[ad_1] Bitcoin's (BTC) 7% decline noticed the value drop from $88,060 on March 26 to $82,036 on March 29 and led to $158 million in lengthy liquidations. This drop was significantly regarding for bulls, as gold surged to a report excessive on the identical time, undermining Bitcoin’s “digital gold” narrative. Nonetheless, many consultants argue {that a} Bitcoin rally is imminent as a number of governments take steps to avert an

[ad_1] Bitcoin has slipped to $82,516.97, down 1.55% in 24 hours, triggering issues of a deeper correction. However in line with Samson Mow, this breakdown is a “bear lure”—a fakeout designed to flush out weak palms earlier than a bigger transfer increased.Mow stays agency on his $1 million BTC goal, arguing the latest sell-off doesn’t replicate fundamentals. Bitcoin nonetheless holds a $1.64 trillion market cap, with 19.84 million BTC in

[ad_1] SUI has gained 6% this week, outperforming broader market weak point whereas sustaining help above an ascending trendline close to $2.29. Regardless of a pointy 10.17% decline up to now 24 hours, the worth stays technically supported by concentrated shopping for exercise at key ranges.Now buying and selling at $2.30, SUI/USDT has stabilized on the intersection of trendline and horizontal help, sustaining its short-term upward construction. The Relative Energy

[ad_1] Prediction market Kalshi filed a lawsuit in opposition to the Nevada Gaming Management Board and the New Jersey Division of Gaming Enforcement after each state regulators despatched stop and desist orders for the agency to pause all sports-related contracts within the states.Kalshi's authorized workforce argued that the contracts fall below the jurisdiction of the Commodities Futures Buying and selling Fee (CFTC) and, due to this fact, can't be regulated

[ad_1] Picture by KI AdvertismentThe dialogue about the way forward for decentralized finance (DeFi) is gaining momentum. Whereas Ethereum is taken into account the pioneer of the DeFi motion, Bitcoin is more and more coming into focus as a extra steady basis for the monetary world. Ethereum’s function within the improvement of decentralized finance can't be overstated. It laid the inspiration for programmable blockchains…TheBitcoinNews.com – Bitcoin Information supply since June

[ad_1]

Picture by KI Advertisment Based on early Bitcoin investor Arthur Hayes, the crypto market is going through turbulent occasions. Why the Federal Reserve may trigger the BTC value to blow up. The unpredictability of the Trump administration has stored Bitcoin buyers and shareholders alike on edge for weeks. Whether or not tariff threats, saber-rattling, or the specter of a US recession – not often… TheBitcoinNews.com

[ad_1] Opinion by: Alisia Painter, chief working officer of Botanix LabsWith out Ethereum, the trade wouldn’t be the place it's at present when it comes to bringing decentralized finance (DeFi) to life, making programmability a key function of blockchains and proving the worth of sensible contracts at scale. The Ethereum Digital Machine has develop into the go-to platform for builders, with the most important ecosystem and tooling. As DeFi matures,

[ad_1] Institutional adoption of Bitcoin within the European Union stays sluggish, at the same time as the US strikes ahead with landmark cryptocurrency laws that search to determine BTC as a nationwide reserve asset.Greater than three weeks after President Donald Trump’s March 7 govt order outlined plans to use cryptocurrency seized in felony instances to create a federal Bitcoin (BTC) reserve, European corporations have largely remained silent on the problem.The

[ad_1] Institutional adoption of Bitcoin within the European Union stays sluggish, whilst the USA strikes ahead with landmark cryptocurrency rules that search to ascertain BTC as a nationwide reserve asset.Greater than three weeks after President Donald Trump’s March 7 govt order outlined plans to use cryptocurrency seized in prison circumstances to create a federal Bitcoin (BTC) reserve, European firms have largely remained silent on the problem.The stagnation might stem from

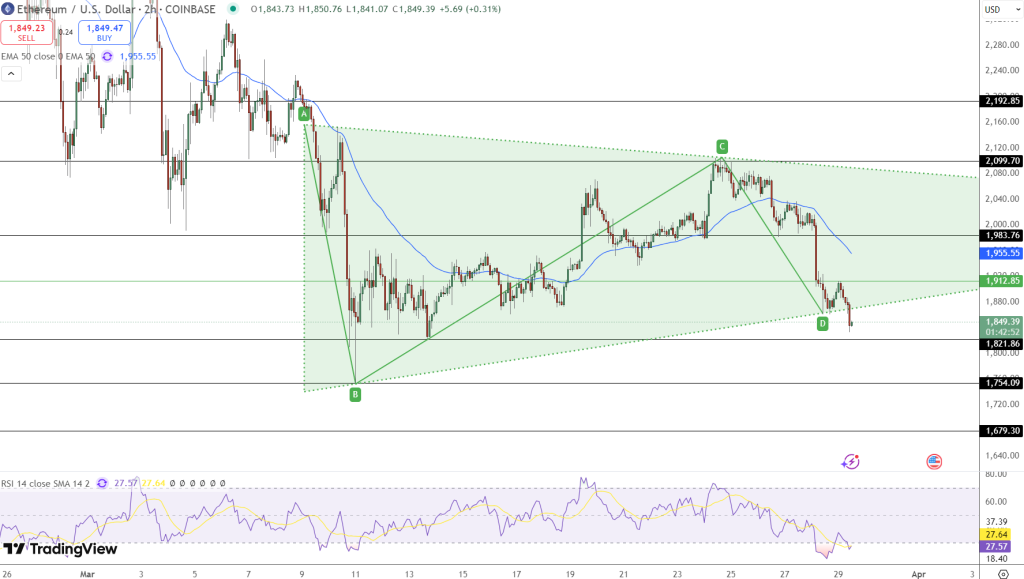

[ad_1] Ethereum has dropped to $1,874, testing a key assist stage as promoting stress intensifies throughout the broader crypto market. With costs inching dangerously near essential liquidation thresholds round $1,805, analysts warn {that a} sharper correction might be on the horizon.This downturn locations $238 million price of ETH in danger, as two main MakerDAO whales face potential liquidation. Because the market braces for volatility, merchants are carefully watching whether or