Bitcoin (BTC) is on track to hit $45,000 in November as part of a classic BTC price cycle, popular analyst CryptoCon said.

In an X thread on Oct. 25, the Bitcoin price model creator turned his attention to one based on Fibonacci retracement levels.

Analyst: $45,000 next month is “possible” for Bitcoin

Bitcoin reaching 17-month highs this week has many market participants expecting a pullback, but CryptoCon believes that plenty of upside potential remains.

Comparing current BTC price behavior to previous cycles, he showed that there is still room for BTC/USD to expand to the highest of the Fibonacci model’s five targets to hit a mid-cycle top.

Four have already been seen, with target four lying around 3.3% above this week’s top at $36,368. In between them are what are called “phases” — and November now marks a deadline for the next to be completed.

“The move to the cycle mid-top usually takes about 2 months after the end of phase 2. Since our first month is about to come to a close in phase 4, the mid-top could be complete as soon as November,” part of the commentary stated.

“Translation: A possible move above 45k by next month.”

Continuing, CryptoCon flagged two key resistance levels for Bitcoin bulls to clear in order for the $45,000 target to become reality.

“Both of these line up at about $36,400,” he noted.

BTC price cycle behavior “completely different”

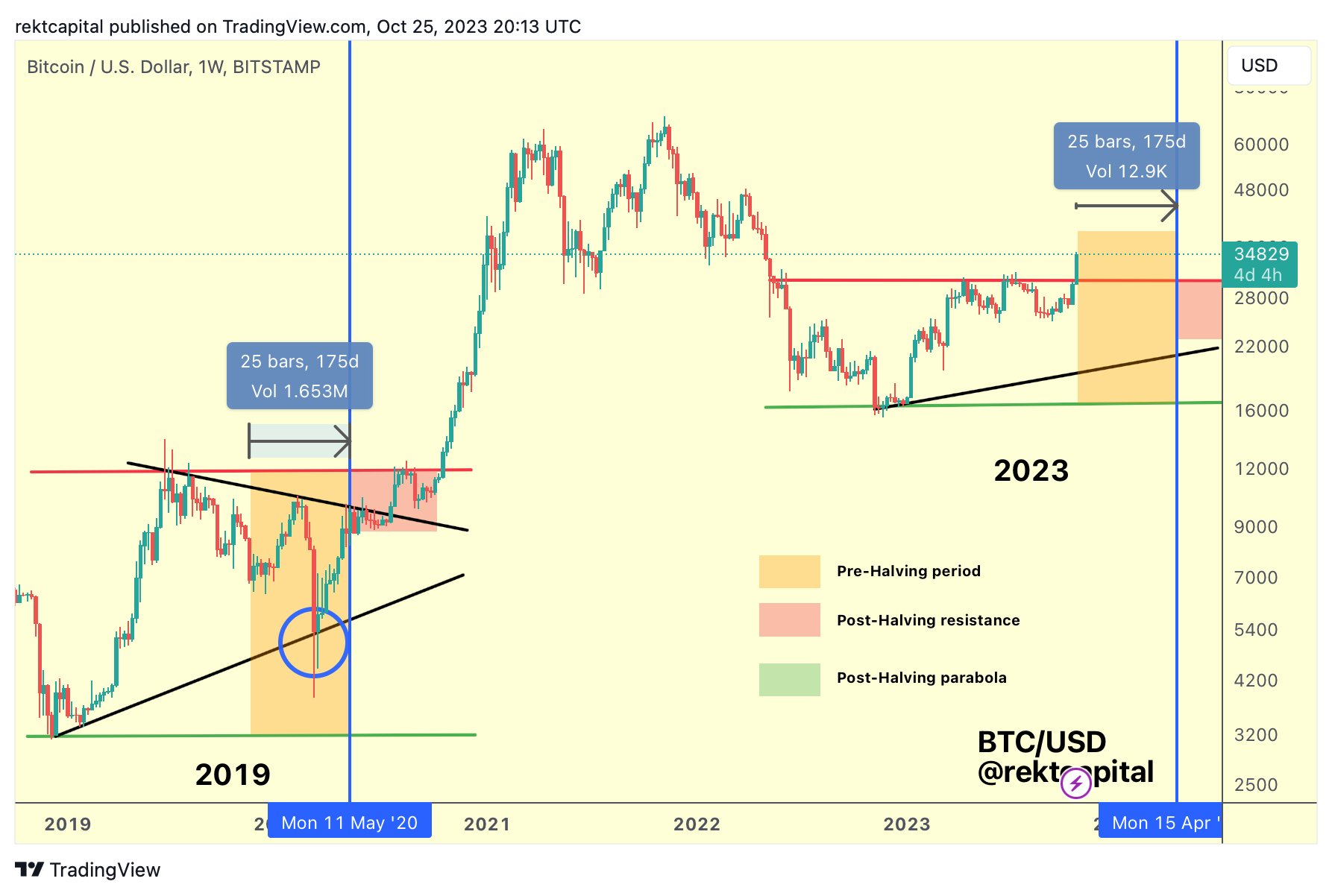

Updating his own cycle comparison, meanwhile, fellow trader and analyst Rekt Capital described a “completely different” setup for Bitcoin in 2023.

Related: ‘This is the trigger’ — Arthur Hayes says it’s time to bet on Bitcoin

At this point in its four-year pattern, BTC/USD should be testing support, not resistance, he argued, contrasting the current landscape to that from March 2020.

At the time, the pair put in cycle lows of just above $3,000 as part of a cross-market crash engendered by the start of the COVID-19 pandemic.

“Bitcoin is doing something completely different to what it did in 2019 at this same point in the cycle,” he wrote.

In various recent X posts, Rekt Capital added that any significant pullback would represent a significant cycle buying opportunity.

Any deeper retrace that occurs over the next 175 days before the Halving will represent an outsized opportunity for the next few years$BTC #Crypto #Bitcoin pic.twitter.com/KH7bsC7edq

— Rekt Capital (@rektcapital) October 25, 2023

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.