[ad_1]

The crypto market is up today as Bitcoin (BTC), Ether (ETH), XRP (XRP), Solana’s SOL (SOL) and numerous altcoins rally to restore the bullish momentum commonly associated with “Uptober.” Cryptocurrencies continued their positive growth, bringing the total crypto market cap up to $1.15 trillion on Oct. 23 while Bitcoin price flirts with the $31,000 level.

Let’s examine three of the major factors influencing today’s crypto market rally.

Uptober continues on notable high volume

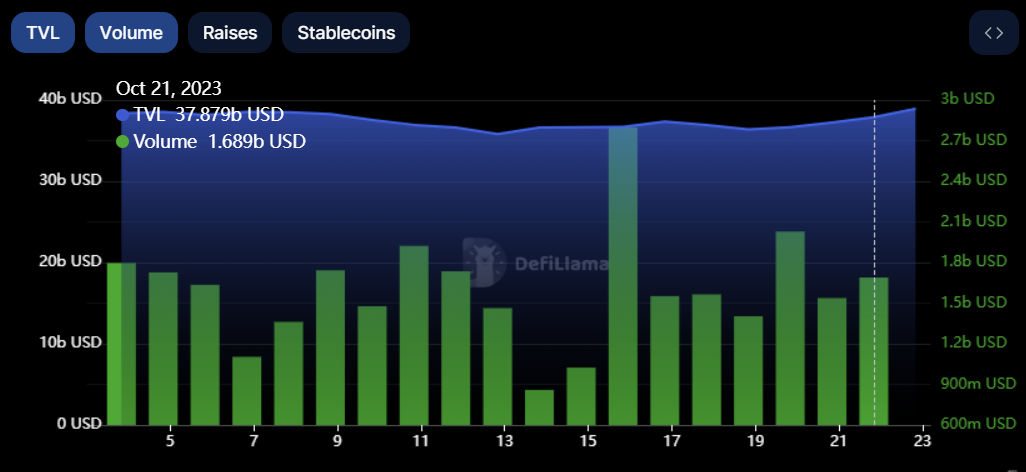

October has historically been celebrated as “Uptober” due to the positive returns in the crypto market. Bitcoin and crypto market volume rallied from $1 billion to over $2.7 billion on Oct. 15. Since Oct. 13, total trading volume has not dropped below $1 billion per day.

