[ad_1]

Last week, Bitcoin.com CEO Roger Ver and lead developer Corbin Frasers unveiled a new tool which allows developers to issue tokens on the Bitcoin Cash blockchain, hosted on their publication.

“For better or worse, ICOs and CryptoKitties are probably coming to Bitcoin Cash in the near future,” Fraser said half-jokingly, to which Ver optimistically added that “they are probably coming to Bitcoin.com, too,” hinting that his publication might hold an ICO based on new tokens.

This became possible with the arrival of the Wormhole protocol, which might challenge the ERC-20 reign in the world of crypto tokens.

What are tokens and how are they issued?

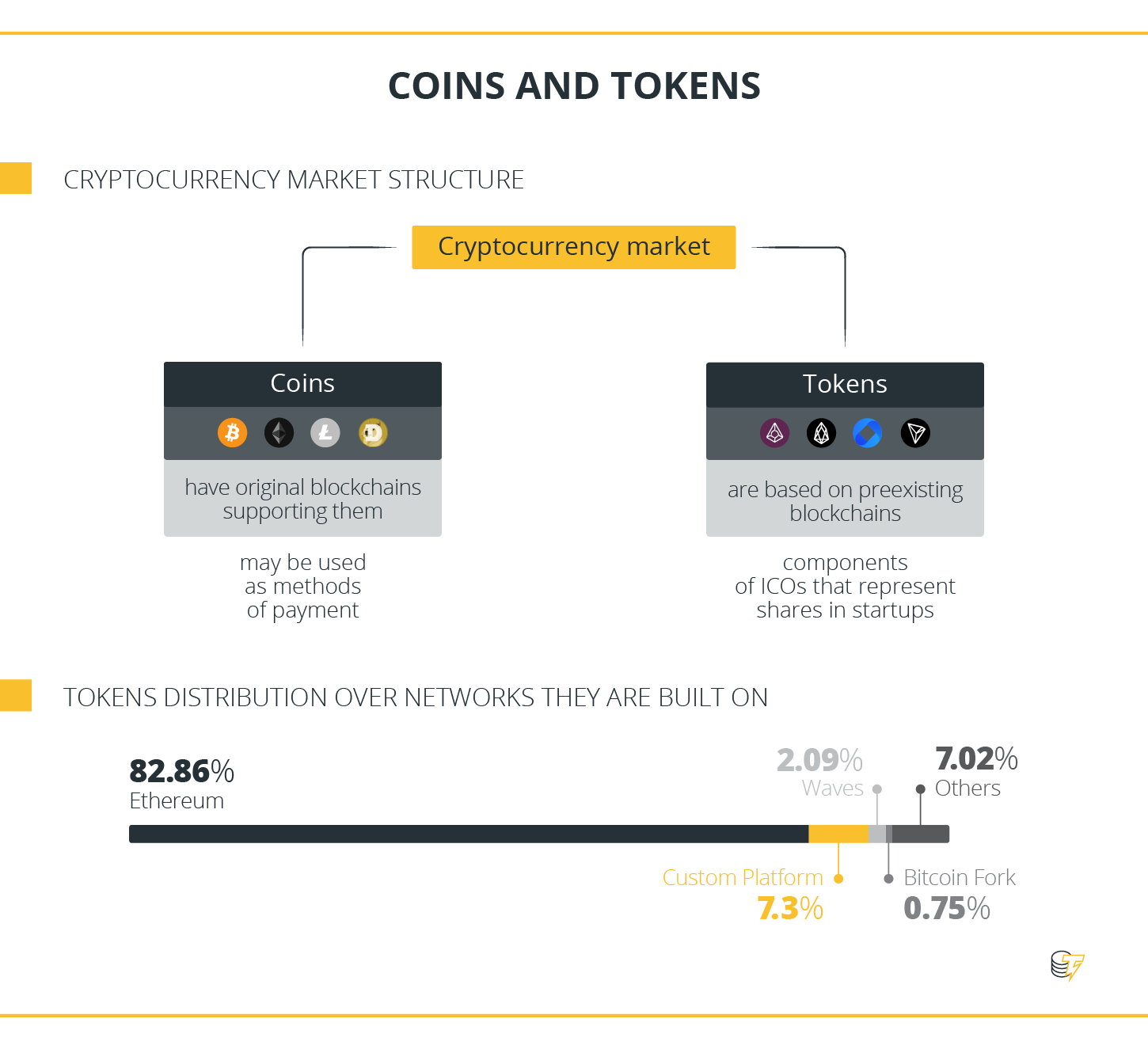

The cryptocurrency market can be split into two parts: coins and tokens. The former are cryptocurrencies that have original blockchains supporting them — the two most obvious examples would be Bitcoin (BTC) and Ethereum (ETH). Tokens, in turn, are based on pre-existing blockchains to represent a particular asset or utility.

Tokens are essential components of Initial Coin Offerings (ICOs): Normally, a startup publishes a white paper for its decentralized app (DApp), holds fundraising rounds, collects investments in cryptocurrencies and then distributes its own tokens so that investors get their share based on their input.

The overwhelming majority of those tokens are built on the Ethereum network — they constitute nearly 83 percent of the whole token market, according to data obtained from ICOWatchList.

ERC-20: The ultimate token blueprint

The most popular protocol used for forging tokens on the ETH blockchain is ERC-20, which has been proclaimed as “the king of DApps” for that reason. ERC stands for Ethereum Request for Comments, and the number is the one that was assigned to this request. It was first published on GitHub back in November 2015 by DApp developer for the Ethereum Project Fabian Vogelsteller. Basically, ERC-20 outlines a common list of rules that an ETH token has to follow, giving developers the ability to program how new tokens will function within the Ethereum ecosystem — for instance, to determine the total amount of issued tokens.

