[ad_1]

FTX collapse: Unraveling the cryptocurrency disaster of November 2022

In November 2022, the cryptocurrency world was rocked by the collapse of FTX, one of many largest cryptocurrency exchanges. The collapse was triggered by a liquidity disaster at FTX, which was attributable to a mix of things, together with mismanagement of buyer funds and dangerous buying and selling practices by FTX’s sister firm, Alameda Analysis.

The collapse of FTX had a ripple effect across the crypto market, inflicting a pointy decline in cryptocurrency costs, a drain of liquidity and a lack of confidence within the crypto industry. It additionally raised severe questions concerning the security and safety of buyer funds on cryptocurrency exchanges. The crypto business’s lack of threat administration requirements was uncovered via the disaster.

FTX has filed for chapter, revealing a debt of over $3 billion to its collectors. Moreover, the change is unable to find roughly $8.9 billion value of buyer belongings. The precise sum of money misplaced by clients is troublesome to find out, as some clients could have been capable of withdraw their funds earlier than the change suspended withdrawals. Nonetheless, it’s estimated that clients misplaced billions of {dollars} within the FTX crash.

The collapse of FTX induced a pointy decline in cryptocurrency costs. The total market capitalization of the crypto market fell from over $1 trillion in November 2022 to beneath $800 billion in December 2022. This represents a market collapse of over $200 billion in greenback phrases.

Sam Bankman-Fried’s strategic path

SBF noticed a possibility to create wealth at an unparalleled tempo by combining the ICO method of token creation and subsequent leveraging.

SBF noticed a possibility to revenue by creating a new cryptocurrency exchange that will exploit the shortcomings of present exchanges. Bankman-Fried started by organising a quantitative buying and selling agency referred to as Alameda Analysis.

Alameda Analysis used subtle algorithms to commerce cryptocurrencies on quite a lot of exchanges. Alameda Analysis was very profitable, and it shortly turned one of many largest cryptocurrency merchants on this planet.

In 2019, Bankman-Fried launched FTX, a cryptocurrency change designed to be extra user-friendly and environment friendly than present exchanges. FTX additionally provided quite a few options that weren’t obtainable on different exchanges, equivalent to margin trading and derivatives trading. Nonetheless, not one of the regulatory controls usually wanted by mainstream monetary providers buying and selling platforms have been addressed.

Relationship between FTX and Alameda Analysis

FTX and Alameda Analysis have been carefully linked. Bankman-Fried and Caroline Ellison have been the CEOs of FTX and Alameda Analysis respectively. Nonetheless, Bankman-Fried managed a majority of the shares in each corporations. Alameda Analysis additionally used FTX as its major change.

The shut relationship between FTX and Alameda Analysis allowed Bankman-Fried to interact in quite a lot of fraudulent actions, together with:

- Misappropriating buyer funds: Bankman-Fried transferred buyer funds from FTX to Alameda Analysis with out the shopper’s consent. He used these funds to cowl Alameda Analysis’s losses and to fund his personal lavish life-style.

- Manipulating the cryptocurrency market: Alameda Analysis used its massive buying and selling quantity to control the costs of cryptocurrencies on FTX. This allowed Bankman-Fried to revenue from insider trading.

- Providing fraudulent monetary merchandise: FTX, beneath Bankman-Fried’s management, provided unregulated monetary merchandise like margin and derivatives buying and selling. This lack of oversight allowed him to defraud clients by promoting these merchandise with out disclosing the related dangers.

FTX rip-off and Alameda hole unveiled

The rip-off started to unravel in November 2022 when it was revealed that Alameda Analysis held a big place in FTT, the native token of FTX.

The report sparked a sell-off of FTX Token (FTT), which induced the token’s worth to plummet. It additionally raised considerations concerning the monetary well being of Alameda Analysis and FTX. This led to a liquidity crisis at FTX, as clients rushed to withdraw their funds from the change.

FTX was unable to fulfill the withdrawal calls for, and it was compelled to droop withdrawals. FTX additionally filed for chapter on Nov. 11, 2022. The collapse of FTX had a devastating impression on the crypto market.

In November, a big lower in liquidity inside the crypto market was coined because the “Alameda hole” by blockchain knowledge agency Kaiko. This time period emerged as a result of notable position performed by Alameda Analysis, the most important market maker throughout that interval.

The Alameda Hole represented a considerable decline in obtainable liquidity, impacting buying and selling volumes and market stability. This phenomenon underscored the affect of main market contributors and highlighted the intricate dynamics that govern cryptocurrency markets.

Whereas the FTX episode could have been the final domino to fall in a sequence of bankruptcies that have been filed throughout 2022, it was simply the largest occasion of the yr, and it put the business beneath a authorized and regulatory microscope.

The Bankman-Fried trial

SBF was arrested within the Bahamas on Dec. 12, 2022, after United States prosecutors filed legal expenses in opposition to him. He was extradited to the U.S. in January 2023 and went on trial in October 2023.