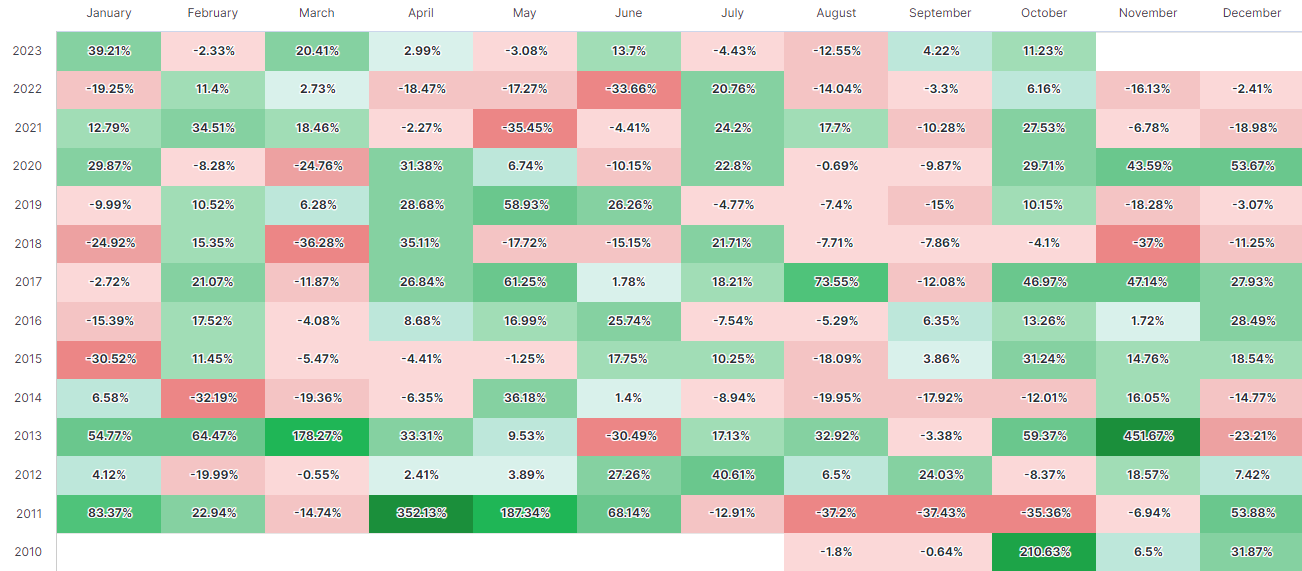

There is optimism surrounding the increase in volume, as the seasonality of Bitcoin’s returns in October has remained positive, only failing to achieve gains three times in the month. October statistically is one of the strongest months for Bitcoin price gains, already producing 11.2% returns so far in 2023.

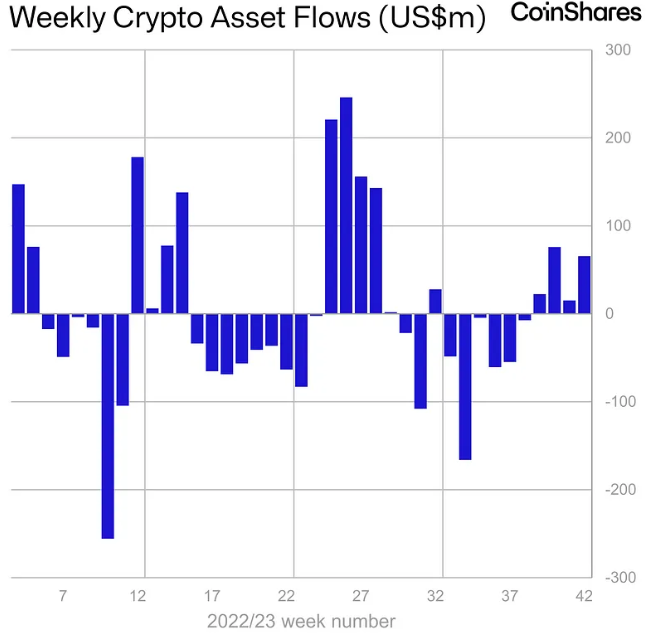

A strong October is coinciding with an increase in crypto market inflows. For four consecutive weeks, the crypto market has witnessed inflows in digital asset funds, totaling $66 million in the 42nd week of 2023.

Related: Ethereum restaking: Blockchain innovation or dangerous house of cards?

