[ad_1]

Bitcoin (BTC) begins Thanksgiving week in the USA with a return to $37,000 as bulls stubbornly refuse to loosen their grip.

BTC worth motion stays tantalizingly close to 18-month highs as one other weekly shut gives a recent style of bull market momentum.

The biggest cryptocurrency continues to carry onto reclaimed floor, and whereas upside now comes slower than in earlier weeks, BTC/USD is up 7% month-to-date.

How may the approaching days form up for Bitcoin?

Macroeconomic information prints present the chance for some snap volatility, whereas underneath the hood, the panorama relating to Bitcoin’s community fundamentals is as rosy because it has ever been in 2023.

On the identical time, provide dynamics are shocking — cash dormant for a 12 months or extra now make up over 70% of the provision for the primary time, indicating a reluctance amongst long-term holders to “promote the rip.”

Bitcoin domnaince can also be staying sturdy, resulting in hopes {that a} basic crypto bull market is as soon as once more in its early innings.

Cointelegraph takes a take a look at these elements and extra as a part of the weekly rundown of all issues transferring BTC worth motion within the coming week.

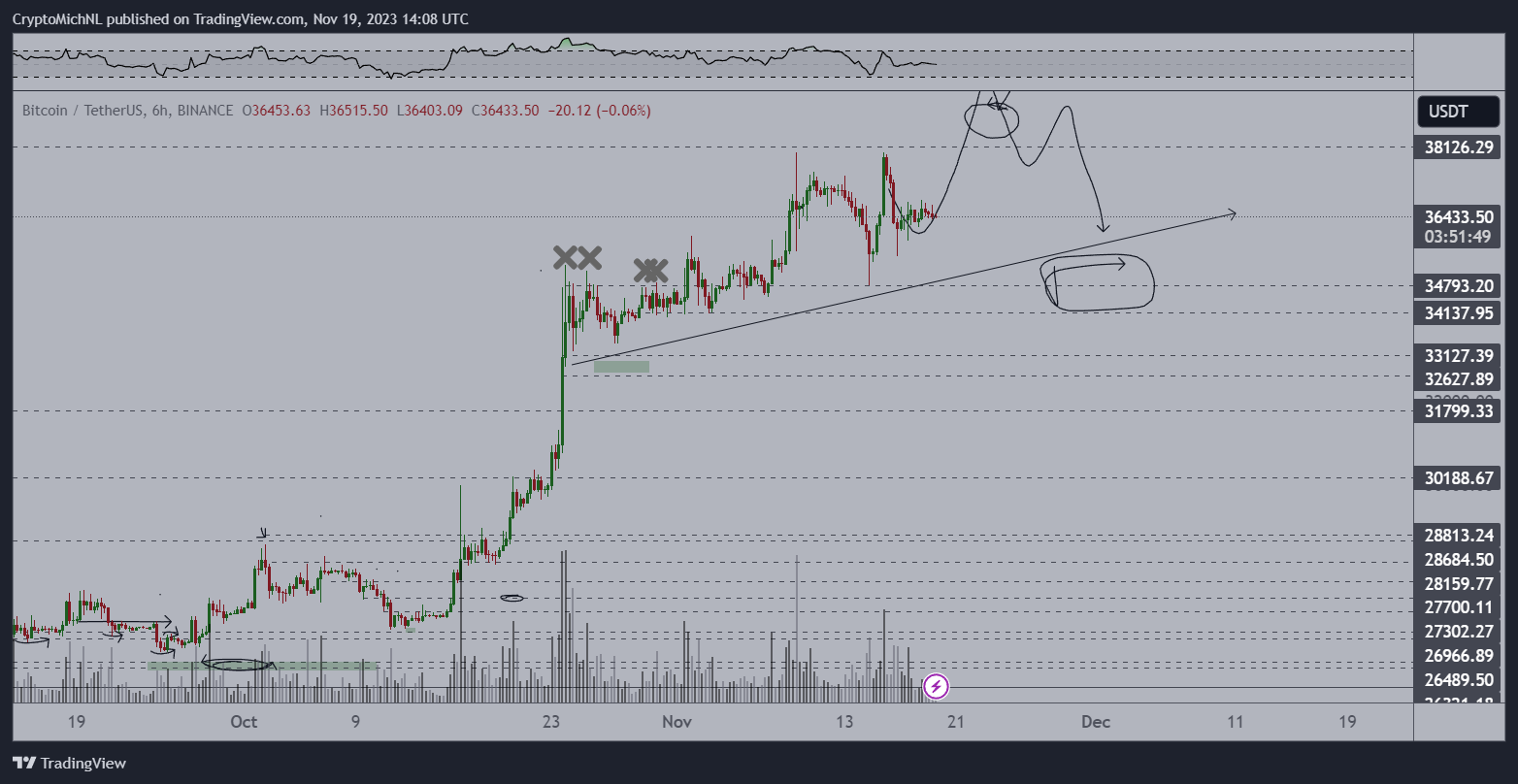

Bitcoin merchants keep BTC worth retracement odds

Bitcoin delivered a suitably buoyant weekly shut with a visit to $37,500, however subsequently failed to carry that stage.