ERC-20 has gained its reputation by employing user-friendly principles and a simplified structure, which doesn’t require advanced programming skills: YouTube is swamped with tutorials on ‘how to create a cryptocurrency in X minutes,’ and the bulk of those suggests doing it via ERC-20. Basically, you just have to copy-paste a template from GitHub, choose a total amount of tokens, their name and symbol, pump some gas and ETH in and a new token is born.

Currently, there are more than 110,000 of these, as per Etherscan database. The most notable examples are EOS and TRON (TRX), which currently rank fifth and 12th respectively in terms of their market cap. Although most ERC-20 tokens have not been applied for direct use, some of them, like Basic Attention (BAT) and 0x (ZRX) tokens, are still being reviewed to be listed by major, law-compliant exchanges like Coinbase, despite their unclear regulatory status. While Ethereum itself has finally been deemed as “not a security” by the U.S. Securities and Exchange Commission (SEC), ERC-20 tokens might potentially represent securities, depending on how they are marketed. Despite being within the Ethereum ecosystem, most of them simply represent one’s shares in a startup.

Consequently, ERC-20 played a crucial role in the 2017 ICO craze. Soon after the protocol was widely introduced, the number of ICO startups in the cryptocurrency market increased substantially. Prior to that, the industry had no unified programming standards: Coins were unique and, hence, interaction with exchanges, wallets and other applications was significantly hindered. To ensure compatibility, a token’s software had to be upgraded every time.

ERC-20’s flaws

However, ERC-20, being the first-adopted version of the Ethereum-based protocol, has shown a number of problems and shortcomings over time.

The most notable one is the batchOverflow bug. Basically, when users accidentally send ERC-20 tokens (instead of ETH) to the address of a smart contract, the funds remain trapped inside that contract. Albeit over $3 million have been lost by ICO participants due to that loophole so far, the ERC-20 developers continue to call it “a user error,” not a bug.

That issue has led to other serious consequences for ERC-20 tokens. In April 2018, a number of exchanges, including OKEX, Poloniex, HitBTC and Changelly, halted deposits and withdrawals of all Ethereum-based tokens, citing the aforementioned bug.