Bitcoin dominance holds

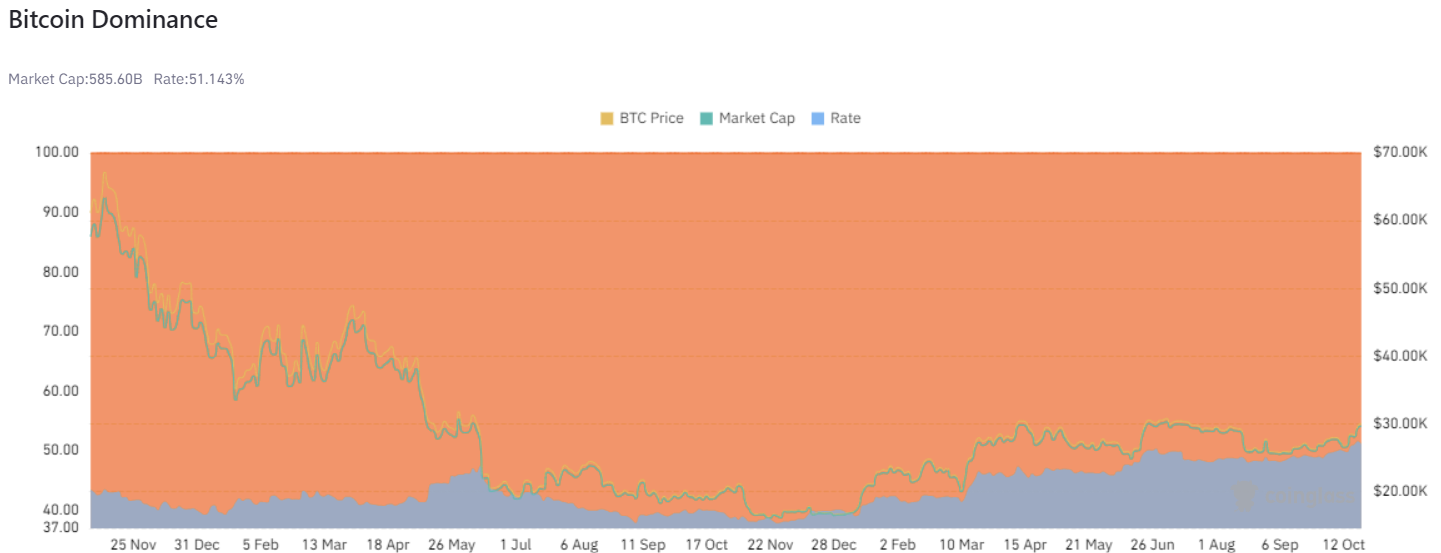

Bitcoin is regaining dominance in the crypto market before the supply halving in April 2024. For the first time since June 28, Bitcoin represents greater than 50% of the crypto market cap. Bitcoin dominance remained above 51% on Oct. 23.

Typically, when Bitcoin dominance plateaus, there is a rush to altcoins and other cryptocurrencies. The dominance comes on the heels of models showing Bitcoin’s potential to reach $130,000 after the 2024 BTC halving event. Despite these models, analysts believe Bitcoin’s price must break $31,000 to avoid a bearish fractal cited by technical analysts.

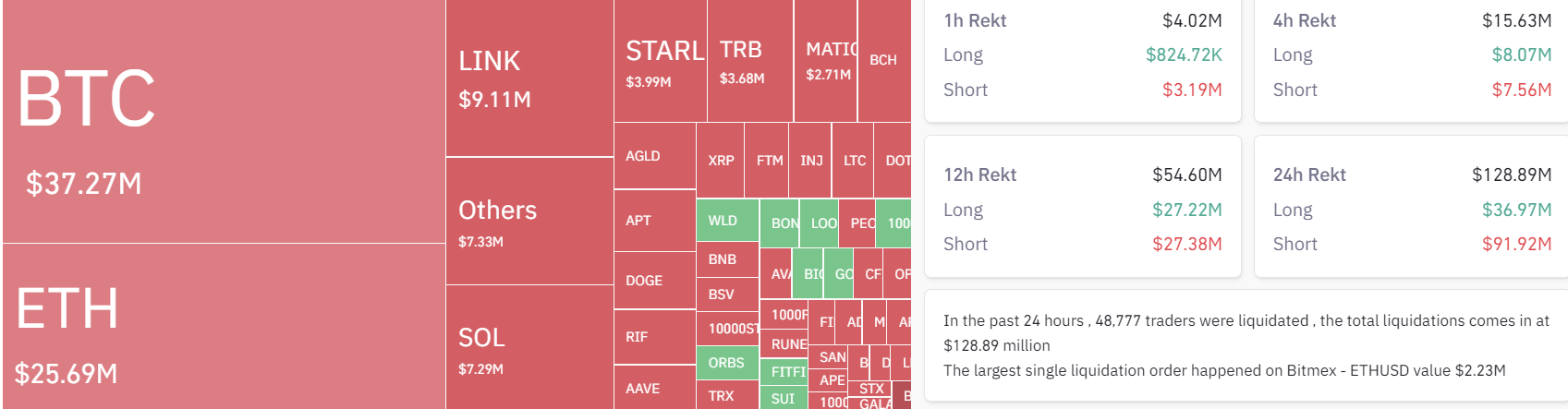

Crypto liquidations push short traders out

The crypto market rally has fueled a wave of short position liquidations across the market, totaling over $91 million in 24 hours. While Bitcoin short liquidations lead the way with $37.3 million in total shorts wiped out, the largest single liquidation was an Ether short of $2.23 million in one transaction on the BitMEX exchange.