In an ongoing expression of the issue of reclaiming increased floor as help, BTC worth motion is now again across the $37,000 mark as of Nov. 20, per information from Cointelegraph Markets Pro and TradingView.

“Appreciable provide above worth & in direction of $40K,” common dealer Skew noted in a part of his newest social media evaluation.

“This may take persistent demand for spot BTC to crack imo. Bullish affirmation is seeing restrict bids transfer up nearer to cost right here, that might sign for increased costs & demand.”

With hours to go till the Wall Avenue open, the sense amongst some market individuals is certainly one of rangebound buying and selling persevering with for the quick time period.

“Bitcoin clearly making a variety building right here,” Michaël van de Poppe, founder and CEO of buying and selling agency Eight, told X subscribers because the weekly candle accomplished.

“Resistance at $38K, whereas help at $33-34.5K is the one to observe for lengthy entries. I feel we’ll sweep barely decrease (possibly barely beneath $36K) earlier than we revisit highs. Wants to carry the pattern.”

The idea of a retracement to check latest liquidity is nothing new. As Cointelegraph reported, draw back targets embrace a visit to $33,000 and even under $31,000.

In contrast to its preliminary push to 18-month highs final week, nevertheless, Bitcoin market information exhibits a a lot calmer ambiance amongst merchants, with each open curiosity (OI) and funding charges staying impartial.

#Bitcoin Some shorts pushed out on that push earlier than the weekly shut.

General open curiosity nonetheless fairly low in contrast to some weeks again. Funding charges impartial.

Should you’re in search of an trade to commerce on, Contemplate Bybit and help me:

https://t.co/rIxsG0GIWl pic.twitter.com/mtn3aNTfvv— Daan Crypto Trades (@DaanCrypto) November 20, 2023

BTC/USD stays up 7% in November — modest positive aspects, but nonetheless the pair’s finest performing November month since 2020, per information from monitoring useful resource CoinGlass.

“Regardless that the sentiment is not nice, $BTC continues to be up ~5% for the month of November,” common dealer Daan Crypto Trades commented on the efficiency.

“December tends to be a risky month that places in massive numbers. Sure to see a turbulent finish of 12 months I feel!”

Jobs, Fed minutes lead quick Thanksgiving macro week

U.S. Thanksgiving week is because of be characterised by a cool set of macroeconomic information releases in a interval of aid for crypto merchants.

Jobless claims mark one of many highlights of the approaching days, these set for launch on Nov. 22.

Whereas Bitcoin has total turn into much less vulnerable to macro-induced volatility this 12 months, unemployment surprises have nonetheless succeeded in injecting short-term momentum previously.

