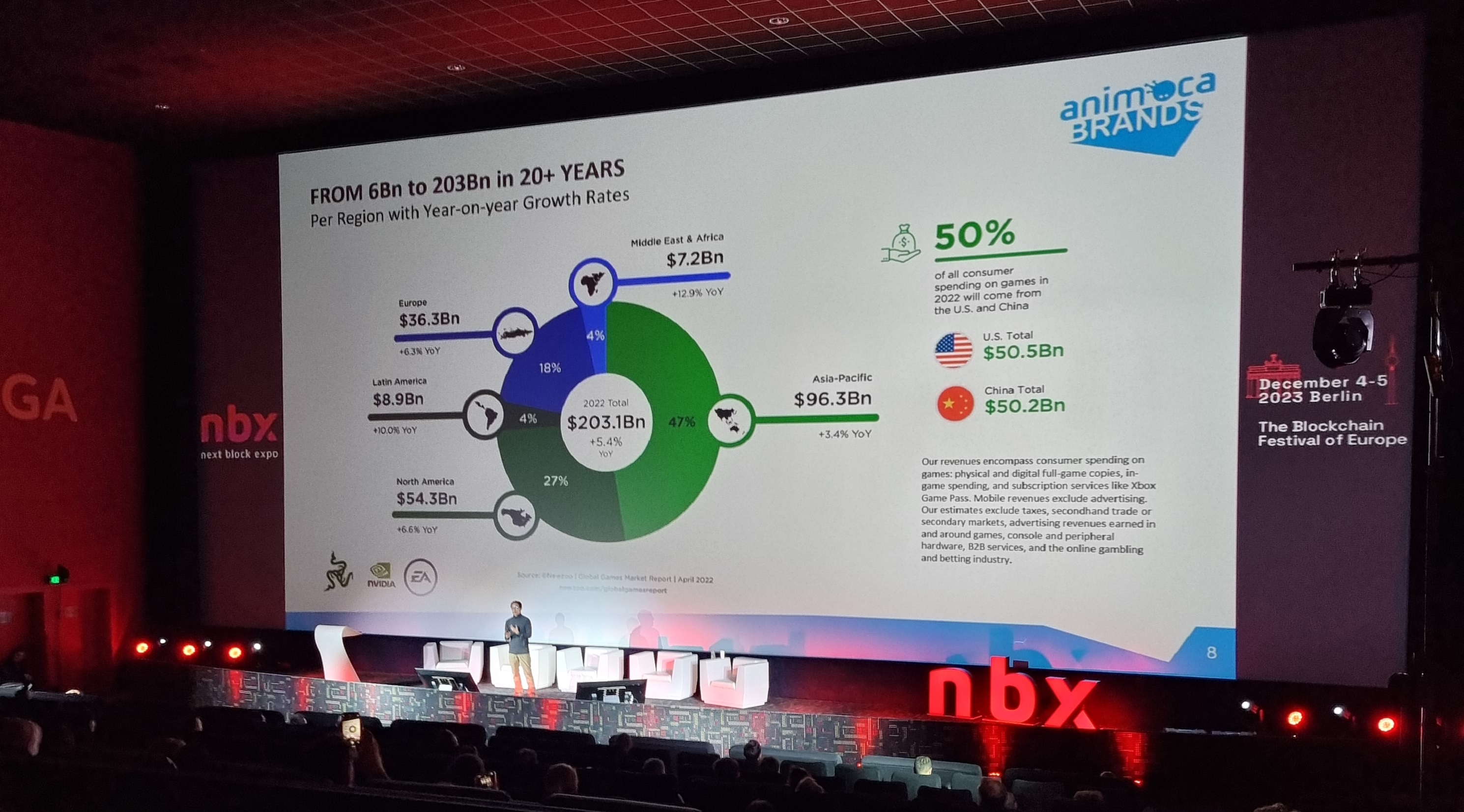

Animoca Manufacturers co-founder Yat Siu is assured that numerous investments and partnerships might show fruitful in 2024 as mainstream institutional curiosity in Bitcoin gathers a head of steam.

Talking completely to Cointelegraph on the Subsequent Block Expo occasion in Berlin, the chairman of the gaming enterprise capital agency highlights some 70 investments made in 2023 which can be anticipated to ship outcomes subsequent 12 months.

Related: Animoca eyes SportFi ecosystem, becomes Chiliz Chain validator

Chief amongst these is a high-profile partnership with The Open Community (TON) blockchain which was announced on Nov. 28. Siu confirmed that the funding concerned the acquisition of an undisclosed quantity of Toncoin, which was then staked as a part of the validator settlement:

“We truly suppose that is a instrument for mass onboarding with TON pockets. There are 800 million customers on Telegram utilizing TON. What’s to not be enthusiastic about?”

Siu additionally notes that Animoca’s acquisition of social informal gaming platform Gamee in July 2020 is ready to capitalize on its rising presence as a gaming platform on Telegram. He provides that the acquisition was hampered by an incapacity to monetize video games by means of the messaging utility.

“There have been no promoting and in-app purchases, and nothing was allowed in Telegram till just lately with the combination of TON. So now they’re commercially viable,” Siu explains.

Whereas Gamee is just not but totally built-in into Telegram, the appreciation of its native $GMEE token is a robust indicator of “GameFi pleasure and its potential on Telegram”.

Animoca additionally has a vested curiosity within the wider efficiency of metaverse tasks and nonfungible tokens (NFTs). Siu says the NFT market is recovering because of long-term holders who positioned worth within the respective tasks and the basics backing them:

“Most of the traditional speculators are gone, or there aren’t as many as a result of they did not suppose they might make a lot cash and since all of them declared NFTs lifeless.”

He provides that the variety of NFTs from varied high-profile collections available for purchase in the marketplace is “sometimes now in single digit proportion.” That is in stark distinction to the bull market of 2021, the place greater than half of a given assortment was listed on the market on NFT marketplaces.

Related: Web3 gaming investors more ‘choosy’ in crypto winter — Animoca’s Robby Yung

Macro components additionally give Siu cause to be bullish as 2024 looms on the horizon. He factors to the constructing anticipation round Bitcoin spot exchange-traded funds within the U.S., the tip of Sam Bankman-Fried’s criminal trial and Binance’s $4.3 billion settlement with the American authorities as key causes for constructive sentiment going into the brand new 12 months:

“Frankly, even the Binance chapter to me has been an exquisite conclusion. In some methods, we now have readability for 2024.”

The potential approval of a number of Bitcoin ETFs touted to happen early within the new 12 months provides to the robust basis, in line with Siu. The recent liquidation of $60 million of BTC quick positions additionally alleviates downward stress on the markets.

Magazine: NFT collapse and monster egos feature in new Murakami exhibition

[ad_2]

Source link