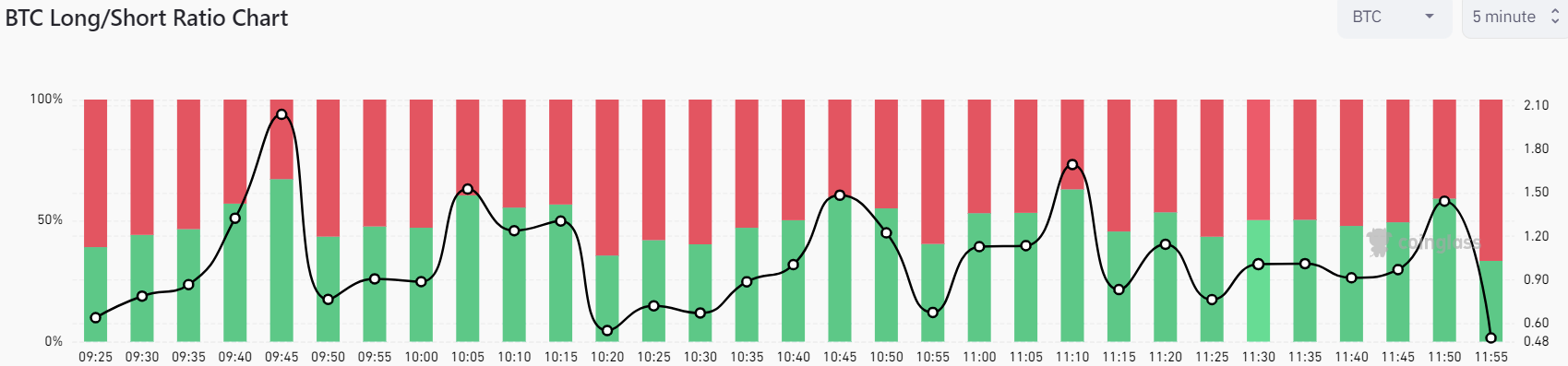

Despite the short-seller losing streak, 66% of the futures market remains short. With the ratio remaining skewed short, a potential opportunity for a short squeeze could lead to further price upside.

Related: MicroStrategy’s Bitcoin stash back in profit with BTC price above $30K

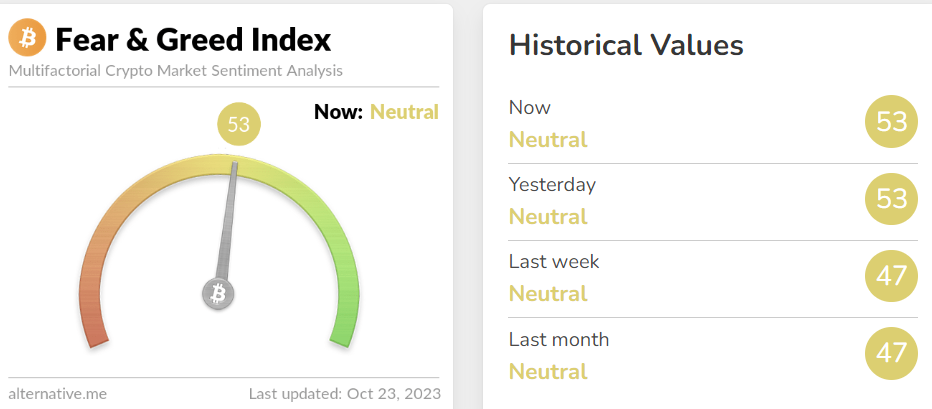

While Bitcoin and altcoins still have overhanging risk events that could impact their price, the growing institutional interest is improving sentiment across the market. The Bitcoin Fear & Greed Index highlights the improved sentiment, noting a six-point increase over the last month.

Overall, crypto markets are likely to continue to experience price volatility. While the positive October price action is providing a nice short-term bump in crypto prices, the market’s reaction to any new enforcement actions or an economic recession will be the true determinant of the direction the market chooses to take.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

[ad_2]

Source link