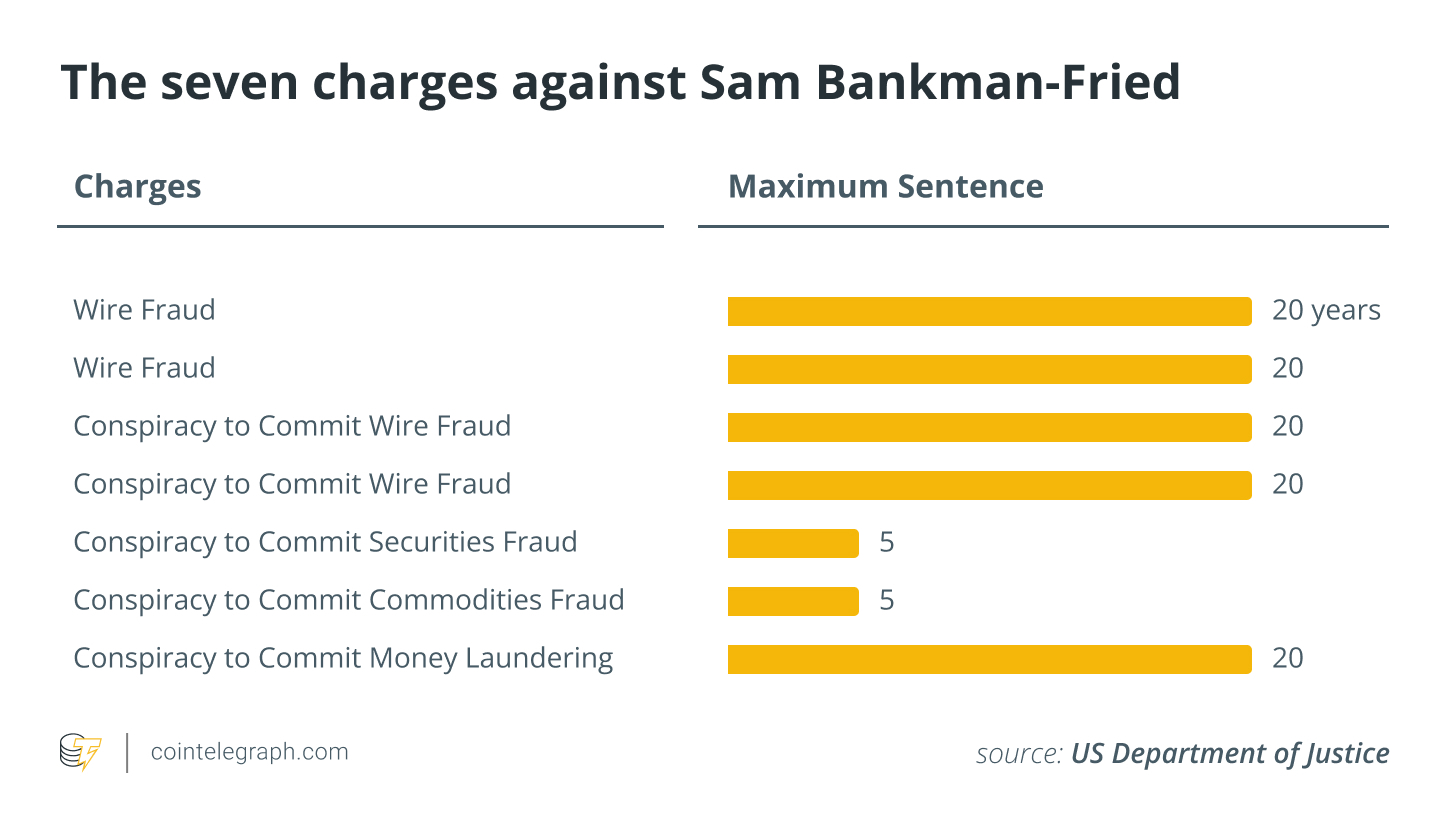

The arrest and trial of SBF was a serious growth within the crypto business. It was the primary time {that a} main crypto founder had been arrested and tried on legal expenses. Bankman-Fried was charged with seven counts of fraud and conspiracy.

The important thing witnesses for the prosecution have been:

- Caroline Ellison, Bankman-Fried’s ex-girlfriend and the previous CEO of Alameda Analysis

- Nishad Singh, former FTX engineering director

- Gary Wang, co-founder of FTX

Ellison, Singh and Wang all pleaded responsible to a number of expenses and cooperated with the prosecution. They testified that Bankman-Fried knowingly misled traders and clients concerning the monetary well being of FTX and Alameda Analysis. In addition they testified that Bankman-Fried used FTX buyer funds to cowl losses at Alameda Analysis and to fund his personal lavish life-style.

Bankman-Fried was discovered responsible of all seven charges on Nov. 2, 2023. He faces a most of 115 years in jail. Bankman-Fried denied the entire expenses in opposition to him. He mentioned that he made errors however that he didn’t commit any crimes.

Publish-FTX reforms within the cryptocurrency business

There’s typically a silver lining with black swan events. A black swan occasion is one that’s unimaginable to foretell and has extreme penalties. Within the wake of the FTX and Alameda Analysis rip-off, a number of issues have gained momentum, and the business has targeted on getting itself regulated. Internationally, regulators and crypto companies have labored collaboratively and consciously to guard traders.

The next are some notable developments within the crypto business submit the FTX disaster:

- Elevated regulation: Governments worldwide have began to develop and implement complete rules for the crypto business. These rules would deal with defending traders and stopping fraud.

- Transparency: Cryptocurrency exchanges have come ahead and provided transparency round their operations and monetary situation via correct documentation and threat administration practices. This helps traders make knowledgeable selections about the place to take a position their cash.

- Audits: Cryptocurrency exchanges are being repeatedly audited by impartial auditors. This helps to make sure that the exchanges are working actually and that buyer funds are secure.

Traders additionally must be vigilant and do their very own analysis earlier than collaborating in any cryptocurrency exchange-related actions. Traders ought to search for exchanges which can be regulated, clear and have a superb repute.

[ad_2]

Source link