Nevertheless, a number of other ERC protocols are lining up to dethrone the ERC-20 by attempting to cover its flaws or offer new features. These include ERC-223 (designed to correct ERC-20 errors), ERC-721 (which introduces ‘collectible’ tokens, such as the famous CryptoKittens) and ERC-948 (which allows to implement the “subscription” model), among others. However, now an ERC-20 competitor arrived from a completely different blockchain.

Wormhole: Bitcoin Cash’s answer to ERC-20

Thus, Roger Ver’s plan mentioned above is to simplify token issuance on Bitcoin Cash’s (BCH) rails and host it on Bitcoin.com. It should be noted that Ver is a renowned adherent of BCH — Bitcoin’s hard fork that departed from the original blockchain in August 2017 with the aim to position itself as a transactional currency. Ver has been continuously declaring that “Bitcoin Cash is Bitcoin” via social media, citing the original white paper issued years prior to BCH’s release. Another prominent BCH believer, Dr. Craig Wright, recently labeled the ERC-20 concept as a “dead end,” adding that he was “looking forward to competition with Wormhole.”

Wormhole is a smart-contract protocol upgrade for the Bitcoin Cash blockchain proposed by a team of Chinese developers led by Jiazhi Jiang. Its white paper — available only in Chinese, at the moment — was presented in July. The development was initiated by crypto mining hardware giant Bitmain, the CEO of which is also a notable BCH advocate. Essentially, the Wormhole protocol allows users to implement a smart contract feature — just like ERC-20 does within Ethereum network — without changing the consensus rules of Bitcoin Cash’s blockchain. To achieve this, it employs OP_RETURN opcode based on the Omni Layer protocol.

It also supports native tokens called Wormhole Cash (WCH). Those tokens are the fuel for smart contracts on the BCH blockchain and are hence required for actions like creating new tokens or listing an ICO. WCH is generated through a proof-of-burn mechanism — to get 100 WCH, a user is required to send one BCH to the burn address. As of press time, more than 2,300 BCH (worth more than $1,200,000) have been burned this way. WCH has already been recognized by CoinEx, who listed the tokens on its platform on Aug. 1.

Politics behind Wormhole

Praising the alternative token-forging process based on BCH’s blockchain and moving it to Bitcoin.com seems like a logical step for Roger Ver. Earlier in August, developer Gabriel Cardona, who created the open-source BCH software developer’s kit (SDK) called Bitbox, introduced a Wormhole beginner’s guide on Bitcoin.com. There, it explains how people can utilize Bitcoin.com’s developer’s tools to create tokens and launch an ICO using the Wormhole protocol. There are three types of those tokens — namely, tokens with a fixed number (where the cap number of tokens is predetermined), tokens with a managed number (the total amount of those token is controlled through granting/revoking) and tokens for crowdsale/ICOs (tokens which are later sold for WCH during an ICO.)

For Bitmain, in turn, fortifying he BCH ecosystem appears to be a more constrained decision. Prior to holding its IPO, the mining behemoth reportedly converted most of its savings from BTC to BCH, while the coin has been having an overall unfortunate year in terms of its market value.

“According to the Bitmain pre-IPO investor deck, they sold most of their [Bitcoin] for [Bitcoin Cash]. At $900/BCH, they’ve bled half a billion in the last three months,” Blockstream CSO Samson Mow claimed on Twitter on Aug. 11.

In either way, ERC-20 has been challenged

At this point, it is unclear if Wormhole will manage to outperform the current staple of ICO economics — i.e., ERC-20 tokens. While WCH might not feature obvious bugs like the batchOverflow one, some shortcomings might be revealed over time.

Nevertheless, despite being a relatively new concept, Wormhole enjoys more support when compared to another prominent Ethereum-based “killer” of ERC-20 — i.e., the ERC-223, which was introduced much earlier, back in 2017, but still has not been widely adopted. While both are yet to receive massive backing from software and hardware wallets, Wormhole has now received a convenient interface platform, making it easier to experiment with new, BCH-based tokens. However, while ERC-223 is lagging behind, another ETH-based protocol, ERC-777, could be presented as soon as this month.

[ad_2]

Source link