Bitcoin (BTC) has gained a brand new generatio of “hodler” prior to now three years as cussed buyers refuse to promote.

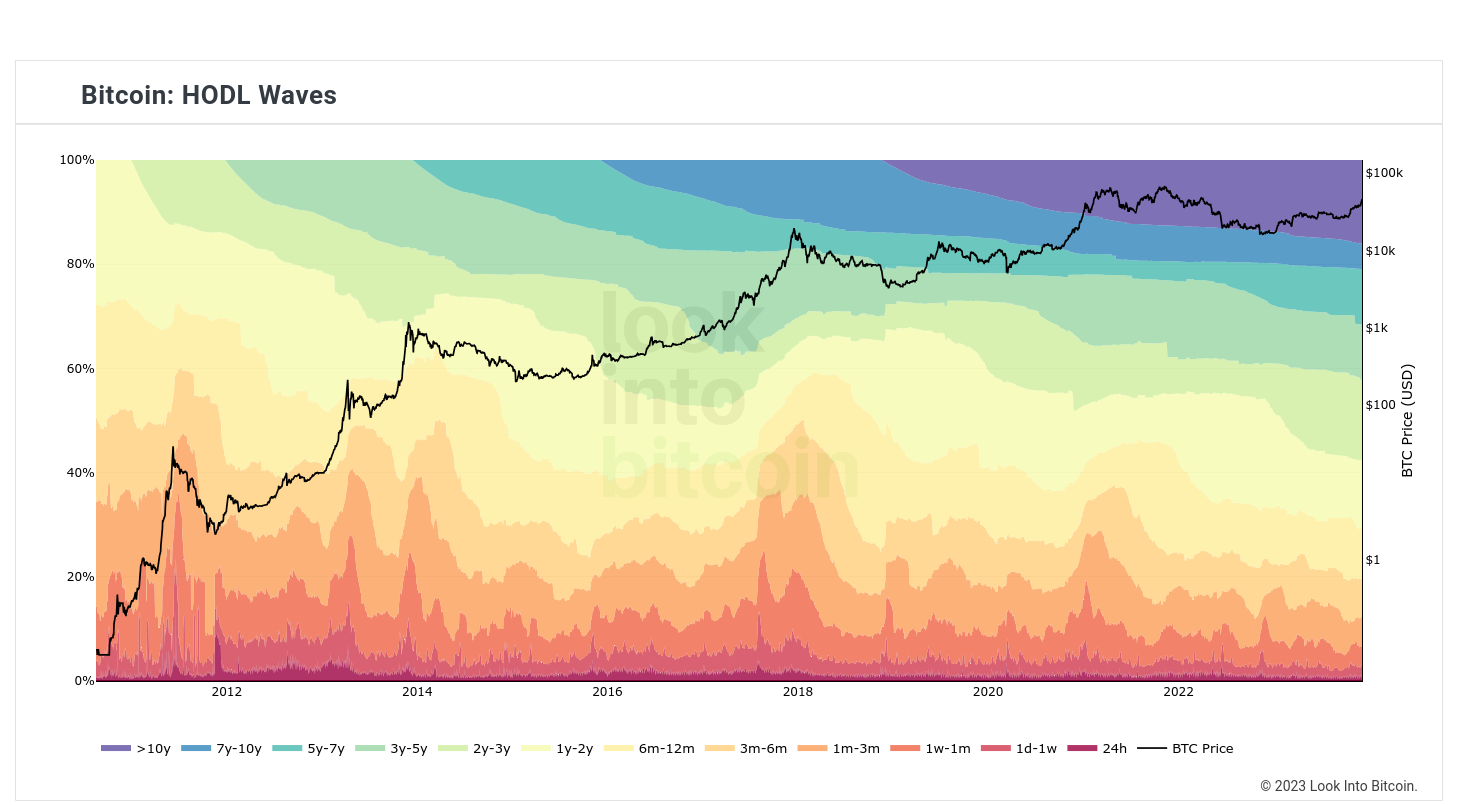

Information from the favored HODL Waves metric exhibits that those that purchased Bitcoin in late 2020 are nonetheless sitting on their cash.

