[ad_1]

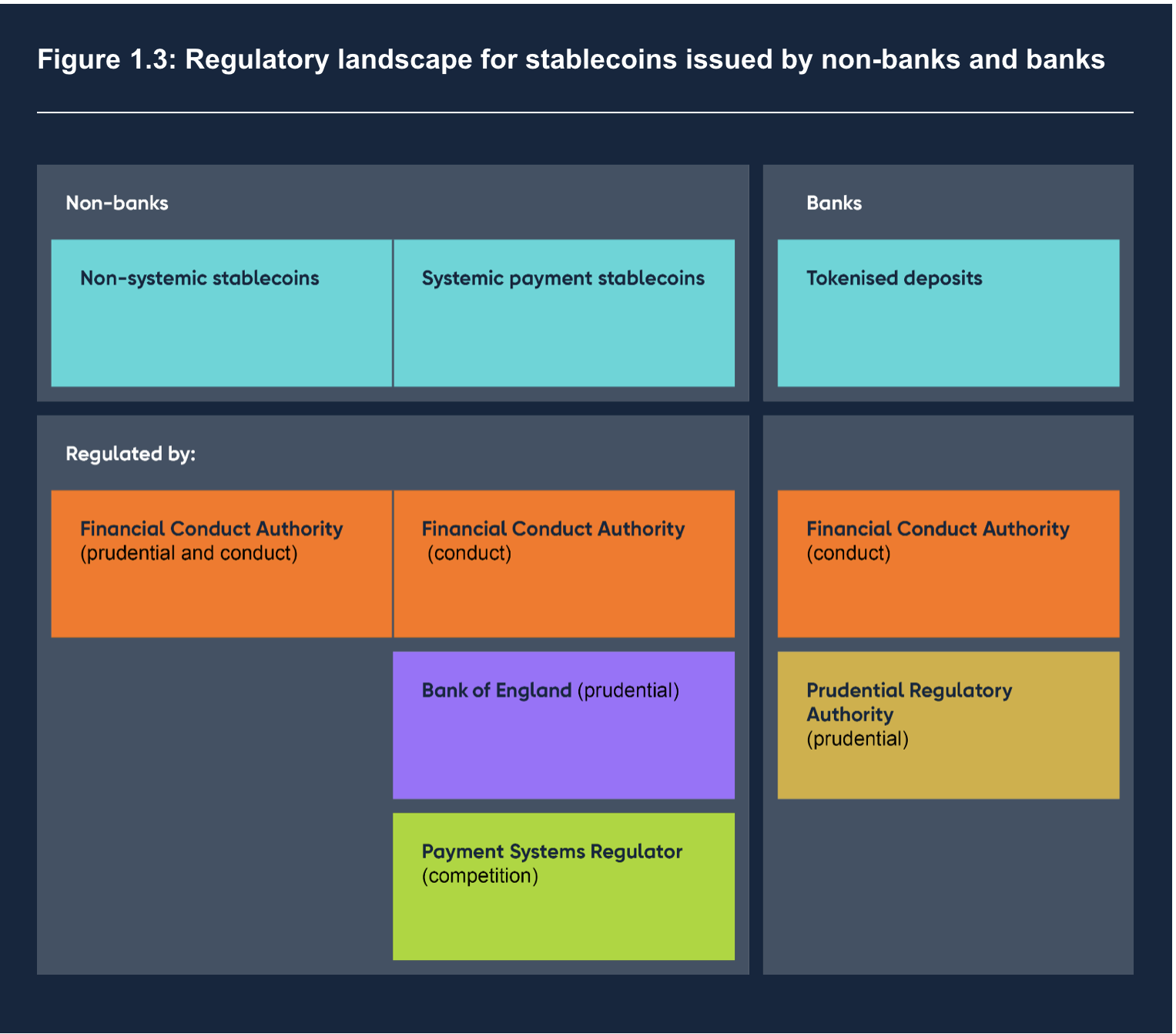

A set of paperwork was revealed in the UK on Nov. 6 that concern stablecoin regulation. The Monetary Conduct Authority (FCA) launched a dialogue paper, as did the Financial institution of England (BOE). To accompany these, the BOE’s Prudential Regulatory Authority (PRA) launched a letter to CEOs of deposit-taking establishments, and the BOE launched a “cross-authority roadmap” to hyperlink them collectively.

His Majesty’s Treasury set the stage for the flurry of releases on Oct. 30 with a brief doc previewing plans for regulation. The FCA paper explored the identical floor in a lot larger element.

Stablecoin regulation is step one to broader crypto asset regulation, the FCA said. The dialogue paper outlined potential retail and wholesale stablecoin use instances. Its dialogue included auditing and reporting, the backing of cash owned by the issuer and the independence of the backing belongings’ custodian.

The paper targeting methods by which the precept of “similar threat, similar regulator end result” may very well be utilized. It proposed utilizing the prevailing shopper belongings regime as the idea of guidelines on redemption and custodianship and the senior administration preparations, techniques and controls sourcebook to arrange enterprise affairs. There are present operational resilience and monetary crime frameworks, in addition to quite a few others.

The UK FCA is proposing that stablecoin holders have the appropriate of direct redemption. Which makes issuers much more like banks and can increase a bunch of AML/KYC points for issuers pic.twitter.com/lZLQXlmemu

— Sean Tuffy (@SMTuffy) November 6, 2023

The FCA is contemplating adapting present prudential necessities for regulated stablecoin issuers and custodians from the prevailing regime and making them relevant to different crypto belongings finally.

The BOE paper looked at using sterling-based retail-focused stablecoin in systemic cost techniques. It thought of switch operate and necessities for pockets suppliers and different companies, and it partially overlapped with the FCA’s dialogue of stablecoin issuers and deposit safety.

Associated: UK crypto businesses to comply with FATF Travel Rule beginning in September

The BOE will “depend on” the FCA to manage custodians, it mentioned, nevertheless it left open the potential for imposing necessities of its personal, if vital. It pointed to Anti-Cash Laundering and Know Your Buyer necessities for unhosted wallets and off-chain transactions as potential regulatory sore factors.

The BOE PRA letter emphasised that the distinction between “e-money or regulated stablecoins” and different varieties of deposit must be clearly maintained:

“With the emergence of a number of types of digital cash and money-like devices, there’s a threat of confusion amongst prospects, particularly retail prospects, if deposit- taking entities have been to supply e-money or regulated stablecoins below the identical branding as their deposits.”

Deposit-taking establishments ought to restrict their innovation to deposits. Issuance actions ought to have distinct branding, the PRA suggested. An issuer that wishes to take deposits as nicely ought to transfer rapidly and contain the PRA within the course of. Lastly, improvements in deposit taking are additionally topic to guidelines and necessities, it reminded.

The BOE roadmap included a timeline, with an implementation date of 2025.

Journal: Unstablecoins: Depegging, bank runs and other risks loom

[ad_2]

Source link