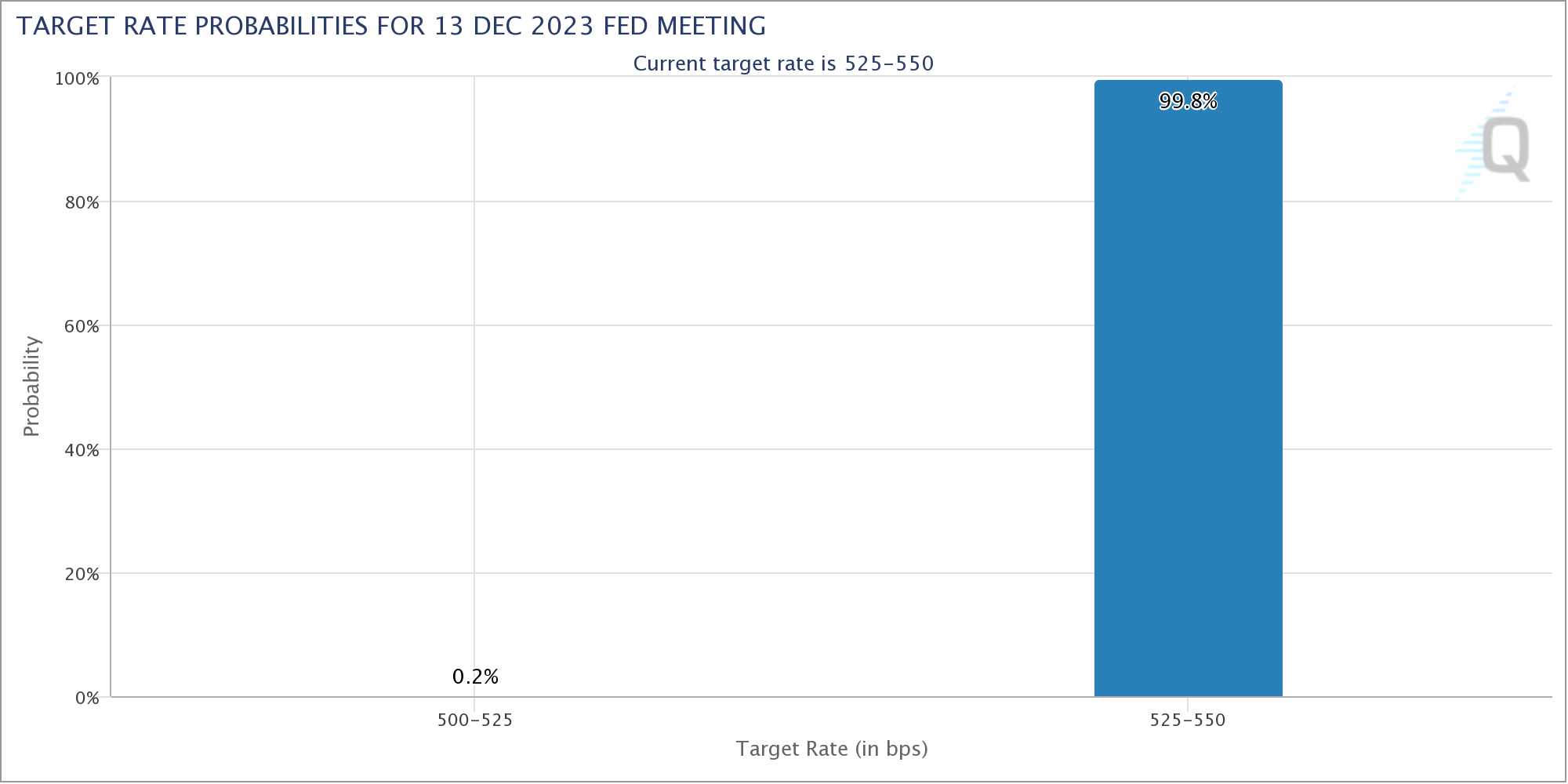

After final week’s information prints confirmed U.S. inflation cooling faster than markets anticipated, nevertheless, market individuals are in “wait and see mode” forward of the subsequent resolution on rate of interest adjustments due in mid-December.

To this point, consensus is virtually unanimous on present ranges remaining in place on the Federal Reserve’s Federal Open Market Committee (FOMC) assembly, per information from CME Group’s FedWatch Tool.

The Fed will launch the minutes of its earlier FOMC assembly this week.

Key Occasions This Week:

1. Current Dwelling Gross sales information – Tuesday

2. Fed Assembly Minutes – Tuesday

3. Core Sturdy Items Orders – Wednesday

4. Preliminary Jobless Claims – Wednesday

5. US Markets Closed for Thanksgiving – Thursday

6. US Markets Shut at 1 PM ET – Friday

Blissful…

— The Kobeissi Letter (@KobeissiLetter) November 19, 2023

“Quick week, however nonetheless some vital occasions to observe. The Fed assembly minutes will likely be within the highlight,” monetary commentary useful resource The Kobeissi Letter wrote in a part of its weekly forecast.

