The current positive aspects are a uncommon sight in 2023, even contemplating Bitcoin's spectacular 108% year-to-date efficiency. Notably, the final occasion of such value motion occurred on March 14 when Bitcoin surged from $20,750 to $26,000 in simply two days, marking a 25.2% value improve.

It is price noting the importance of the truth that a staggering 208,000 contracts modified fingers in a mere two days. To place this into perspective, the prior peak, which occurred on August 18, noticed a complete of 132,000 contracts exchanged, however that was throughout a interval when Bitcoin's value plummeted by 10.7% from $29,090 to $25,980 in simply two days. Apparently, Bitcoin's choices open curiosity, which measures excellent contracts for each expiry, reached its highest stage in over 12 months on Oct. 26.

This surge in exercise has led some analysts to emphasise the potential "gamma squeeze" threat. This theoretical evaluation seeks to seize the necessity for possibility market makers to cowl their threat based mostly on their doubtless publicity.

the #bitcoin gamma squeeze from final week might occur once more

if BTCUSD strikes increased to $35,750-36k, choices sellers might want to purchase $20m in spot BTC for each 1% upside transfer, which might trigger explosiveness if we start to maneuver up in direction of these ranges

extra pic.twitter.com/OA9tJ0ZaK9

— Alex Thorn (@intangiblecoins) October 30, 2023

In accordance with estimates from Galaxy Analysis and Amberdata, BTC choices market makers might have to cowl $40 million for each 2% optimistic transfer in Bitcoin's spot value. Whereas this quantity could appear substantial, it pales compared to Bitcoin's staggering every day adjusted quantity of $7.8 billion.

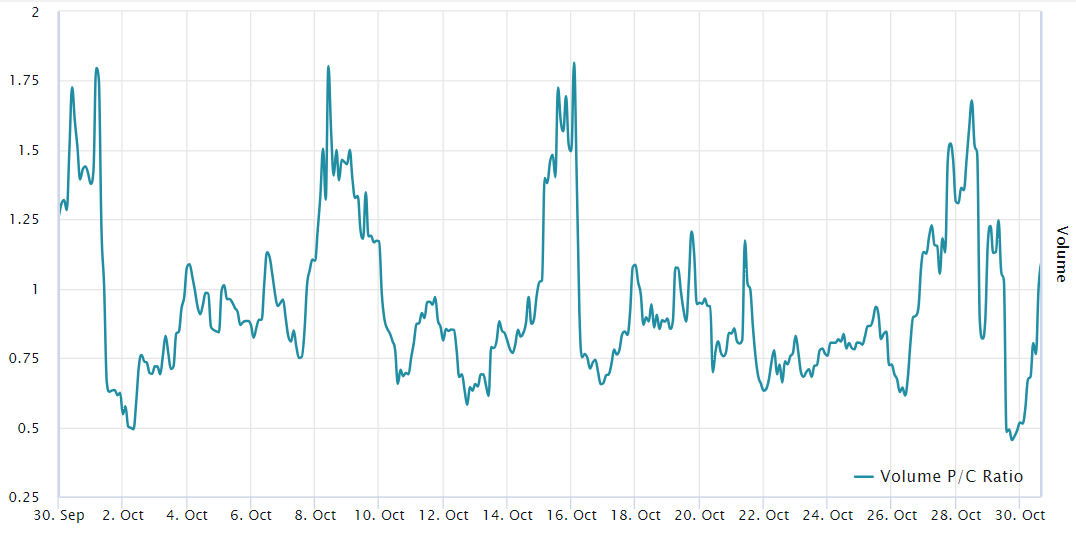

One other side to contemplate when assessing Bitcoin choices quantity and whole open curiosity is whether or not these devices have primarily been used for hedging functions or neutral-to-bullish methods. To deal with this ambiguity, one ought to intently monitor the demand distinction between name (purchase) and put (promote) choices.

Notably, the interval from Oct. 16 to Oct. 26 noticed a predominance of neutral-to-bullish name choices, with the ratio constantly remaining beneath 1. Consequently, the extreme quantity noticed on Oct. 23 and 24 was skewed in direction of name choices.

Nonetheless, the panorama modified as traders more and more sought protecting put choices, reaching a peak of 68% increased demand on Oct. 28. Extra not too long ago, the metric shifted to a impartial 1.10 ratio on Oct. 30, indicating a balanced demand between put and name choices.

How assured are Bitcoin possibility merchants?

To gauge whether or not traders utilizing choices have grown extra assured as Bitcoin's value held above $34,000 on Oct. 30, one ought to analyze the Bitcoin choices delta skew. When merchants anticipate a drop in Bitcoin's value, the delta 25% skew tends to rise above 7%, whereas intervals of pleasure sometimes see it dip beneath unfavourable 7%.

The Bitcoin choices' 25% delta skew shifted to a impartial place on Oct. 24 after residing in bullish territory for 5 consecutive days. Nonetheless, as traders realized that the $33,500 help stage proved extra resilient than anticipated, their confidence improved on Oct. 27, inflicting the skew indicator to re-enter the bullish zone beneath unfavourable 7%.

Associated: Bitcoin’s bull move might not be over yet — Here are 3 reasons why

Extraordinary choices premiums and continued optimism

Two noteworthy observations emerge from this information. Bitcoin bulls using choices contracts previous to the 17% rally that started on Oct. 23 had been paying the very best premium relative to place choices in over 12 months. A unfavourable 18% skew is extremely unusual and signifies excessive confidence or optimism, doubtless fueled by expectations of the spot Bitcoin ETF.

What stands out most, nonetheless, is the current unfavourable 13% skew after Bitcoin's value surged by 26.7% within the 15 days main as much as Oct. 27. Usually, traders would search protecting places to hedge a few of their positive aspects, however this didn't happen. Consequently, even when the preliminary demand for name choices was primarily pushed by ETF expectations, the prevailing optimism has endured as Bitcoin soared above $34,000.

Bitcoin (BTC) choices volumes skilled a major surge on Oct. 23 and Oct. 24, marking the very best stage in over six months. This exercise coincided with a exceptional 17% BTC value rally over two days. Merchants at the moment are pondering whether or not the elevated exercise within the BTC choices market will be solely attributed to the anticipation of a Bitcoin spot exchange-traded fund (ETF) or if the optimism has dwindled following the current value surge above $34,000.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.