BTC value ought to go "means increased" for hodlers to promote

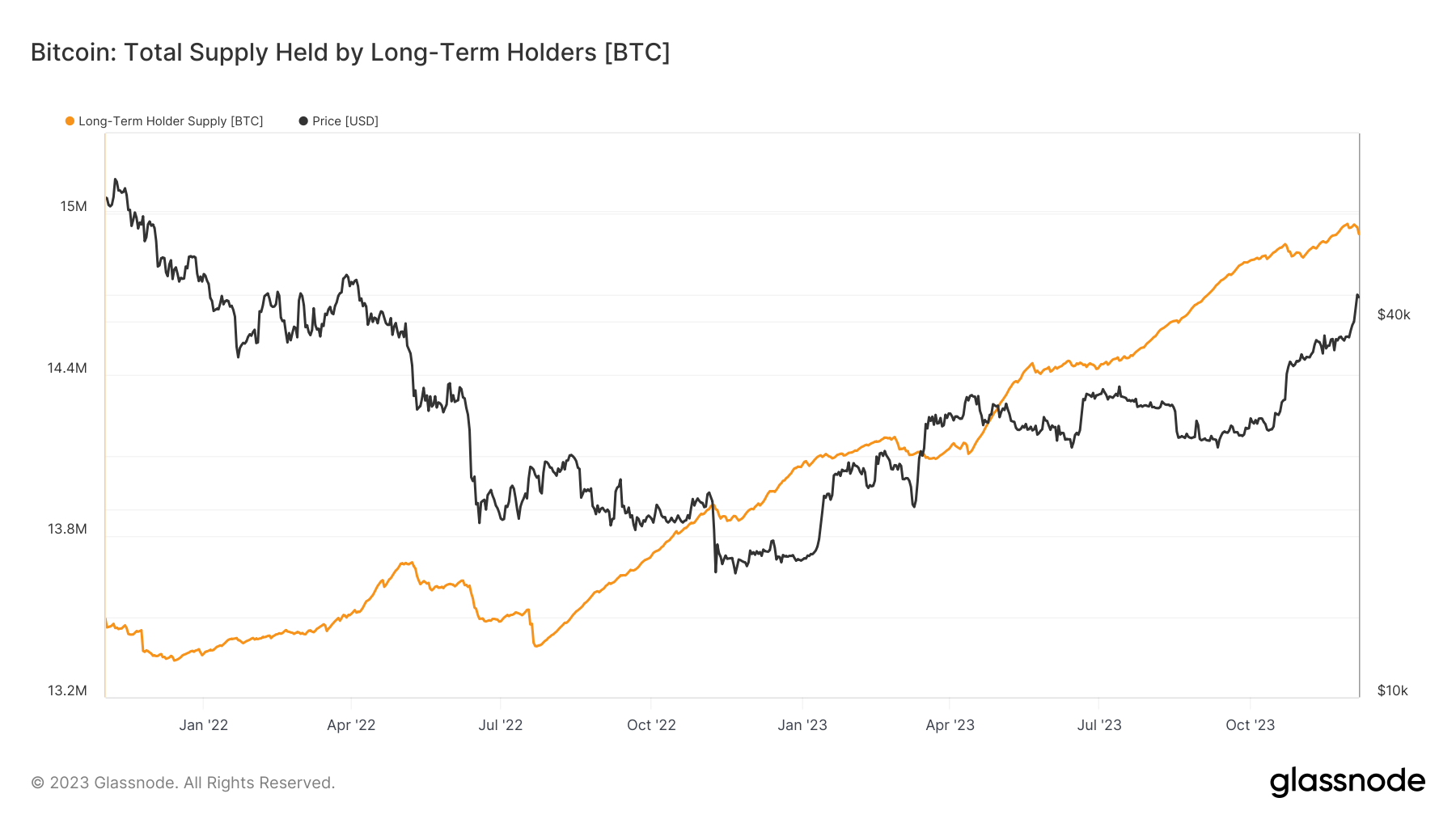

Bitcoin’s longer-term investor cohorts, also called long-term holders (LTHs), are in no temper to lower their publicity regardless of the 2023 bull run.

HODL Waves, which teams the BTC provide by the point elapsing since every coin final moved, exhibits a specific age band rising significantly over the previous 12 months.

For the reason that bear market backside in late 2022, cash unmoved in two to a few years have elevated their presence inside the general provide significantly. Final December, the group accounted for round 8% of the availability, whereas now, its share is greater than 15%.

Put one other means, at current, those that purchased BTC between December 2020 and December 2021 have resisted the urge to have interaction in mass profit-taking.

Realized Cap HODL Waves, which present the relative weighted worth of coin cohorts, additionally reveal the largest acquire in share of the overall realized cap coming from 2-3 12 months previous cash.

BTC/USD is nonetheless up 165% year-to-date, information from Cointelegraph Markets Pro and TradingView confirms, making hodlers' resilience no imply feat.

Philip Swift, creator of statistics useful resource Look Into Bitcoin, which hosts HODL Waves, steadily feedback on the LTH phenomenon as seasoned buyers turn out to be extra entrenched of their positions over time.

“Bitcoin 1yr HODL wave has hardly budged to date,” he predicted about one other group of hodlers final month on X (previously Twitter).

“Lengthy-term Bitcoiners not promoting their cash till we go WAY increased.”

Speculators on the again foot

The group which contrasts with LTHs — the short-term holders (STH) or speculators — has against this upped profit-taking over the previous week.

Associated: Bitcoin is up 170% since the ECB called its ‘last gasp’ at $16.4K

As Cointelegraph reported, Bitcoin passing $40,000 triggered a snap promote response from these entities, which bought off $4.5 billion of BTC in a matter of days.

This had little affect on spot markets, in an setting the place LTHs already managed extra of the availability than ever before.

Per information from on-chain analytics agency Glassnode, the determine stood at 14.92 million BTC as of Dec. 6 — barely under all-time highs of 14.95 million, or 76.3% of the availability, seen on Nov. 28.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.