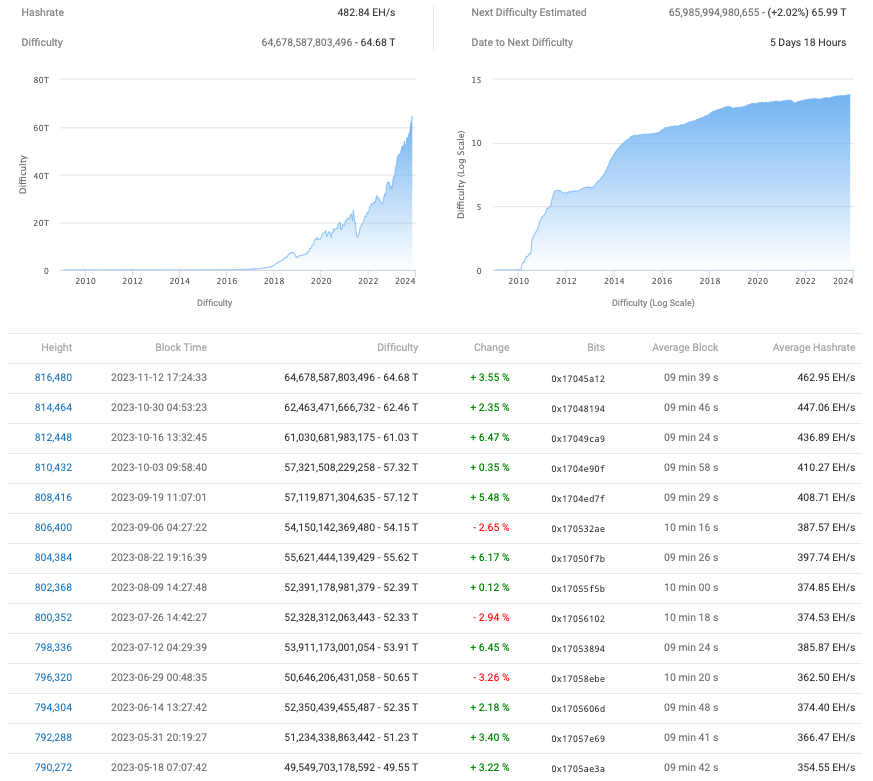

Evaluation involved over Bitcoin mining growth

Bitcoin community fundamentals stay at or close to all-time highs — and relying on how the near-term BTC worth motion performs out, they could but bounce increased nonetheless this week.

Each hash price and mining issue are in full bull mode, evaluation has concluded, having spent most of 2023 in a relentless uptrend with solely minor retracements alongside the way in which.

Nevertheless, the optimistic establishment shouldn’t be with out its warning indicators.

In his newest Quicktake market replace for on-chain analytics platform CryptoQuant on Nov. 19, contributor Gigisulivan famous that new hash price highs have historically preceded a BTC worth comedown.

“This was now not the case after fifteenth of Sept because the dominant BTC Spot ETF rally took over and pushed BTC’s worth 30%+ up,” he acknowledged.

Regardless of this, there may be nonetheless time for historical past to repeat itself, with the consequence doubtlessly constituting a return towards the $30,000 mark.

“Vital to notice is that now we have one other new excessive on hashrate 2 weeks in the past, that’s sitting nonetheless throughout the ordinary timeframe and ordinary pump earlier than dump vary,” the replace added.

“Almost certainly pullback goal between 30-31.5k.”

As Cointelegraph reported, one principle means that miners will likely be seeking to improve BTC stockpiles prematurely of the April 2024 halving, when the quantity of BTC awarded to them per block is reduce by 50%.

Bitcoin’s subsequent automated issue readjustment is in the meantime scheduled for Nov. 25, and is at present anticipated to take issue solely modestly increased — by round 2%, per information from monitoring useful resource BTC.com.

Dominance fuels hopes of basic bull market

In terms of Bitcoin versus altcoins, the basic market cap dominance surge, which characterizes early levels of the crypto bull market stays in play.

Bitcoin at present accounts for round 52.5% of the overall crypto market cap — round 2% decrease than at first of the month, however nonetheless conspicuously increased than its year-to-date lows of nearer 40%.

“Bitcoin worth dominance is lastly again, not less than in the meanwhile,” analysis agency Santiment wrote in an replace on the established order late final week.

“Altcoins have been retracing on the tail finish of the week after the previous month’s blistering sizzling rally. If the group begins to get apprehensive and present FUD, nevertheless, we may see some fast worth rebounds.”

Bitcoin historically advances previous to main altcoins, with small cap tokens citing the rear as pleasure over worth positive aspects permeates crypto markets.

For Daan Crypto Trades, that sequence of occasions ought to ideally proceed to play out.

“Greatest for Bitcoin and the general market can be if Bitcoin Dominance takes off once more whereas BTC grinds up,” he argued on Nov. 17.

“Not sufficient liquidity but to maintain the whole market transferring directly. It’s why we see these flushes so typically as liquidity is unfold too skinny. Then when BTC has rallied, capital can move again into alts to play catch up. The weaker ETH/BTC is the stronger BTC will likely be more often than not.”

ETH/BTC returned to 0.05 BTC on the finish of October — its lowest since mid-2022.

