[ad_1]

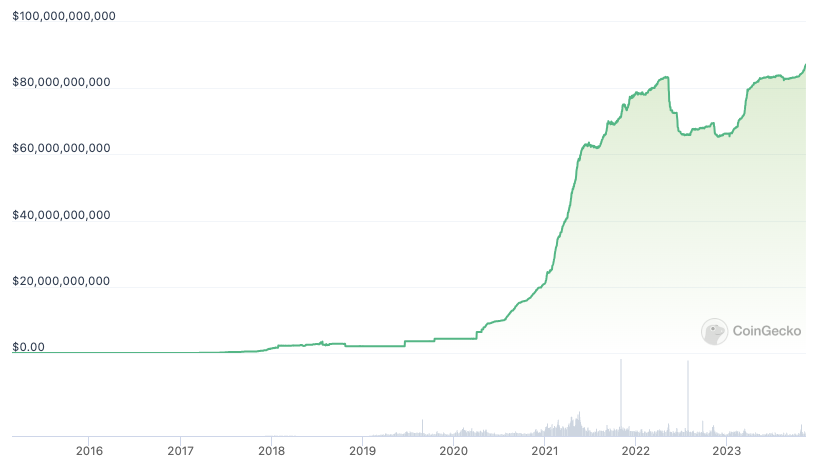

Tether (USDT), the biggest stablecoin by market worth, has been breaking new information all through 2023, with its market capitalization including a minimum of $20 billion to this point this yr.

Based on information from the blockchain information supplier Whale Alert, Tether has minted 22.75 billion USDT to this point this yr, with a minimum of 4 billion USDT being issued up to now 4 weeks.

After beginning the yr with a market cap of roughly $66 billion, Tether USDT has been steadily gaining momentum, with its market worth surpassing $80 billion in April 2023. On Nov. 14, the USDT market cap briefly hit $87 billion, according to information from CoinGecko.

Based on a spokesperson for Tether, the continuing USDT development needs to be attributed to 2 key causes, one being the continued market pleasure across the potential approval of a spot Bitcoin exchange-traded fund (ETF).

“There’s a rising curiosity in Bitcoin from institutional traders, pushed by the joy round the opportunity of a Bitcoin ETF,” a Tether consultant mentioned.

Associated: First deadline window looms for SEC to approve Bitcoin ETFs: Law Decoded

Tether’s record-breaking development has additionally been fuelled by rising demand in rising markets, in accordance with the corporate’s spokesperson. The USDT stablecoin has been “more and more establishing itself because the de-facto digital greenback” for all rising markets and creating nations, the consultant mentioned, including:

“There are, in reality, many nations affected by the devaluation of their nationwide currencies in comparison with the greenback, therefore all of the communities dwelling in these nations are searching for safety […] USDT is essentially the most trusted asset for them.”

Citing public data from the Brazilian authorities, Tether mentioned that USDT accounts for 80% of all crypto transactions in Brazil. “This sample is just like tens of different nations,” the consultant acknowledged.

Whereas Tether has been seeing this surge, some main stablecoins like Circle’s USD Coin (USDC) have failed to achieve a lot momentum in 2023. After peaking at $55 billion in June 2022, USDC market capitalization has regularly dropped and continued to say no in 2023. Since January 2023, USDC has misplaced $20 billion in market worth, or about 45%. On the time of writing, USDC’s market cap stands at $24 billion, according to CoinGecko.

Journal: How to protect your crypto in a volatile market — Bitcoin OGs and experts weigh in

[ad_2]

Source link