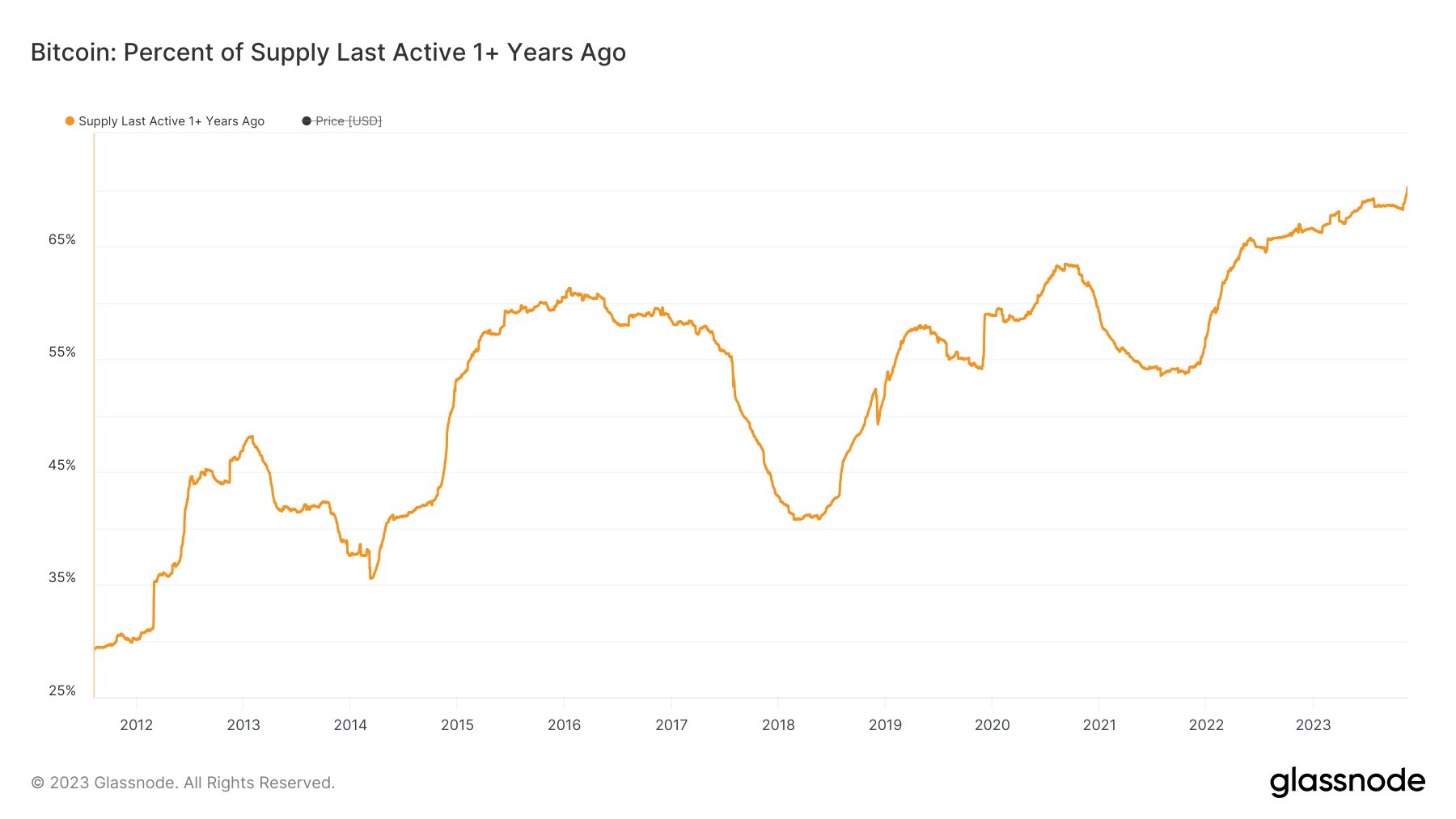

Provide dormancy units new file

In terms of long-term holder resolve to HODL past fast worth motion, few charts are arguably as bullish as dormant provide.

Associated: Bitcoin nears pre-halving ‘target zone’ toward $50K BTC price

From the angle of its iteration displaying the proportion of mined BTC which has not moved in not less than a 12 months, the metric has now hit all-time highs.

Over 70% of the provision has ignored any positive aspects seen for the reason that 2022 bear market backside, and stays in the identical pockets.

“Bitcoin has gained +139% over the previous 12 months and 70% of all BTC in circulation hasn’t been offered / transferred,” Caleb Franzen, senior analyst at Cubic Analytics, responded.

“Now that is conviction.”

Franzen referenced information from on-chain analytics agency Glassnode uploaded to X by William Clemente, co-founder of crypto analysis agency Reflexivity.

As Cointelegraph reported, the realm instantly under $40,000 may nicely symbolize a key profit-taking watershed for these Bitcoin buyers who bought BTC through the 2021 run to present all-time highs.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.

[ad_2]

Source link